|

Isle stocks endure T was a year of survival for Hawaii stocks.

merger madness

Hawaiian Airlines edges Schuler

Homes for best performance Five

of 16 companies in the state are

involved in acquisitionsBy Dave Segal

dsegal@starbulleti.comAnd by the end of a terrorist-plagued 2001, the state's 16 publicly traded companies were most notable not by those who were standing at the finish but by those who weren't.

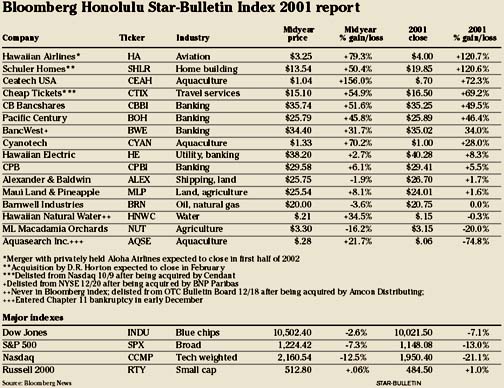

In a race that came down to the final seconds of the final trading day, Hawaiian Airlines Inc., one of four Hawaii companies involved in mergers in 2001, came from behind to edge out another merger participant, Schuler Homes Inc., 120.7 percent to 120.6 percent, for the top performance in the state.

|

Hawaiian Airlines, which had seen its stock tumble in the aftermath of the Sept. 11 terrorist attacks, received new life Dec. 19 when it announced it would form one statewide airline by merging with rival and privately held carrier Aloha Airlines.Former Continental Airlines Inc. President Greg Brenneman, who put the deal together, will become chairman and chief executive of the new company.

"These two carriers (for) the last five years, which (have been) the five most profitable years in the airline industry, have essentially been break-even cash flow and break-even (on) profits," Brenneman told Bloomberg News. "So, it's been hard for them to invest a lot back in their business. I think this'll allow a profitable airline to exist that can invest back."

Hawaiian Air's stock, which had topped the index at midyear with a 79.3 percent gain before fading, took off again and ended 2001 at $4.

Meanwhile, Schuler Homes, whose takeover by Arlington, Texas-based D.R. Horton Inc. is expected to close in February, received a boost Oct. 23 when it announced it was being acquired for $1.2 billion in cash, stock and assumed debt. The stock, which now moves in tandem with Horton's shares, started the year at $9 and ended at $19.85.

"People say we're in a recession but the housing market is not in a recession, obviously, when you look at the earnings and stock prices of what homebuilders have done," said Jim Schuler, co-chairman, president and CEO of Schuler Homes. "It's a different housing market today compared to previous slowdowns. There are very few homes sitting on the marketplace, and that's caused by a number of things. There was a very high demand for housing that existed over the past several years that we couldn't meet as fast as we could sell. It was taking a long time to get property-zoned lots. And over the past three years there have been labor shortages and material shortages that still exist today.

"The other thing fueling the strong housing market are lower mortgage rates. And I think if the mortgage rates stay at their current levels and the economy doesn't worsen and stays relatively level, I think the housing market will remain as strong as it is today."

Amazingly, more than a quarter of the 14 members who started the year in the Bloomberg Honolulu Star-Bulletin Index were involved in mergers. Another member, Aquasearch Inc., filed for Chapter 11 reorganization bankruptcy.

In addition, Hawaiian Natural Water Co., the only Hawaii company not in the index that regularly files financial reports with the Securities and Exchange Commission, also was acquired during the year.

Hawaiian Airlines' merger was the only one not involving a mainland company.

"The Hawaiian merger has got to be a major positive if it goes through," said Richard Dole, CEO of Honolulu-based Dole Capital LLC. "If the thing drags on for nine months, people may get a little bit concerned. There may be a little resistance because a lot of people don't like the elimination of competition. The Sept. 11 attacks made it possible to do whereas before it might not have gotten the antitrust support. Now it's easier to do, especially if the Hawaii economy starts to improve."

While Schuler and Hawaiian Air will remain in the index until their mergers are completed, two Hawaii-based companies already have bid aloha.

First Hawaiian Bank parent BancWest Corp., which announced in May that French bank BNP Paribas was acquiring the 55 percent of BancWest that it didn't already own, saw the $2.5 billion cash deal close Dec. 19 with shareholders getting $35 a share for their holdings. BancWest, which was in a holding pattern after the deal originally was announced in May, ended the year up 34 percent at $35.02.

The other takeover involved travel discounter Cheap Tickets Inc., which was swallowed up in a $280 million, $16.50-per-share deal by travel and residential real estate services provider Cendant Corp. Cheap Tickets' stock ended the year up 69.2 percent at $16.50.

Aquasearch, the worst performer of the index, entered Chapter 11 last month after a group of creditors earlier sued the biotech company to force such a move. Mark Huntley, the chairman, CEO and co-founder of the company, stepped down to the position of chief technology officer and the stock plummeted to a mere 6 cents amid the upheaval. The shares finished 2001 down 74.8 percent.

Big Island rival Cyanotech Corp., which like Aquasearch makes nutritional supplements from microalgae, endured a volatile year. It rose as high as $1.61 in June after some favorable test results and following comments from its chief financial officer that the company would become profitable in the 2002 fiscal year ending March 31. It later fell to as low as 50 cents in September before staging a rebound last month after announcing that it would increase production capacity by about 60 percent. The stock finished the year up 28 percent at $1.

Among the banks, thinly traded City Bank parent CB Bancshares Inc., whose consolidated net income through the first three quarters was 12.7 percent higher than year-ago levels, jumped 49.5 percent to $35.25 to lead the way. Bank of Hawaii parent Pacific Century Financial Corp., which has been divesting noncore assets throughout the year, was close behind with a gain of 46.4 percent to $25.89. Central Pacific Bank parent CPB Inc., which has reported nine consecutive quarters of record earnings, gained 5.5 percent to $29.41.

Hawaiian Electric Industries Inc., whose subsidiaries include American Savings Bank, returned 8.3 percent to $40.28 on top of a 6.2 percent dividend yield. The state's largest utility company divested its international operations during the second half of the year.

Ceatech USA Inc., which replaced Cheap Tickets in the index in August, was the third-best gainer behind Schuler and Hawaiian Air with an increase of 72.3 percent. The Kauai shrimp producer, which is attempting to win a $2.5 million loan from the state Department of Agriculture, ended the year at 70 cents. It was one of five index members that ended the year trading at $4 or below per share.

Big Island-based ML Macadamia Orchards LP, which earlier in the year won a court decision requiring exclusive purchaser Mauna Loa to purchase all nuts regardless of condition, ended 2001 down 20 percent at $3.15. ML Macadamia also offered a 6.4 percent dividend yield.

Alexander & Baldwin Inc., which last month said the Hawaii tourism slump would drag down its 2002 earnings, especially in its Matson Navigation Co. division, rose 1.7 percent to close at $26.70, near its 52-week high of $28.94 on Jan. 10. The company, which pocketed $77 million after taxes from the sale of its BancWest holdings, was active in its real estate acquisitions last year.

Barnwell Industries Inc., whose real estate development partnership won a favorable state land-use ruling, was unchanged at $20.75. The company, which also explores and develops oil and natural gas, continued its recent trend of paying out dividends that began in September 2000 after a five-year hiatus.

Maui Land & Pineapple Co., whose surging Kapalua Resort sales continued to be dragged down by the company's money-losing pineapple operations, gained 1.6 percent to $24.01.

Hawaiian Natural, whose stock fell 0.3 percent this year to 15 cents, was acquired last month by Omaha, Neb.-based Amcon Distribution Co.