Like any business in Hawaii, wholesaler Shell Oil Co. kept detailed reports of its financial results, even breaking down revenues, expenses and pre-tax income by gas station.

Oil firms claimed not to know how

much money they made in Hawaii.

Their records say it was a bundle.By Tim Ruel

truel@starbulletin.comFor example, in 1989, one Aiea Shell station posted $285,368 in revenue and $183,457 in income, while a nearby station generated $417,475 in revenue and $298,465 in income, according to Shell's confidential service station performance reports.

The reports weren't perfect, but they were useful to Shell. "It would be a good guide, or at least a tool, for determining whether to make capital investments at a site or not," Shell executive Edward L. Schmitz said in a sworn court statement.

That same year, 1989, the state Attorney General's Office began investigating the high pump prices of gasoline that followed the Exxon Valdez oil spill in Alaska, and the state demanded local oil companies reveal their profitability in Hawaii.

At the time, Shell told the state it did not track revenue and income in each state, let alone at each station."Any response, assuming ... the information could be retrieved from some source, would be speculative, arbitrary, and incompatible with the way Shell operates," Shell wrote the state on Dec. 4, 1989. "Shell has made every reasonable effort to respond fully to the state of Hawaii's investigative demand."

The state found the Shell reports during fact-finding in its anti-trust lawsuit against the oil companies. Shell later argued in court documents that it did not turn over the service station reports because they were not widely accepted as reliable. The state said the company should have delivered the reports anyway. A Shell attorney could not be reached for comment Friday.

For much of the 1990s, when the Legislature, the Attorney General's Office and reporters asked oil companies how much money they were making in the islands, the firms said they didn't know. The companies would only say their profits were generally in line with the rest of the country.

Then, in 1997, while mainland pump prices plummeted along with the cost of crude oil, Hawaii's prices hardly stirred. The state sued the oil companies in October 1998, and it soon discovered the firms were making big profits in Hawaii, and the companies knew it all along.

The Shell evidence was gathered for one segment of the state's lawsuit against the oil companies, in which the state alleged that the firms attempted to hide information from state investigators. The allegations were made in July 1999, nine months after the state sued, and had the effect of tripling potential damages and penalties from the suit to $2 billion.The oil companies sought to have the so-called "fraudulent concealment" charges thrown out of court along with the conspiracy charges, but the entire case was settled in January of this year before both sides were to argue in court about concealment.

Arguably, the state got a pittance for the lawsuit: 1 percent of the $2 billion it was seeking. But while the case is settled, the new battlefield is the state Legislature, which is considering ways of dealing with high gas prices. Many details of the case that were sealed for the past three years by court order became available to the public and lawmakers a month ago.

Those documents clearly illustrate that while the companies denied having information on Hawaii profitability, they were creating internal financial reports that contained isle data.

In 1989, the state Attorney General's Office formally asked the oil companies how much they were making, using extremely broad terms in its demand for documentation.

In 1992, the state asked for more financial information specifically from Chevron Corp., which responded by providing its densely detailed profit segmentation system reports. What Chevron didn't provide was its so-called "blue books," reports designed for high-level management to review the firm's financial data with relative ease.When questioned by state lawyers in April 2000, Chevron representative David Heck had no explanation why the firm didn't give the blue books to the state. About a month later, Chevron lawyer Bruce W. McDiarmid submitted a declaration saying state deputy attorney general Ted Clause had agreed to accept the profit segmentation reports. Under oath, McDiarmid said he didn't tell Clause the blue books existed.

Chevron spokesman Albert Chee had no immediate comment Friday about the blue books, saying, "That's news to me."

Texaco Inc., another defendant in the lawsuit, provided the state with no Hawaii profitability information in 1990.

But nine years later, after the lawsuit was filed, the state found a 1990 document used by Texaco managers to compare Hawaii profitability with Seattle and Portland, Ore., called an "Ambucs report." In the report, Texaco projected its 1990 Hawaii net income at $6 million, a return of 42 percent on its $14.5 million in isle assets. The projection was based on actual "contribution," or revenue minus some expenses, from January 1990 through September 1990.

Two years ago, when the state attempted to question Texaco's in-house lawyer Megan Gee under oath as to why the firm withheld the report, her lawyer told her not to answer, citing attorney-client privilege.

Texaco and Chevron have since merged into ChevronTexaco Corp. Spokesman Chee was not available for questions about Texaco.

Last year, a Texaco attorney told state lawyers the company did not give the state the Ambucs report because the state never said there was a problem at the time, documents show. The company said there was no evidence it had fraudulently concealed anything.

The clearest depiction of how much the oil companies made in Hawaii comes from Chevron. During fact-finding in the state's lawsuit, Chevron provided its financial "blue books" to Barry Pulliam, senior economist with Econ One Research Inc., a Los Angeles firm that worked for the state.

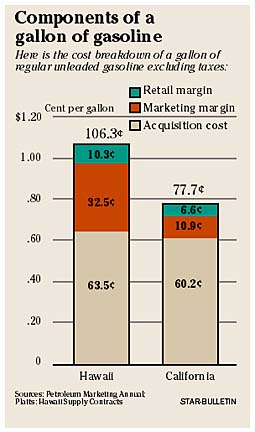

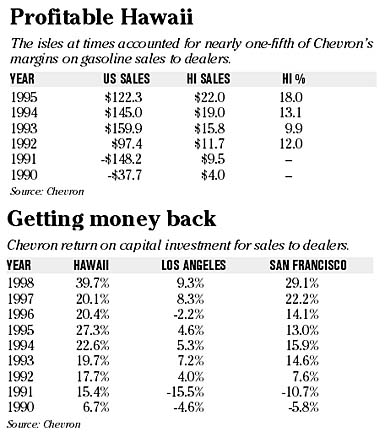

From 1988 to 1995, Chevron made $101.2 million in profit from its Hawaii refinery sales through its isle dealers, 22 percent of the company's entire $462.3 million national profit in the same period, according to Pulliam's June 2000 report.

During the same eight-year period, Hawaii's sales volume accounted for 3.1 percent of Chevron's overall U.S. market, an annual average of 5,580 barrels per day in the islands compared with 180,700 nationwide.

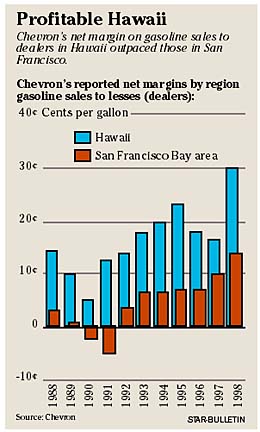

Between 1988 and 1998, Chevron's average after-tax return on its capital investment in Hawaii from gas sales through dealers was 20.8 percent, compared with 1.9 percent in Los Angeles and 9.8 percent in San Francisco, Pulliam said.

Comparisons in this case aren't valid, Chevron spokesman Chee said, because the West Coast was "underperforming" at the time. Also, Hawaii's gas market is far less competitive than major U.S. cities like Los Angeles, Chee said.

Chevron has invested more than $58 million in its dealer stations and related facilities in Hawaii, according to facts presented in a separate lawsuit between Chevron and the state.

Despite having the blue books, Chevron has maintained it didn't know how profitable Hawaii was.

As late as 1998, then-Chevron public affairs manager Dave Young told a state legislative committee that Chevron didn't know how much it cost to produce gasoline, or how much the company earns in Hawaii when it sells gas through dealers, because the crude oil used to make gas is also used to make other products.

"So you may take X number of cents on the gasoline, Y number of cents on the jet fuel, Z number of cents on the fuel oil, but you never, you can't tell what you're making, because in fact you must look at the entire product slate that comes from the barrel of crude oil. So it's not easy and it's not very simplistic," Young testified. Young left Chevron in 1998 and now works for the state.

Similarly, when Star-Bulletin reporter Rob Perez was investigating Hawaii's high price of gasoline in 1998, then-marketing manager Brant Fish told Perez it would be difficult to isolate gas profits from other products.

In general, Chevron doesn't provide internal company data to the public because the firm wants to avoid potential securities violations, spokesman Chee said.

"We do not want that kind of information floating around," Chee said. "It falls along the lines of insider trading." Chee could not point to any specific securities law that would be broken. Even so, Chevron had nothing to gain from giving out competitive information, he said.

"We've always been told that those internal tools that we use to kind of gauge how the business is going is not an accurate reporting of profits," said Ken G. Smith, marketing manager for Chevron. "They were never created to use for public consumption."

Why didn't the company just say that? "I think that was always the intent of the answer," Smith said.

It's not illegal to make money, lawyers for the oil companies said in November summary judgment hearings in the state's lawsuit.

High gas prices in Hawaii are the result of a lack of competitive market forces, not collusion, said Maxwell Blecher, attorney for defendant Tosco Corp.

"Once you decide it's an oligopoly, you've got an explanation for the phenomenon of the high prices, the high margins, the high profits, the lack of vigorous price competition. That explains it all," said Blecher, who gave an opening statement on behalf of all the oil companies.

But that's not what Chevron told Hawaii consumers and the state through much of the 1990s.

"Competition, costs and taxes drive gasoline prices in Hawaii," Jeff McElroy, Chevron Hawaii region marketing manager, said in 1995 testimony at the Legislature. "Competition is alive and well in Hawaii at both the wholesale and retail levels."

How does Chevron account for the difference now?

"I don't want to comment on that," said Chevron's Smith.