Property assessment If you own property in East Honolulu, Kailua or Kaneohe, chances are that the tax assessment notice you just received showed a higher increase in value than someone in Central Oahu.

values raise concerns

Increases have some residents

worried over possible tax hikesBy Gordon Y.K. Pang

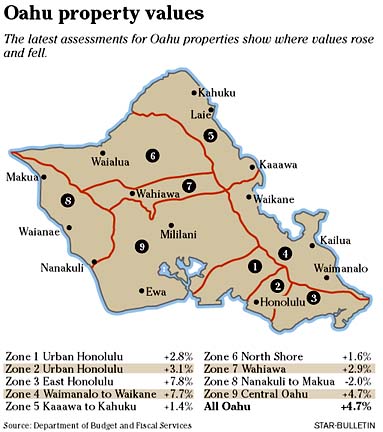

gpang@starbulletin.comLeeward Coast property owners, meanwhile, likely saw their assessments drop, according to statistics provided by the Department of Budget & Fiscal Services.

Real estate watchers said the assessments appear to reflect recent changes in Oahu's sales market.

But City Councilman John Henry Felix, who represents the region from East Honolulu to Kailua, said the unusual number of complaints he has received in recent days warrants further investigation into how assessments are done.

Whether the higher valuations will result in higher taxes for most island property owners remains to be determined.Property taxes are based on multiplying the assessed values by the tax rates given for the different classifications of property. The City Council will set the rates this spring.

The value of all taxable properties on the island went up 4.7 percent to $89.1 billion for the fiscal year 2001-2002.

It was the second straight year the island's total assessed value went up. Last year's increase, of 2 percent, was the first since 1994-95.

Mike Sklarz, a real estate economist with Fidelity National Information Solutions, said the valuations mirror recent real estate market patterns.

If anything, the assessments are "a little conservative" and lagging behind recent spikes in Oahu home prices, Sklarz said.

Windward and East Honolulu values have gone up because "these are considered the most desirable parts of the island," and there has been little construction there, he said.

Felix said he has received about 25 complaints from constituents since the assessments went out late last week. That is the most he has received in 13 years on the Council, he said.

One Coconut Grove resident reported her assessment doubled, he said.

"I question the property values that the department has come up with," Felix said, adding that he intends to meet with tax assessors today to discuss the issue.

Assessments are based on recent sales activities in the immediate area of properties.

"I think there's something awry about the methodology and we should revisit it," Felix said. "We should be assured it is the most equitable way to approach real property assessments."

Council Budget Chairman Steve Holmes, who also represents Windward Oahu, said he does not think the higher assessments are necessarily bad news.

"The fact that the market is turning around is a good thing," he said.

Holmes said it is premature to say taxes are going up when the mayor's budget will not be in the Council's hands until March.

Lowell Kalapa, executive director of the state Tax Foundation of Hawaii, said he also believes the rates are reflective of recent sales.

However, Kalapa said, the city should make an effort to justify higher taxes or cut rates.

Taxpayers, he said, should be asking themselves if they believe their funds are being used wisely by the city.

Kalapa added, "We're in tough economic times, and (taxpayers) are beginning to doubt if some of the things the city is doing ... are justifiable and necessary."

City & County of Honolulu