![]()

Think Inc.

A forum for Hawaii's

business community to discuss

current events and issues.

Sunday, January 20, 2002

![]()

Think Inc.

A forum for Hawaii's

business community to discuss

current events and issues.

Sunday, January 20, 2002

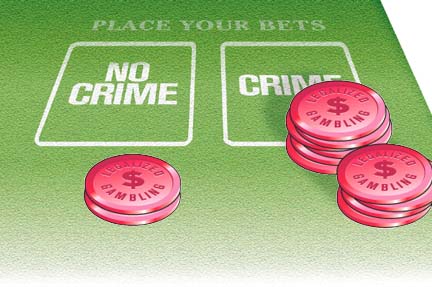

Not a sure bet

Who should own Hawaii's airlines

|

As Hawaii enters its 11th year of economic decline, aggravated by the terrorists' attack on Sept. 11 -- which caused a 26 percent decrease in tourist arrivals and a 163 percent increase in unemployment claims -- some legislators, the governor and representatives of various lobbying groups have started a new round of debate on legalizing gambling in Hawaii. Not a sure bet

Casino gambling doesn't necessarily

lead to an increase in crimeBy Ernesto C. Lucas

For example, Gov. Ben Cayetano abandoned his opposition against gambling when he said he "would support a licensing agreement that would allow a single casino to operate."

He also said he would legalizing gambling on interisland cruise ships. Further it was reported the governor favors a constitutional amendment to legalize gambling in the state.

Three groups are known to support the legalization of gambling in Hawaii. The first is the Coalition for Economic Diversity, which is funded by Sun International Hotels Ltd. Investment group. The second is Hawaii Entertainment, which is funded by the Motor City Casino in Detroit, Mich.

These proponents estimated two casinos in Hawaii would generate 19,000 direct and indirect jobs and $67 million in new taxes. The third is the International Longshoremen and Warehouse Union Local 142 which represents 20,000 workers. It testified before the legislators in favor of Sun International's proposal to build a $1 billion resort and casino in Hawaii.

On the other hand, there is a strong opposition to legalizing gambling in Hawaii. In a recent survey, 18 of the 19 house Republicans are opposed to casino gambling, shipboard gambling and lottery.

The Hawaii Coalition Against Gambling points to the social costs resulting from legalized gambling, such as increased divorce and suicide rates.

Eleven states that have opened casino gambling in United States since 1978 are: New Jersey (1978); South Dakota (1989); Colorado, Iowa, Illinois, and Mississippi (1991); Louisiana (1993); Missouri (1994); Indiana (1995); Michigan (1999) and Nevada (as early as 1931).

FBI crime statistics were analyzed to see the trends of crime in eight of the above states for 11 years -- five years before and five years after the opening of the casino. Four states -- Colorado, Illinois, Iowa and Missouri -- showed decreases in their crime indexes. All of these decreases were considered statistically insignificant.

Four states showed increased crime rates: Louisiana, Mississippi, North Dakota and New Jersey. Of these, only Mississippi and New Jersey showed a statistically significant increase.

The conclusion is the crime argument against legalizing casino gambling is not definitive. There may be other arguments against legalizing casino gambling -- religious, social and ethical -- but the crime argument is not one of them.

The debate on legalizing gambling has become more intense as the unemployment rate in Hawaii increases.

An important and promising area of diversification is legalizing casino gambling. Fortunately, other cities have gone through this process and Hawaii can benefit from their experience. The results show there is overwhelming evidence that casino gambling generates new employment with little or no negative effects.

Based on the analysis of data files from the FBI and on the experiences of other states and cities with casino gambling, it is reasonable to conclude the link between casino gambling and crime is not conclusive.

Furthermore, casino gambling has positive employment impact on the locations where it has been legalized.

Ernesto C. Lucas is an associate professor of economics at Hawaii Pacific University. He can be reached at elucas@hpu.edu.

If you think inter-island air fares are high now, imagine what they'll be if policy-makers approve the merger, as currently proposed, between Hawaiian and Aloha. Who should own

Hawaii’s interisland airlines?There are alternatives to having

Aloha and Hawaiian controlled by

mainland investorsBy Jeff Gates

The deal now under consideration would allow investors from the mainland to pocket the majority of what's poised to become monopolistic profits. Of course, they don't pitch it that way. But this is certainly part of what makes the deal so attractive to them.

Its hard to imagine that a monopoly of an essential transportation service owned by a handful of well-to-do mainlanders would make anyone's Top Ten list of what's best for Hawaii's future. Yet that's essentially what's now under consideration. Are there antitrust concerns with this combination? You bet.

But even if the dealmakers finagle an antitrust waiver, that won't mitigate the real anti-competitive impact on Hawaii's people -- not only on passengers, but also on employees, small business shippers, the visitor industry, etc.

With the freedom to choose, who would be picked as the most natural owners of these airlines?

Surely the state's residents should have a priority stake. For although Hawaii is totally dependent on Aloha and Hawaiian for inter-island travel, the airlines are also obviously largely dependent on the state's residents. Employees are another obvious group. Without them, the airlines don't fly.

How about the other airline customers -- the shippers and passengers? Without their patronage, the airlines are virtually value-less.

What about the airlines' broader networks of support: suppliers, travel agents and such? All of them contribute value. Yet none of these natural owners have the know-how, the funds or the influence to "do the deal."

Personal ownership

There are other ways to do business that would work far better both for the airlines and for the residents of Hawaii. For instance, some 11,500 U.S. companies now operate with employee stock ownership plans, covering about 10 percent of the U.S. work force. That version of business-as-usual includes an ESOP holding a 55 percent stake in United Airlines.I served as counsel to the U.S. Senate Committee on Finance when much of the framework for ESOPs was put in place. Since then I've advised on creating democratic ownership structures in 36 countries. I can tell Hawaii's people this much: I would be hard-pressed to name a situation in which broad-based ownership makes as much sense.

As the world's most financially hip nation, it should come as no surprise that the United States boasts clothing firms owned by their distributors and retailers, breweries and wineries owned by their customers, manufacturers owned by community residents, and even Internet sites that offer "ownershopping" designed to convert their regular customers into valued "investomers."

How about the airlines' customers? A vast array of purchasers now collect "patronage dividends" just for being customers, frequent-flier coupons being only the most obvious example.

Ownership patterns are a design option. Ownership can be thoroughly inclusive, radically exclusive, or somewhere in-between. Private property has long been the engine of free enterprise.

So why choose an ownership solution for this crucial industry that's anything other than inclusive? That's the question policy-makers need to address. And the standard by which their decision-making is most usefully judged.

Money is not necessarily the issue. Income-producing assets can often pay for themselves from the income they generate. That's a financial no-brainer.

Why couldn't the state guarantee financing, as it agreed to do for Hawaiian Air a decade ago, provided it's used to Hawaiian-ize the ownership of Hawaiian and Aloha?

Over time, could employees become owners in both airlines? Clearly they could.

Since 1975, federal tax law has provided incentives for that very purpose.

What about passengers and shippers? The information technology is already in place to credit customers' individual accounts when they make a purchase, much like a grocery store tracks its clientele in order to grant a credit to a local sports team.

Travel agents? They receive travel credit every time they book a flight. Why not ownership?

Participatory democracy

Certainly, since the government provides financial assistance to Hawaii's airlines, the state's residents have a legitimate beef if they're excluded. A component of resident-ownership may prove the best mechanism for anchoring the benefits of this critical industry in-state.

It's working in Alaska. Residents of the 49th state have a stake in the royalties paid by firms drilling for oil on state-owned lands.

Last year, each of the state's residents pocketed almost $2,000.

A highly participatory brand of democratic capitalism may be just the tonic needed to ensure that these airlines remain independent and competitive. A democratic ownership structure would also ensure that those who contribute to the airlines' success share in that success.

Instead of business-as- usual, a widely Hawaiianized proprietorship could be the recipe required to ensure that the ownership of this key industry ends up in the portfolios of those with a real stake in its future.

A lawyer and investment banker, Jeff Gates is author of "The Ownership Solution" and "Democracy at Risk" and president of the Shared Capitalism Institute (www.sharedcapitalism.org).

To participate in the Think Inc. discussion, e-mail your comments to business@starbulletin.com; fax them to 529-4750; or mail them to Think Inc., Honolulu Star-Bulletin, 7 Waterfront Plaza, Suite 210, 500 Ala Moana, Honolulu, Hawaii 96813. Anonymous submissions will be discarded.