Hawaiian and Aloha Every day during the final three months of 2001, Hawaiian Airlines spent an average of $75,000 to $100,000 more than it took in. Aloha Airlines lost $109,000 to $170,000 a day.

both losing money

Neither has finished in the black

since '98, says an SEC filingBy Russ Lynch

rlynch@starbulletin.comOverall during the period, Hawaiian posted operating losses of between $12 million and $17 million, not counting $22 million received from the federal government to compensate for the Sept. 11-related shutdown.

Aloha, which had federal subsidies of about $5 million in the quarter, was in the red about $11 million.

Those are just two of hundreds of disclosures about the operations of the two airlines contained in a document several hundred pages long and filed yesterday at the Securities and Exchange Commission in support of the proposed merger of the two airlines.

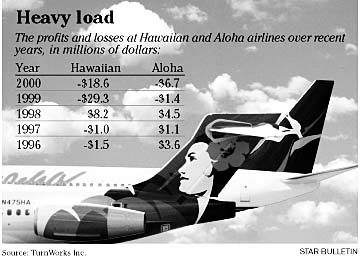

The document paints a picture of two recently unprofitable airlines, neither of which has ended a year in the black since 1998. It also gives a rare public glimpse at the finances of Aloha, which as a private company is not required to disclose such data.

The proxy statement filed by TurnWorks Inc., the company headed by former Continental Airlines head Greg Brenneman that is putting together the merger, contains previously unpublished details of the operations of the airlines. That includes preliminary estimates of their performance since Sept. 11, when terrorist attacks sent tourism into a tailspin. It contains full details of the merger and figures that Brenneman uses to back up his contention that the merger is necessary.If the merger goes through as Brenneman expects, he will be chairman and chief executive officer, and TurnWorks will own about 20 percent of the company.

Paul Casey, chief executive and vice chairman of Hawaiian, and Glenn Zander, CEO of Aloha, will lose their jobs but get a multimillion-dollar severance package.

In the three months after the Sept. 11 attacks, both airlines racked up huge losses, as did nearly every airline across the country.

"Hawaiian did not generate positive cash flow during the quarter," after adjusting for federal financial assistance and deferred federal taxes, the document said.

"The trends evidenced during the quarter ended Dec. 31, 2001, may continue to affect Hawaiian to an extent that cannot yet be fully measured," the filing said. "However, Hawaiian anticipates that it may have operating losses during the current quarter and does not expect to meet its break-even total and interisland load factors during the current quarter."

"In addition, Aloha has not generated positive cash flow from operating activities since Sept. 11, 2001," but its cash flow has recently improved, the statement said.

The filing paints a different financial portrait of Aloha and Hawaiian for the first nine months of 2001. During that period, Hawaiian generated a profit of $15.2 million while Aloha lost $5.6 million.

Both airlines have consistently lost money since 1999.

From 1996 through 1998, Aloha made $9.2 million, but lost a total of $8.1 million in 1999 and 2000. Hawaiian lost $50.4 million in four of the five years from 1996 to 2000 and made money, $8.2 million, in only one year, 1998. Its largest loss was in 1999, at $29.3 million.

The detailed document also listed a number of risk factors and some possible conflicts of interest that TurnWorks said it wants shareholders to know. They include:

>> The right of John W. Adams, Hawaiian's chairman, to receive a $10 million cash payment from TurnWorks through a company Adams controls, in addition to 18.2 million shares of the new airline and notes worth about $36 million.The document says conversations about a merger between Aloha and Hawaiian were going on for years, and Brenneman entered the picture well before Sept. 11, talking to both of them.>> Adams and another of his businesses, Smith Management, also will receive $5 million in cash, a million shares of the new company's common stock and notes worth $2 million in return for advisory services to Hawaiian.

>> Hawaiian could end up paying its departing CEO, Casey, $1.7 million if he gives up severance pay and cancels his options to buy shares.

>> Aloha CEO Zander and Brenda F. Cutwright, executive vice president and chief financial officer of Aloha, could receive a combined $4.9 million if they also cancel their rights to severance pay and stock options.

"We believe that merging Hawaiian and Aloha into a single carrier is necessary to maintain the viability of Hawaii's interisland air service," TurnWorks says in the filing.

"Hawaiian and Aloha have suffered losses during the most profitable period in the airline industry's recent history," and the events of Sept. 11 worsened their problems.

Merging the airlines, including rationalizing the fleet structure, and implementing cost savings "will create a financially stronger airline, provide passengers with improved service and enhance shareholder value to Hawaiian and Aloha shareholders," the statement said.

The complete filing can be found online at

sec.freeedgar.com/displayText.asp?ID=1765689

(12.9 megabyte download)