Alcohol tax hike sought Gov. Ben Cayetano has proposed doubling the state liquor tax next year to help offset the revenue shortfall in the second year of the current state budget.

Gov. Cayetano wants the proceeds

to offset retirement payments

By Pat Omandam

pomandam@starbulletin.com"It is significant," the governor said. "Anyone who buys or consumes alcohol will be impacted. From our standpoint, alcohol is a luxury, and if we had to raise money anywhere, that is a good place to do it."

If approved by the Legislature next spring, the tax would add just less than 9 cents to a bottle of beer, $1.20 to a fifth of hard liquor and 53 cents to a quart of wine.

The increased tax would also generate an additional $38 million to $40 million into state coffers, helping offset mandatory state payments to the Employees' Retirement System, said Cayetano, who approved his proposed financial plan for the state yesterday.The alcohol tax -- one of the state's two "sin taxes" along with the levy on tobacco products -- generated about $37.8 million in fiscal year 2001. It raised $39 million in fiscal year 2000.

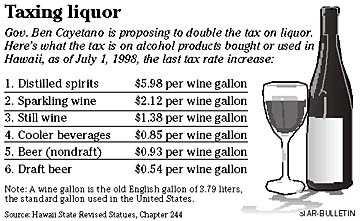

The tax last was raised on July 1, 1998.

Because of the state Council on Revenues' projected $315 million tax revenue shortfall over the next two years, Cayetano said the state was considering delaying mandatory payments to the retirement system because it could not afford it. But that extension would not be necessary if the Legislature approves the liquor tax increase, he said.

State Tax Director Marie Okamura said the liquor tax is a gallonage tax imposed on dealers and certain others who sell or use liquor. It is based on a formula that includes the amount of liquor as well as the percentage of alcohol in a product.

Different rates are imposed on different types of alcohol, such as draft beer, regular beer and wine. An annual liquor tax permit also is required.

Okamura said one reason for the proposed tax increase was the success in raising the tobacco tax, now one of the highest in the country, to help curb smoking.

"Alcohol does create a lot of problems for the community," she said.

Cayetano said his administration has taken a strong stand against alcohol abuse. Although the state cannot prohibit people from drinking, alcohol does have tremendous social implications on the rest of society, he said.

"There's no question that it's probably second to drugs in terms of the health care cost that it generates," Cayetano said. "It causes accidents, and so if people want to consume alcohol, they still may do so, but we're going to try to make it a little more expensive."

Patrick McCain, president of the Hawaii Restaurant Association, said the liquor tax increase will further hurt an already struggling tourism industry.

McCain said the tax increase will penalize job creation in the state while it makes it more expensive for tourists and residents. He suggested legislators focus on cutting the budget and not raising taxes.

"I would hope that the government would try to help the private sector, but I don't know if that's part of the plan," McCain said. "They just keep adding one burden after another. Smoking ban, minimum wage increase, grease traps -- where do they think the jobs come from?"

Meanwhile, the state Legislature's respective money committees will hold a series of state hearings starting Thursday to get public input on the state budget before the session begins in mid-January.

State Budget Director Neal Miyahira is expected to present the governor's financial plan in detail while lawmakers field testimony and questions from the public.

The hearings begin at 7 p.m. and are set for Dec. 27 in Honolulu, Jan. 3 on Hawaii, Jan. 7 on Kauai, and Jan. 9 on Maui. Specific locations will be announced later.

Other options floated by the governor to balance the budget include an across-the-board cut for all state departments, including the Department of Education and the University of Hawaii, at 1 percent in fiscal year 2001-2002, and 2 percent for fiscal year 2002-2003.

Cayetano also wants to transfer the remaining $213 million balance in the Hawaii Hurricane Relief Fund to the state general fund, and authorize $900 million in general obligation bonds for construction projects to stimulate the economy.

The state's November revenue projections predicted state tax collections will shrink by 0.7 percent next year, or about $158 million compared with last year. Lawmakers felt the public should get early input on how to make up the shortfall.

"The governor is considering a number of alternatives in the state's updated financial plan -- across-the-board spending restrictions, possible debt restructuring, tapping some special funds, increases in capital improvement projects to bring more construction projects on line faster -- and the Legislature will be assessing both short- and long-term impacts of these proposals," said Brian Taniguchi (D, Manoa), Senate Ways and Means chairman.

State Web Site