|

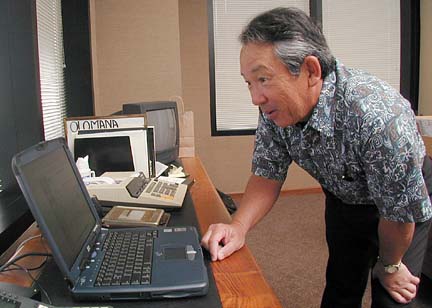

"We're the last of the Mohicans," said Allan Kitagawa, chief executive of Territorial Savings and Loan Association.

Territorial Savings and Loan is

the only S&L left in Hawaii that

hasn't changed its structure, merged,

been bought or closed its doorsBy Russ Lynch

rlynch@starbulletin.comTerritorial, formed in 1921, is the only savings and loan institution left in Hawaii that hasn't changed its structure, merged, been bought or closed its doors.

Its steadfastness and lack of news makes it interesting. All the other savings and loans have either been acquired by other businesses or have gone out of business for various reasons.

Territorial just goes on, quietly improving its position. At the end of 2001 it had assets of $553.6 million, up 5.5 percent from $524.6 million at mid-year.

It is also the only remaining mutual savings and loan in Hawaii, falling into a class of only a few hundred in the nation that have no outside corporate ownership, no shareholder corporate structure to report to, no parent company whose quarterly profits have to match up to Wall Street expectations.

Its owners are its depositors and borrowers, much like a credit union. It still is a savings and loan, required by federal law to make community investments and fill other guidelines not mandated of credit unions, but its need for profit is less than those of corporate S&Ls, allowing it to offer more and cheaper services, Kitagawa said.

|

For now, it is too small to do major advertising. It doesn't have enough branches or enough geographic spread to really get out and push for new customers, Kitagawa said. But he expects that will change."We only had 12 branches when I came in 1986. It would have been a waste to advertise heavily," he said, because there is no point in trying to attract a lot of new customers if there is no branch convenient to them. Territorial now has 17 branches and Kitagawa said his goal is to add two branches a year, to get to the point where the business can begin promotions to grow its customer base.

"It's not easy to find branch locations," he said, adding that they have to be in populated, easy-parking areas, but Territorial now is definitely on the lookout.

Territorial hasn't always been run as quietly as Kitagawa and the current management have enjoyed. In 1984, Territorial hit the headlines because of allegations that two of its directors, Kenneth Ian Woo and Francis Wong, had defrauded the institution in loan deals. Lawsuits were settled in 1986 and Territorial got some money back, but some changes were needed. One of them was bringing in Kitagawa, who had had 15 years with American Savings and Loan, 12 of which were in top executive positions.

American Savings, then owned from Salt Lake City was later to go through some serious changes. In the end, it became a subsidiary -- and a very profitable one -- of Hawaiian Electric Industries Inc.

Territorial Savings

and LoanCompany dates

>> Founded March 1921 as Kaimuki Building and Loan Association, to lend to Kaimuki home buyers.

>> In 1926 became Territorial Building and Loan, to serve all Hawaii.

>> Became Territorial Savings and Loan Association in May 1954.

>> In 1958 it became the first S&L to open a branch in Windward Oahu (still there, in Kailua)

>> It is Hawaii's only mutual savings and loan, owned by its customers.

>> It has 17 branches on Oahu, Maui, the Big island and Kauai.

>> 160 employees

Executives

>> Allan S. Kitagawa, chief executive officer.

>> Daniel L. Colin, president.

>> Directors; Kitagawa, Colin, Melvin Miyamoto, Vernon Hirata, Howard Y. Ikeda, Wade H. McVay, Richard I. Murakami, Harold Ohama.

Statistics

Total assets: $553.6 million

Deposits: $476.75 million

Total liabilities: $522.48 million

Kitagawa says he got a lot of his experience and management capabilities from Shiro "Sam" Hironaka, longtime American Savings head who has retired to Maui.

"I owe a lot to American Savings Bank and my old boss Sam Hironaka," Kitagawa said. "Sam was the best."

Kitagawa said he enjoyed working at a big company with the day-to-day buzz of activity. His daily activities now are much more staid, working with Territorial's president, Daniel Colin, and six other members of the eight-member board of directors elected to represent the owners, who are the customers.

Directors are elected largely by management, since new customers are asked to sign proxy forms turning the duty over to corporate officers.

The fact that Territorial does not have to report to a corporate parent or major shareholder does help, he said. The institution doesn't have to reach corporate earnings targets and because of that it can wash profits back to customers in the form of services such as free checking accounts, free travelers' checks and other services.

Accounts are insured and regulated just the way they are with banks and credit unions.

"But we're making a return on equity of over 12 percent," he said. Territorial has averaged a 10 percent to 12 percent return for the past three or four years "and we're still giving a lot of things free," Kitagawa said.

Other S&Ls are still around but not under their original structure. The long-time biggest, Honolulu Federal Savings and Loan, was acquired by a group led by former Treasury Secretary William Simon and as HonFed Bank ended up selling its assets to Bank of America. In turn, American Savings picked up those assets.

International Savings and Loan was absorbed by City Bank parent CB Bancshares Inc. Pioneer Savings became part of First Hawaiian Bank, and through that, part of BancWest Corp. -- now French-owned BNP Paribas. First Federal went to Bank of Hawaii.

But at Territorial, such mergers can't happen, at least under its present structure. But Territorial's managers recognize that the world is changing. The dividing lines between different financial services companies are largely gone and they all offer pretty much the same things to their customers, he said.

"The credit unions are becoming savings and loans, the savings and loans are becoming banks," Kitagawa said.