|

Like the 800-pound gorilla, Wal-Mart Stores Inc. is used to getting whatever it wants. Wal-Mart juggernaut

flexes its musclesThe retail discounter has fueled

its growth by expanding into food

and branching out overseasBy Dave Segal

dsegal@starbulletin.comThat may be bad for competitors but it's good news for consumers and investors in an economic slowdown that has stretched into a second year.

"Pricing is what our business is all about," Wal-Mart spokesman Tom Williams said. "We do compete and will compete with other retailers who try to match our prices."

There's little question that the world's largest retailer, which opened its first of six Hawaii general merchandise stores in 1993, has been helping itself to an increasingly bigger piece of the pie.

The latest example occurred the day after Thanksgiving when the discounter rang up record single-day sales of more than $1.25 billion at its domestic general merchandise stores, supercenters and neighborhood markets. That follows $1 billion in sales on the same day in 1999 and $1.1 billion last year.

"We saw very strong sales in all our stores across the country, including Hawaii, and the customer count was up on that day compared to a year ago," Williams said. "But the average ticket was flat compared to a year ago, which means there were more people in our stores shopping. People are shopping for value without a doubt, and this has accelerated as the year has gone on."

"We started noticing this spring a number of people shopping that normally didn't shop with us," Williams added. "We know we picked up market share. The challenge is to keep those shoppers when the economy goes north."

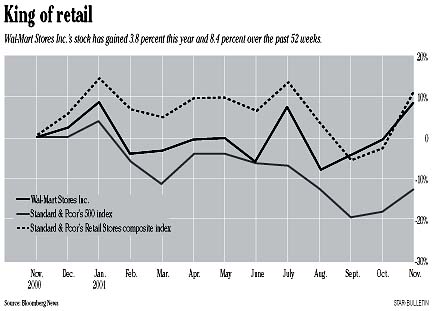

Bentonville, Ark.-based Wal-Mart has been a longtime favorite of Wall Street. Its stock, which trades at a price-earnings ratio of 37.8 after closing Friday at $55.15, has gained just 3.8 percent this year but has jumped 388 percent since a low of $11.31 on Jan. 3, 1997. Of the 30 analysts listed by Bloomberg News as covering the stock, 26 list the shares a "buy" and four rate them a "hold."The attraction of the company to investors and analysts has been its ability to grow despite its size. Wal-Mart's sales rose 16 percent and its earnings gained 17 percent in the fiscal year that ended in January. The company now has 1,637 general merchandise stores, 1,060 supercenters, 492 Sam's Clubs and 26 neighborhood markets in the United States as well as 1,133 international stores in Puerto Rico, Canada, China, Mexico, Brazil, Germany, the United Kingdom, Argentina and South Korea.

In Hawaii, the retailer opened its newest and largest general merchandise store (141,892 square feet) on Oct. 31 in Kahului, Maui. In addition to Maui's first outlet, the retailer also has two stores on Oahu (the state's original one in Kunia as well as one in Mililani), two on the Big Island (Kona and Hilo) and one on Kauai (Lihue).

Wal-Mart also has one Sam's Club, a members-only discount warehouse, on Oahu in Pearl City. Overall in the state, Wal-Mart has nearly 3,000 employees.

Plans for a two-store complex, featuring a Wal-Mart and Sam's Club at the Keeaumoku superblock near Ala Moana Center, fell through earlier this year.

Williams, would not break out regional sales or discuss whether Wal-Mart has any new plans for Hawaii.

"We want to do what is best for the community, but right now there's nothing I can share," he said. "We're always looking for opportunities and will continue to."

Even two of the analysts who have "hold" or "market perform" ratings on the stock are upbeat on the company.

"The key to Wal-Mart's strategy is that they've redefined the market potential of every retail industry," said Sanford C. Bernstein & Co. analyst Emme Kozloff. "It was a retail industry analyst's dream when they decided to take on the $400 billion food industry. That created a much bigger growth opportunity for the company."

Kozloff, who said she has a "market perform" rating on the stock only because of its current valuation, said the retailer is pushing all the right buttons by not only converting many existing general merchandise stores into supercenters but also by expanding its food business as well.

"Wal-Mart, in general merchandise, had gone pretty high in terms of penetration when they got into food," Kozloff said. "And that's not for the faint of heart because food is pretty challenging. But they've done it through their supercenters.

"What investors should recognize is it's very low-risk growth because the majority of supercenter expansion is converting existing discount stores into supercenters. So what you have is a loyal customer base that has already been shopping at Wal-Mart discount stores. They're now being offered a better one-stop shopping experience. It's the ultimate convenience because they now have food. So opposed to another retailer trying to gain a lot of new customers, Wal-Mart is grabbing a higher share of wallet from its existing customers."

Kozloff, who said she likes competitor Target Corp. as a more immediate investment due to its valuation ($37.54 price, 26 P-E), noted that Wal-Mart has proved a great trading vehicle because of its fairly predictable price range.

"It's a great company," said the New York-based Kozloff. "My perspective is that they have a fantastic model but the gains already are in the stock and the risk reward is to the downside. The best investment strategy for the last 12 months in Wal-Mart has been to pare your position in the 55 range and reinvest in the 40s. While it seems like a mundane strategy, it's been pretty successful given its trading range."

Wal-Mart's 52-week high was $58.44 on Jan. 3 while its low for the year was $44 on Sept. 17.

Analyst John Lawrence of Memphis, Tenn.-based Morgan Keegan also thinks the stock is somewhat expensive at its current levels but likes it for the long term.

"We have a 'long-term buy' on the stock, and any pressure on the stock below 50 we'd become more aggressive," said Lawrence, who also rates the shares "market perform." "But before we get more aggressive over the near term, the next six months, we'd like to see a little more earnings visibility as they continue to compete in this promotion or competitive environment. I think this subsides a little bit in the fourth quarter compared to what we've seen in the last six months."

Wal-Mart, which beat analysts' expectations in October with a 6.7 percent rise in same-store sales compared with a year ago, has said that its November sales will come in at the lower end of the 4 percent to 6 percent range. Those results will be announced Thursday.

"The retail industry has been anticipating a slowing economy for most of the year and there has been a lot of promotional activity driven by competitors such as Kmart," Lawrence said. "You've had to really spend some money to contain and retain market share in this environment. Wal-Mart has con- tinued to do this and take share."

Lawrence points to the company's international growth, as well as its inroads into food, as driving the company.

"The international division continues to do extremely well, growing at a clip of 40 to 50 percent a year," he said.

"As it continues to grow, it eventually will represent a third of the growth of the company. And it was only a few short years ago that they really started this international venture. So they've come a long way in a short period of time.

"Combine that with what's happened with the food side of the business. It's certainly taken market share from a number of people in the grocery business and continues to make strides as it gets economies of scale.

"It's a great company. Wal-Mart has great management teams, and the company continues to leverage existing assets. We've said for 10 years that we think Wal-Mart will be the place where everyone in the world buys basic goods over time.

"In certain parts of the world, that's becoming a reality. They're only going to get better at that over time."