Pacific Capital It's still four months before Christmas but the managers of the Pacific Capital Small Cap Fund already have stocked their portfolio with toys.

Small Cap

winning big

The value fund has gained

20.6 percent this year by betting

on financials and manufacturersBy Dave Segal

dsegal@starbulletin.comLast December, Hasbro Inc.'s stock was in a tailspin and trading in single digits amid its first unprofitable year in at least a decade. Today, the toymaker is a turnaround story and the seven-member team that selects stocks for Bank of Hawaii's Asset Management Group is riding high with Hasbro as the fund's second-largest position.

Small Cap Fund, which invests in U.S. stocks with a market capitalization of up to $1.5 billion at the time of purchase, has flourished during a time when the economy has foundered.

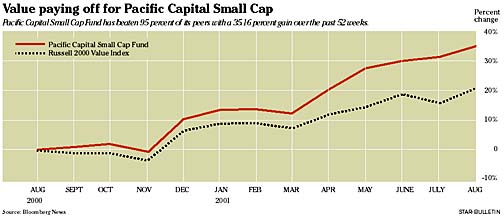

The 3-year-old fund is up 20.06 percent this year through Thursday, putting it 33rd out of 273 small-cap value funds ranked by Denver-based Lipper Analytical Services, which tracks the performance of mutual funds. Small Cap Fund's performance ranks it in the top 13 percent of similar funds.

The fund, which closed yesterday with a net asset value of $13.65, also is outperforming the Russell 2000 Value Index, which is the index the fund managers use to gauge their performance. The Russell 2000 Value Index is up 11.13 percent this year through Thursday. Net asset value is the price of each share of a mutual fund.

Small Cap Fund has gained 35.16 percent over the past 52 weeks, exceeding 95 percent of its peers and ranking it 11th of 254 funds in the small-cap value category, according to Lipper. The Russell 2000 Value Index is up 20.90 percent over that same period."Hasbro is one of our most successful holdings," said Small Cap Fund lead manager Mark Stuckelman. "It's very typical of the value stocks that we buy. Three years ago, it got into an (interactive) business that lost a lot of money. That depressed earnings and it became a small-cap stock. They brought in new management and got out of that business, lowered their cost structure and cut their debt to help them become a more viable company going forward. Now, we're seeing some exciting products from them that can take the stock to the next level."

Small Cap Fund, one of 12 funds in the Pacific Capital Funds family managed by the Asset Management Group, has its investment decisions made by a team of subadvisers at San Diego-based Nicholas-Applegate Capital Management.

Nine of Asset Management Group's 12 funds are managed from within Hawaii, but the Small Cap Fund, along with the International Stock Fund and the New Asia Growth Fund, are managed on a day-to-day basis from outside the state.

"To complement the investment expertise we have here in Hawaii, we made a strategic decision to partner with other high-quality investment managers in highly specialized areas such as small cap and foreign investing," said David Zerfoss, senior vice president of Asset Management Group."Nicholas-Applegate was selected as a result of an extensive search based upon their established expertise, long-term performance, and a philosophical viewpoint that fit with ours."

Assets total $57.9 million

The Small Cap Fund, listed under the ticker PCSAX, had $57.9 million in assets as of yesterday. The front-loaded Class A fund, which has a 5.25 percent sales charge, opened Dec. 1, 1998, and is available for an initial minimum investment of $1,000 and for $250 in retirement accounts. Its expense ratio, which includes all applicable fees but the sales charge, is 1.66 percent. The average small-cap value fund has an expense ratio of 1.57, according to Lipper."In this environment, I think we've done well overall because we've generally been focused on companies that have reasonable valuations," said Stuckelman, whose fund slipped 1.63 percent during the tech-boom year of 1999 and jumped 26.52 percent in 2000.

"Our companies have performed much better in this kind of (economic) uncertainty and we also haven't had a lot of technology. Generally, technology has represented less than 5 percent of the portfolio in recent periods. We focus on companies we think can benefit from the current economic environment."

Hasbro, one of the stocks that fit Stuckelman's criteria, represents 1.49 percent of Small Cap Fund's portfolio. It has risen 59.4 percent this year, to $16.94, and 69.2 percent since Small Cap Fund purchased it at an average price of $10.01. Hasbro's market cap has swelled to $2.92 billion and is approaching the $3 billion ceiling in which the portfolio managers will sell it out of the fund.

"Nicholas-Applegate is very disciplined and pure with our style," company spokesman Rick Shaughnessy said. "When small-cap value is out of favor in the market, we'll still stay small-cap value. Other managers may move around to bolster returns, but with a pure approach, if you create an asset allocation plan, then it creates an optimal mix of asset classes that can carry through all market cycles to achieve those objectives."

Kelly Ko, one of the managers on the Small Cap Fund team, is high on Hasbro because of some new products it has coming out later this year and also because its year-over-year sales comparisons will be easier because former hot sellers like Pokemon trading cards and Furby interactive toys cooled off in the second half of 2000.

"They have an electronic handheld game called Pox coming out later this year that has received a favorable preview from an electronic game magazine," Ko said.

"B.I.O. Bugs (robotic bugs that can act autonomously) is an interesting item. And they have licensing rights with some of the studios. Pixar is coming out with a movie (on Nov. 2) called 'Monsters Inc.' and Hasbro has the licensing rights for toys associated with the movie. It will be the first movie Pixar has put out since 'Toy Story 2.' Expectations are that it will be a pretty good movie.

"Hasbro also has licensing rights for the 'Star Wars' series, including a new 'Star Wars' movie coming out next year called 'Episode II Attack of the Clones.' They also have a licensing deal with Harry Potter for a trading-card game."

Small Cap Fund, which typically holds between 80 and 100 stocks, had 26.6 percent of its holdings in financial services and 19 percent in producers/ manufacturing as of July 31.

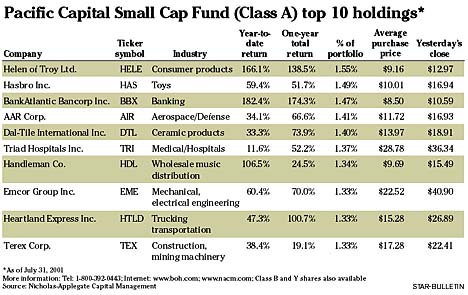

Its top holding is Helen of Troy Ltd., a consumer products company that sells personal care and comfort products such as hair dryers, curling irons and foot massagers under licensed brands that include Vidal Sassoon, Revlon and Dr. Scholl's. Small Cap Fund bought the stock at an average of $9.16 per share and it now trades at $12.97, representing 1.55 percent of the fund's portfolio.

"A little over a year ago, they divested some poorly performing business lines, brought in a new chief financial officer and some new members to their sales team, and brought their warehousing and distribution activities in-house that previously were outsourced. That gave the company a little more operational control," Stuckelman said.

"Only now are investors starting to recognize the benefits of those moves. They've expanded their margins off very depressed levels, increased sales and have revised guidance upward at least a few times this year. Their stock still has a very reasonable valuation. It's one of those stocks that fell through the cracks and under the radar screen."

Financials to benefit

The remainder of Small Cap Fund's top 10, starting with the third-largest holding, are BankAtlantic Bancorp Inc., a savings bank holding company; AAR Corp., a supplier of products to the global aviation and aerospace industry; Dal-Tile International Inc., a manufacturer of ceramic products; Triad Hospitals Inc., an owner and manufacturer of hospitals and surgery centers; Handelman Co., a wholesale distributor of music to retail chains; Emcor Group Inc., a provider of mechanical and electrical construction and facilities services; Heartland Express Inc., a truckload carrier; and Terex Corp., a global manufacturer of construction and mining machinery."If you look at financials, in particular, they will benefit from lower interest rates and from the steepening yield curve that increases their net interest-rate margins," Stuckelman said. "That's why we find them attractive now. The valuations among small-cap banks are very reasonable. They generally trade from 9 to 15 times earnings.

"Other sorts of companies that benefit in this type of environment are transportation companies. For example, trucking companies Swift Transportation and Heartland Express, which we both own.

"On the surface, you would think trucking companies would not do very well when you have freight volumes declining due to a weak economy and high fuel prices hurting their margins. The weaker trucking companies have difficulty surviving this type of environment. But strong companies like Swift and Heartland are surviving. They have stronger balance sheets and are able to raise rates while weaker companies are going out of business.

"Manufacturers, like steel and ceramic tile companies, also are doing well in this kind of environment. While the slowdown in technology is somewhat of a recent phenomenon, these small manufacturing companies have been facing a slowdown the last three years. As a result, they're much further ahead in cutting costs and rationalizing their business than tech companies."

Still, Stuckelman isn't entirely sour on the former high-flying tech sector and has been looking for bargains after the recent bloodbath.

"You can't look at tech as a homogeneous group of stocks," Stuckelman said. "There are a lot of subindustries within technology. Going forward, some will do well and some won't. Overall, we're actively looking for stocks in tech. That's where we think a lot of the good opportunities are going to be going forward. That said, we're not finding compelling values in technology. We think a lot still trade at rich multiples (price-earnings ratios).

Still wary of tech

"We prefer companies that have leadership in a certain area of technology. One that we like is Ditech Communications. The stock is trading at ($6.37) and at one time it probably was a $60 stock (it actually hit an all-time high of $127.44 on March 3, 2000). It's a leading manufacturer of echo cancellation equipment. It's used by long-distance companies to reduce echoes on phone lines."Right now, no one is really doing any capital spending in the area. But when cap spending comes back, we think Ditech will be a beneficiary. They have a new product cycle that we think will drive their earnings incrementally even in a shrinking market. They just reported their earnings and are cash-flow positive."

Stuckelman attributes the fund's investment style and discipline for its success.

"The hallmark of our investing process is its consistency," Stuckelman said. "We tend to invest in the same sort of stocks throughout time. We always look for stocks that are attractively valued with underlying strength and who have positive change."