Boyd Gaming Corp. may depend on Lady Luck to attract customers, but the Las Vegas-based company hasn't left anything to chance when it comes to growing its business. Boyd Gaming not willing

to hold a pat handBy Dave Segal

dsegal@starbulletin.comCharter flights from Hawaii to its Nevada hotels, riverboat gambling in the Midwest and South, a nearly completed horse racetrack casino in Louisiana and a billion-dollar resort under construction in Atlantic City, N.J., show just how much the company has spread its bets.

It's a wager that has paid off with a steady stream of business to Boyd's Central region properties during a period when lingering fears from the Sept. 11 terrorist attacks have slowed the influx of visitors to Las Vegas.

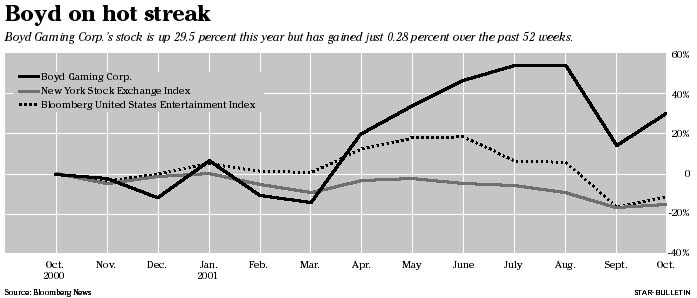

Even its stock, traded on the New York Stock Exchange, is acting like a high roller these days despite its low price of $4.45. Reeling from a hit of nearly 39 percent in the first week of trading following the attacks, the shares have recovered most of that loss and are now up 29.5 percent year-to-date at a time when most leisure companies' stocks are in the red for the year."There's no question the third and fourth quarter will be somewhat challenging, but (the gaming companies) are probably approaching a bottom," said Joel Simkins, an associate gaming analyst with New York-based Deutsche Banc Alex. Brown who was in Las Vegas for last week's three-day Global Gaming Expo.

"Just being out here in Las Vegas and seeing the trend the last few days and for this (past) weekend is pretty encouraging. What we're hearing is that budget-oriented travelers are coming here in pretty strong numbers. We're seeing people trade up. Customers who traditionally go to Circus Circus or Luxor are coming to the Bellagio for a much lower price than they would ordinarily pay. We're seeing discounted room pricing all over, but the rooms are getting filled. So that's encouraging."

Boyd, due to report its earnings Oct. 15, said in a press release last week that the terrorist attacks had caused little impact to its four fully operational Central region resorts, which for the 12 months ended June 30 accounted for 63 percent of all the company's cash flow. However, Boyd said that earnings before interest, taxes, depreciation and amortization for its seven Nevada properties during the last 20 days of September had been reduced by approximately $2 million.

"I think the downtown properties are holding up much better (than Boyd's other Nevada casinos)," Simkins said. "They have a niche of customers who fly in on these charters. I think that's been the secret of their success. Sam's Town and the Stardust, though, are facing some challenges."

The downtown properties, which derive a significant portion of their room occupancy and gambling revenue from Hawaii visitors, consist of the California Hotel & Casino, the Fremont Hotel & Casino and the Main Street Station Hotel, Casino & Brewery. Those properties had 92 percent hotel occupancy and a 2 percent increase in gambling revenue during the last 20 days of September. During 2000, Hawaii tourists made up approximately 67 percent of the room nights at the California, 57 percent at the Fremont and 51 percent at Main Street Station.

Boyd, which purchased Honolulu-based Vacations Hawaii in 1995 to serve its three downtown properties, said Hawaii flights to Las Vegas, which generally are near 100 percent full, were in the mid-90 percent range for the last 20 days of September. The bookings for this month are at similar levels, Boyd said. Vacations Hawaii offers seven Hawaiian Airlines nonstop charter flights a week.

"Hawaii is a very significant part of our downtown operation," said Rob Stillwell, Boyd's vice president of corporate communications. "It's a relationship that's been building for the last 25 years. We pride ourselves on our ability to serve that market particularly well."

Sam's Town Las Vegas, whose Boulder Strip business is split between Las Vegas locals and visitors, and the Stardust, the company's only property on the Las Vegas Strip, both were forced to lay off about 150 to 200 employees each, Stillwell said.

The Stardust, whose headliner, Wayne Newton, performed a benefit concert in Hawaii last month, had 82 percent hotel occupancy and a 24 percent decline in gambling revenue during the last 20 days of September vs. a year ago. Sam's Town had 78 percent hotel occupancy and a 9 percent drop in gambling revenue over the same 20 days. Business volumes have been picking up since then, Stillwell said.

Meanwhile, Boyd's two other Nevada properties, the Eldorado Casino and Jokers Wild Casino -- both located in Henderson, Nev. -- were unaffected by the slowdown.

The company's roots can be traced to 1962 when patriarch Sam Boyd and his son William, now Boyd's chairman and chief executive, purchased the Eldorado Club in Henderson. They founded Boyd Gaming in 1974, incorporated it as a holding company in 1988 and went public in 1993.

Boyd has been entering other gambling jurisdictions over the past seven years and now owns five mainland properties, with a sixth under construction, along with its seven Nevada facilities and the Vacations Hawaii travel agency.

Among Boyd's Central region holdings, Boyd owns and operates three riverboat hotel and casino operations -- the Par-A-Dice in East Peoria, Ill; the Blue Chip in Michigan City, Ind. and the Treasure Chest in Kenner, La., as well as Sam's Town Hotel & Gambling Hall, a dockside gambling and entertainment complex in Tunica County, Miss.

Stillwell said the company has been selective in looking for opportunities to diversify its business.

"We're in it for the long term," Stillwell said. "We looked at a number of opportunities as gaming emerged in various states and decided to pursue certain opportunities and passed on others. We were looking for sound regulatory structures and something similar to Nevada's, which had a proven track record. We wanted the opportunity to have a successful business in an emerging markets partnership in the state or community where the operation was."

That diversity paid off during last month's slowdown when business at Boyd's Central region properties remained steady.

"(The decline in Las Vegas tourism) has more to do with the fact that so many of our Las Vegas visitors come via commercial airlines," Stillwell said. "In and around various emerging markets where you have riverboat casinos, the impact was a little less because most of the customer base is driving from a relatively short distance, like a 150-mile radius."

Of the seven analysts listed by Bloomberg News who cover Boyd, four rate the stock a "buy" and three rate it a "hold."

"We like its diversification," Simkins said. "Most of our 'buy' rating is predicated on the company's growth opportunities."

Those opportunities include two ventures that are different both in nature and in their current stage of completion.

The first project of the two to be completed will be the Delta Downs Racetrack and Casino near Vinton, La. Boyd acquired the property earlier this year and plans to turn it into a "racino," a combination of horse racing and slot machines. Its renovation is expected to be finished by the end of this year.

"It's a Houston feeder market," Simkins said. "I think the racino has a lot of potential."

Simkins says, though, that Boyd's biggest undertaking is its $1 billion joint venture with the MGM Mirage to develop The Borgata in Atlantic City. It will be the first new casino in Atlantic City since the Trump Taj Mahal Casino Resort opened in 1990. The complex, which had its groundbreaking a year ago, still is on budget and on schedule to open in mid-summer of 2003. The facility will feature 2,010 hotel rooms, a 120,000-square-foot casino, 10 retail shops, 11 restaurants and a variety of entertainment venues.

"It will be the first true Las Vegas-style casino in Atlantic City," Simkins said. "It will have all the types of amenities you have in Las Vegas now -- a spa, high-end dining, retail, very luxurious hotel rooms. It will have very easy-access parking. So with its features, it will really feel like a Las Vegas casino, whereas the older properties (in Atlantic City) are somewhat rundown and don't offer the amenities found in Las Vegas."

Boyd's popularity with Hawaii residents, as evidenced by the near-capacity charter flights, stems partly from the state's reluctance to legalize gambling to improve tourism. Opponents say the introduction of the activity would exacerbate crime, poverty, drug addition and encourage compulsive gambling.

Hawaii's reluctance to establish gambling sits well with Boyd Gaming, which relies on the state's residents to fill its downtown properties.

"Obviously, (legalized gambling in Hawaii) is something that's always possible," Stillwell said. "It's something that even around Nevada, if California were to legalize, it's something as an ongoing business we'd have to deal with. We've been around a very long time. The company was created in 1974, and with the emergence of other gaming jurisdictions in the early 1990s, the same questions were posed about whether Las Vegas would survive as a designation resort if other areas started gambling. The answer has been a resounding 'yes.'

"There are so many different variations of legalized gambling that it depends a great deal what the guidelines were. I would think a certain part of the people coming to Las Vegas are coming here just not to gamble but because there are so many different entertainment options. They also come for the restaurants, shopping, golf or particular shows. Las Vegas has a number of entertainment options that quite frankly are hard to beat."

Simkins, aware of criticism over Gov. Ben Cayetano's fact-finding trip last December to a Bahamas gambling resort and the resistance in Hawaii to offer gambling on cruise ships, nevertheless thinks the state is missing out on a lucrative opportunity.

"I think it could be a huge upside for Hawaii, particularly as visitation softens and the market feels more competition from other destination locations," Simkins said. "If you look at the impact gaming has had on the Caribbean -- for example, the Atlantis casino resort in the Bahamas -- it's been a tremendous growth vehicle for that economy. I think Hawaii would be a very attractive market for travelers from Northern California and the West Coast. It would be an alternative to Las Vegas."

Simkins said one needs to look no further than Boyd's success with its Hawaii charters.

"I think it just shows that there's a potential market for gaming there," he said. "I think you'd have a majority of gaming revenues come from tourist destination visitors and still have a base of local customers to fill up the property during slower periods."