Rivals put squeeze The founders of Longs Drug Stores Corp. pioneered novel ideas when they began opening retail outlets 63 years ago.

on Longs’ profits

Discounters and supermarkets

have been cutting into the drugstore

chain's nonpharmacy salesBy Dave Segal

dsegal@starbulletin.comOne innovation, still practiced at the company's 434 stores, gives local managers the autonomy to choose merchandise that best fits their community's needs.

But times have changed for the nation's sixth-largest drugstore chain as discounters such as Wal-Mart, Costco and Kmart, as well as supermarkets and other drugstores, have siphoned off business.

Walnut Creek, Calif.-based Longs, whose 32 Hawaii outlets represent its second-largest market behind California, warned Oct. 9 that its third-quarter results would miss company and analyst forecasts.

On Wednesday, it released results for the quarter that not only showed a nearly 67 percent drop in net income from a year earlier but also earnings per share that were about 40 percent, or 5 cents, worse than company estimates made just 16 days before the end of the quarter.

"Our earnings performance was disappointing, reflecting softer-than-expected margins," Steve Roath, president and chief executive officer, said in a statement.

"(It) was basically the weakest quarterly profit performance we've had in recent memory," he added later during a conference call.

Longs had lowered its earnings guidance to 11 to 13 cents a share from 18 to 20 cents, but posted profits of 7 cents a share. Net income fell to $2.5 million from $7.7 million in the year-earlier quarter while sales rose 4.5 percent to $1.02 billion from $973,763. Net income for the first nine months of this fiscal year dropped 31 percent. Including one-time items, net earnings were down nearly 19 percent.Although Longs does not publicly break out numbers for regions, Roath said during the conference call that the earnings drop-off in Hawaii has been greater than in other areas.

"The Hawaii district has actually had a greater impact than the remainder of the company relative to sales following Sept. 11," Roath said. "That is a direct result of the decline in tourist trade which is coming into Hawaii, principally the Japanese tourists, and those coming from the mainland as well. It seems to be greater in the large shopping center locations over there."

A primary reason Roath gave for the company missing its revised earnings estimate was an inadequate inventory system in which summer seasonal products, such as garden-related items, are sold without bar codes and are booked on an estimated gross margin. He said the company did not discover the shortfall until the physical inventory at the end of the quarter.

"We understand that we can't live like this without having better visibility into what our results are," said Steve McCann, Longs' chief financial officer. "We are looking very strongly at trying to tighten up our ability to be able to predict and monitor our business."

Longs' pharmacy same-store sales, which count stores open at least one year, increased 11 percent from the third quarter of last year and represented 45 percent of the company's business. That's still lower than competitors such as Walgreen Co., CVS Corp. and Rite Aid Corp., the nation's three largest drugstore chains, who have pharmacy sales that represent between 57 percent and 67 percent of their overall operations.

"They have a larger percentage of their sales in the front end of the store compared to the other drugstore chains, and that's increased their vulnerability to this soft economic environment," said Omarr Aleem, a junior analyst at Cleveland-based Midwest Research. "This higher relative front-end exposure also means they could be seeing more pressure in consumables from supermarkets and mass retailers."

Front-end sales, essentially nonpharmacy items, fell 1.5 percent in the quarter from year-ago levels and accounted for 55 percent of total business. They were dragged down by photo, food, over-the-counter health care products and cosmetics.

"The pharmaceutical industry is thought of as being fairly recession resistant because if someone needs a prescription, it probably gets filled," said Franklin Morton, research director of Ariel Capital Management Research,whose firm is Longs' largest outside shareholder with an 8.9 percent stake.

"The front end of the store is getting competition from the supermarkets because some products may be cheaper at discount stores. Customers have a tendency to trade convenience for price in good times and will pay up.

"In difficult times, price becomes more important and they will look more at where the goods are the cheapest, and more often that's at supermarkets or discount stores rather than a local drug store."

Still, the company is making a concerted effort to compete with its larger rivals. In September, it acquired full ownership of RXAmerica, a pharmacy benefits management company with 6 million members. In July, Longs took over direct management of its two California general merchandise warehouses.

"The fact of the matter is, they're doing a lot of the right things but just not fast enough," Morton said. "There are 3,000 Walgreens around the country, over 4,000 CVS's, 3,000 Rite Aids and less than 500 Longs. They're at a great scale disadvantage when it comes to purchasing. And, in the retailing business, where margins are pretty thin, that's significant."

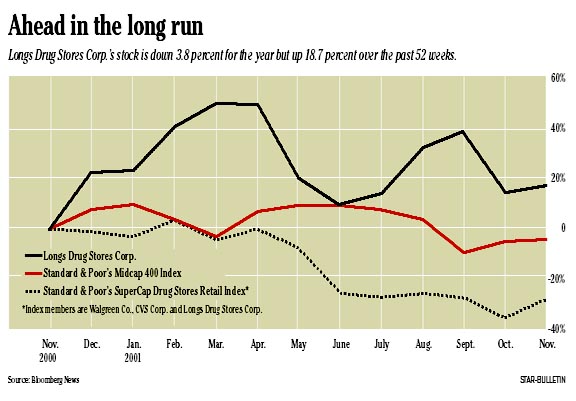

Analysts have been largely negative on the stock.

Three of the five analysts Bloomberg News lists as covering the stock rate it "neutral," with one ranking it a "market perform" and the other calling it a "sell." Standard & Poors, which removed the stock from the S&P 500 index in June, lists the stock as "avoid."

Despite the pervading skepticism, Ariel Capital Management is holding onto the stock in the hope that a larger drugstore chain will acquire the company.

With profit margins squeezed and its stock price having fallen nearly 50 percent during the past three years, Morton thinks Longs may find itself filling the prescription of an acquisition-minded rival.

"I think the drumbeats of consolidation are exceptionally loud," Morton said.

"Our rationale for owning the stock is that we think Longs has an excellent franchise in Hawaii and the West Coast. We also think Longs is losing the battle in consolidation. But the business is worth a lot for someone who wants a strong drug retailing presence in those markets."

Longs, with 346 stores in California, was founded in Oakland, Calif., in 1938 by brothers Joe and Tom Long. But the chain, which has stores in Washington, Nevada, Colorado and Oregon, also has strong ties to Hawaii. Chairman Robert Long held positions in Hawaii as department manager and store manager from 1961-1970.

Paul Loo, senior vice president for the Morgan Stanley brokerage on Bishop Street, speaks glowingly of Longs for good reason -- its stock helped put his two kids through school.

"In the '60s, I put virtually all my savings in Longs after I bought a home," said Loo, who no longer owns the stock. "I used to call Norm Adams, the first district manager for Longs, as a young rookie concerned that the stock had gone down. I'd ask what was wrong with the company and he'd say there was nothing wrong with the company and that Wall Street was sending it down for no reason.

"Norm would say that all our stores are doing just gangbusters and that he doesn't understand why people on Wall Street are selling the stock down in half. So I held onto it, and it went on to fame and glory. And I virtually sent my two kids to Punahou based on that one investment."

Loo, who said he had a couple of lunches with Joe Long (father of current Longs chairman Robert), was impressed with the elder Long's ideas.

"Unlike most drugstores at that time, he gave great discretion to the department head to choose and buy items that were unique to the area," he said.

"In today's world, the success of Dell Computer is because Michael Dell lets decisions be made at the consumer level rather than the home office. Clearly, Joe Long was ahead of his time."