Hawaiian Natural It's been an upstream battle ever since Hawaiian Natural Water Co. became a public company more than four years ago.

Water hopes merger

can quench its thirst

The isle company is counting

on its marriage to an Omaha

firm to take it to the next levelBy Dave Segal

dsegal@starbulletin.comStiff competition, financial problems and a bottling plant incapable of meeting demand all contributed to $13.3 million in losses from inception through the first quarter of 2001.

Even a deal early last year to acquire Honolulu-based Aloha Water Co. dried up when Hawaiian Natural defaulted on payments.

Enter Amcon Distributing Co.

The Omaha, Neb.-based wholesale distributor of consumer products threw Hawaiian Natural a life preserver last November when it announced it would acquire the Hawaii company and provide interim financial assistance. The deal, initially announced to close by the end of the first quarter of this year, now is projected by both companies to be completed by Sept. 30. It just may be the flotation device Hawaiian Natural needs to avoid going under.

"We're merging with a company that is able to not only assist us with distribution in the mainland U.S. but assist us in financing our growth going forward," said Marcus Bender, Hawaiian Natural president and chief executive officer.

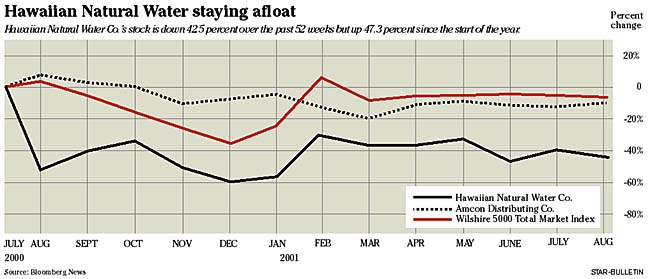

Hawaiian Natural, which bottles, markets and distributes natural water from the Big Island under the Hawaiian Springs trademark, has seen its sales gradually increase each of the last four years. It generated $1 million in reve- nues in 1997, $1.8 million in 1998, $3.1 million in 1999 and $3.7 million last year. Rising sales, though, haven't translated into increased earnings, however, as the company's loss in 2000 widened to $3.1 million from $2 million the previous year.The company's stock price, likewise, has fallen upon hard times even though it is up 47.3 percent this year to 23 cents at yesterday's close. Hawaiian Natural, which hit $5 on the day it went public in May 1997 and was as high as $4 on Feb. 26, 1999, fell as low as 13 cents last December and was trading at just 15.6 cents when it started this year. It was delisted from the Nasdaq SmallCap Market in October 1999 and now trades on the Over The Counter Bulletin Board.

Donner Corp. International, a Santa Ana, Calif-based investment banking firm which no longer covers the stock, initiated coverage of Hawaiian Natural on Sept. 28, 1999 with a "speculative buy" rating. At the time, the stock was trading at 98 cents. Donner, which specializes in microcap and smallcap stocks, cited the growth of the bottled-water industry, the company's improving sales, the quality of the product and the company's packaging in declaring the stock price undervalued. In January 2000, Donner, which provides investor relations, analyst coverage and press releases among other services, reiterated its "speculative buy" rating based on an announcement from Hawaiian Natural that it was introducing a line of herbal beverages under the name East Meets West Xen. The stock at that time was trading at 32 cents. In April 2000, Donner ceased coverage of the company.

"We stopped coverage because we felt there wasn't much we could do for the stock," said Donner's Tony Rhee, one of the analysts at the firm but not the one who had been covering the company. "We thought they had a promising story in the late summer or early fall of 1999. That's why we had a look at them and offered them our services and tried to get their story out there to let investors know what was going on with the company.

"In March of 2000, the stock of Hawaiian Natural Water went from between 65 and 70 cents all the way to near $2. This coincided with the technology boom when almost every stock increased dramatically in value.

"But then, starting in April 2000, that's when the bottom just fell out and many stocks decreased in value. Hawaiian Natural's stock went from near $2 back down to 70 cents again.

"We worked with them for six or seven months and not much happened. Not all the companies that we cover succeed in terms of their stock prices. That's just the nature of the stock market"

Amcon, though, looked past Hawaiian Natural's financial woes when it decided to acquire the company with the plan of making it a wholly-owned subsidiary. Hawaiian Natural fit a niche the Nebraska company was trying to enter.

"It's a quality product that we believe has a big future if properly marketed," Amcon Chairman and CEO Bill Wright said. "Amcon's business is basically the distribution of products, and it appealed to us to have a product that was our own product that we could distribute. We distribute other people's products to thousands and thousands of retail outlets and we like the idea of having a product with the quality of Hawaiian Natural and with the cache of Hawaii to introduce to the mainland."

In fact, Amcon likes Hawaiian Natural's product so much that it loaned the Hawaii company $750,000 last fall, invested $300,000 in Hawaiian Natural stock at the purchase price of 40 cents per share last February and loaned Hawaiian Natural an additional $500,000 in June.

"When we started talking with the Hawaiian Natural Water board, we knew that they needed money," Wright said. "So to this point we have advanced the money. Plus, we have acquired on their behalf a whole new equipment facility that in the next 60 to 90 days will be put in place on the Big Island at the present location so we will have a first-class bottling facility. We knew that they were not flushed with cash and needed help, and it fit our strategic plan to become involved."

Wright said that the current management team will stay in place although the board will be integrated with Amcon representation.

"The board will clearly have some of our people on it and we clearly want strong Hawaii representation on it," Wright said. "(Hawaiian Natural) management believes in the concept and the future of it and we want to just give them the tools that they need so they can prove their belief."

When the deal goes through -- and both parties are certain it will -- Hawaiian Natural shareholders will have their holdings converted to stock of Amcon, which trades under the ticker symbol "DIT" on the American Stock Exchange.

Amcon, which values Hawaiian Natural shares at just under $2.87 million, will allot one share of Amcon stock for every 13 to 16 shares of Hawaiian Natural stock. The exact amount is subject to a formula based on a 20-day trading range of Amcon's stock prior to Hawaiian Natural stockholders' vote on the merger. Amcon's stock closed yesterday at $5.05.

Amcon, which distributes beverage, food, tobacco and health and beauty care products, in June completed the acquisition of the distribution business and assets of Merchants Wholesale Inc. of Quincy, Ill. Earlier this year, Amcon sold its health and natural foods wholesale distribution business. Amcon also operates 14 retail health food stores.

It's this transaction activity, Wright said, that has held up completion of the Hawaiian Natural deal.

"What has happened is Amcon has continued with its business, one aspect which was an acquisition of a distribution business in Illinois that had sales in excess of $400 million," Wright said. "So to close the Hawaiian Natural transaction, we need to do the appropriate filing with the Securities and Exchange Commission, and our company, in doing that acquisition and doing other things, we keep having different numbers to integrate what we acquired or eliminate what we sold. It's been no fault of Hawaiian Natural shareholders or its board. It's been the dynamics of change in our company, which I think are very good. It makes it difficult to stop at a moment in time and provide the appropriate financials.

"We've closed the Quincy transaction and sold a small division of ours several months ago. That's why I think Sept. 30 is a reasonable estimate. We're right now in a position where not a lot of changes are going to occur in two or three weeks. So it's a good time to get our filings done and get our transaction closed."

Hawaiian Natural, whose water is known as a premium brand because it is naturally produced, competes in Hawaii against such "natural water " or "spring water" brands as Dasani, Crystal Geyser, Arrowhead, Dannon, Sparkletts, Alhambra and Evian.

Local brands Menehune, Hawaiian Isles and Hawaii all sell "purified" water.

Hawaiian Natural obtains its water after it filters through thousands of feet of lava rock and forms an underground water flow that passes directly under a well in Kea'au (near Hilo) on Mauna Loa's lower slopes. The company specializes in the small-package business, with the 5-gallon (or large bottle) home delivery business accounting for about 10 percent of its revenues.

Hawaiian Natural also distributes large-bottle "purified" water under the Ali'i name to homes and offices. It entered that market in June 1999 when it acquired the Ali'i Water Bottling Co.

The ill-fated acquisition of Aloha Water represented an expansion of that home- and office-delivery business.

"With purified water, everything is taken out of the water through the filtration process," Bender said. "The water is taken from city and county sources and run through a reverse osmosis filter similar to what you can buy at Sears, put in your house and process right at your own tap. All the minerals and contaminants are taken out and basically the water has nothing in it. From a health standpoint, it has no benefit to you.

"Natural water has calcium and magnesium that are naturally found in water that nutritionists say are good for you."

It's that high-end quality water that appeals to Amcon, which currently distributes its own brand of water at the low end of the market.

"The water we distribute we process through reverse osmosis," Wright said. "Hawaiian Natural is at the high end of the water spectrum. It's absolutely top-notch quality in its natural state and it's bottled at the source, so it's not treated water, which so many other waters on the market are. Natural water is a real gift from nature in a special commodity. Hawaiian Natural gives us an entry at the high end of the market."

Bender, who said there were other potential investors in Hawaiian Natural, said Amcon was chosen because it represented the best fit. He said Hawaiian Natural simply didn't have the money to go it alone and presently has a backlog of 20,000 cases of water for which the company has orders.

"There's a certain level of production needed in any business to overcome investment overhead," Bender said. "In this case, we were building the business steadily but still hadn't overcome the expense side.

"There's always a building process to get to profitability. When we went public, we had virtually no business and used the money to build a business, but we didn't have enough business to get over the hill. We're a start-up business in a public arena, and now we're poised to become profitable. Mr. Wright and his company noticed that and that's where they're going to help fulfill the business plan."

Wright said Amcon will focus on selling the water in Hawaii and, initially, on the West Coast and Southwest on the mainland. Currently, 91 percent of Hawaiian Natural's sales occur in Hawaii.

"We believe the company can very quickly move to profitability," Wright said. "Our objectives, more so than getting our money back, is to build a first-class facility on the Big Island, provide employment to residents of the Big Island and sell a quality product to the state of Hawaii and throughout the mainland.

"If we're as successful in sales as we hope to be, it means we'll be able to produce a product to deliver on those sales. Today, the company is operating against a backlog. Sales backlogs are wonderful but it's better to have the capacity available to meet demand. We expect demand to increase as we broaden our sales."

Bender welcomes the opportunity.

"Generally, the water business is the fastest-growing category of bottled beverages in the U.S., as well as the world. It's a very dynamic market, and because of the growth, it's attracting larger companies to enter the market now that previously weren't in the market.

"We're in a land of giants ... but we have something unique because of the source of our water -- being on the Big Island and the Mauna Loa location where the water comes from. It gives us a pristine source. People are buying it for purity and because it's clean and not polluted. That position is how we can fight in this arena."