City eyes property The city would have only two property tax rates -- commercial and noncommercial -- under a bill proposed by City Councilman Duke Bainum.

tax change

Councilman Bainum proposes

having only 2 property tax ratesBy Gordon Y.K. Pang

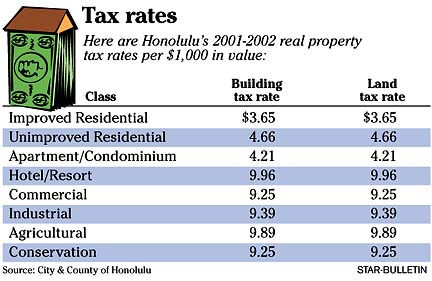

gpang@starbulletin.comBill 25 calls for owners of single-family homes, unimproved residential lots and apartment/condominiums to all be assessed under one rate. It would also put commercial, industrial, agricultural and hotel/resort categories into another classification sharing one rate.

Single-family and apartment/condominium owners are already moving toward property tax equity.

For the second straight year, Mayor Jeremy Harris proposed that the tax rate for the apartment/condominium class be reduced as part of a three-year plan to bring it down to the same amount as the single-family homeowner rate.

The goal is for the rates for both categories to be $3.65 per $1,000 of assessed value in the 2003-04 budget.Bainum said one of the reasons he is introducing the measure is that special-interest groups are asking for real property tax exemptions. He cited Councilwoman Rene Mansho's bill last week that calls for creating a separate golf course classification with the intent of providing them a rate lower than agricultural or commercial properties.

"The trouble is special-interest groups that come in and have enough juice to pass a bill, and you end up with a special exemption," he said. "Why should we subsidize golf courses? They're a business. They're a commercial business."

Likely to benefit the most from Bainum's bill are hotel/resort property owners, who now pay the highest rate. The bill would result in their rates going down, or other commercial rates pulling up to meet theirs.

But according to Bainum, "the intent is not raise venues or increase taxes, but to solidify or streamline against future tinkering."

Having fewer rates would also result in less confusion, he said.

Lowell Kalapa, executive director of the Tax Foundation of Hawaii, said he has been recommending for years that the city move toward fewer rate classes.

"Ultimately, the goal is to have a single rate for all classes of property so that people can know how much they're paying for city government," Kalapa said.

Bainum also introduced Bill 24 yesterday, which would eliminate the separation of land and building values for tax purposes.

The bill is designed in part to make the job easier for assessors who would not have to assign separate values for land and building. Bainum said it would also reduce confusion among landowners.

Council Budget Chairwoman Ann Kobayashi said the bills have merit, are "kind of radical" and require further research and discussion.

"It sounds like it would make for a simpler way of doing things," Kobayashi said.

City & County of Honolulu