Timeshares gaining Tourists and Hawaii residents who strolled the street of Waikiki in the 1970s can remember being hit up by timeshare salesmen. They would be offered free meals, free cameras or other perks to sit through a sales presentation, which often included high-pressure techniques and promises of outlandish returns on investments.

acceptance in Hawaii

The entry of well-known hotel

operators has cleaned up the

image and brought in touristsBy Russ Lynch

rlynch@starbulletin.comThat all changed with a slew of government regulations and the industry's own internal cleanup by the early 1980s.

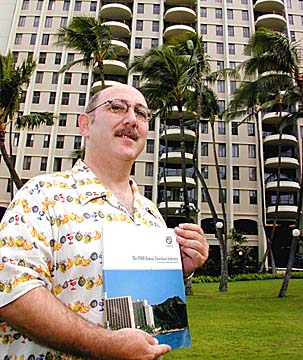

But what really brought timeshares into the arena of respectability was the entry of well-known international hotel operators into the business, says Howard C. Nusbaum, president of the American Resort Development Association, the biggest U.S. association of timeshare developers and operators.

"It isn't like it used to be, thank goodness," said Anne Deschene, president of the Better Business Bureau of Hawaii. "I think it's because the legitimate players are getting into the game."

Timeshare complaints have dropped, she said.

The result is a boom for Hawaii tourism, bringing travelers who spend more, stay longer, return more often and introduce their friends to Hawaii, said Nusbaum, who is in the islands to introduce a new study of timeshares in Hawaii, produced for his association by consulting firms KPMG LLC, Market Trends Pacific Inc. and RCI Consulting Inc.

"The industry has changed its practices. Now it's time to change its image," Nusbaum said in an interview yesterday at the 264-unit Hilton Grand Vacations Club in Waikiki -- the former Hilton Lagoon Tower, which was stripped out and reconfigured as a timeshare operation.

The perception of timeshares began to change in 1984 when Marriott International jumped into the business, Nusbaum said. The first big-brand hotel name endorsed the legitimacy the business had already built up, he said.

Other big names came in too, such as Starwood and Hilton. Now the market challenge is twofold -- to introduce the product to people who have never experienced it and to "reintroduce it to people who possibly had an unsatisfactory experience 20 years ago," Nusbaum said.

"It's not a real estate investment, it's a vacation investment," in which people buy a week or more of time in a timeshare resort for a set price, for use every year, and therefore know forever after what that week in the islands or elsewhere is going to cost them, he said.

In the old days the sales were for a set period, a specific set of dates each year, but that has changed too, Nusbaum said. Timeshares now are more flexible then ever, with owners able to alter the dates or even the units they stay in, as well as exchange their "interval" for a week somebody else owns at another resort elsewhere in the world.

What this is all means to Hawaii is an affluent traveler base, with a steady repeat-visit habit, freedom to spend more because they don't have to worry about hotel room rates and a confidence that they can always come back.

The business is essentially recession-proof, because timeshare owners have already paid for a big part of their vacations and aren't held back by economic downturns, political disturbances and similar factors that can cut into tourism, Nusbaum said.

The new study, called "The 2000 Hawaii Timeshare Industry," which can be purchased through his association's Web site, www.arda.org, shows industry benefits to Hawaii.

Based on mailed-in survey sheets from 1,600 owners of Hawaii timeshare units as well as detailed responses from about half the 70 timeshare-program operators dealing with Hawaii, the mid-2000 survey built on information gathered in a similar study in 1997.

The new survey says timeshares attract more than 400,000 visitors to the islands each year, close to the number that come to the islands for meetings and conventions. Like conventioneers, timeshare visitors tend to have money to spend. They have a high median household income, $89,000 a year. They are well educated -- 64 percent have college degrees. They stay an average of 11.2 days, considered long by visitor industry standards.

They travel in groups averaging three people, larger than the two-person average for the Hawaii visitor industry as a whole.

Based on 1999 figures, the report estimated that timeshares provides 15,200 jobs, about 9,100 directly employed in the industry and more than 6,000 generated in other businesses by timeshare spending.

In the past five years, about $540 million went into timeshare construction activities in the islands, ranging from new building to renovating older condominiums or hotels for timeshare use, the study said.

Timeshare is spread throughout the islands, with 11 projects on Oahu, 22 on Kauai, 31 in Maui County and 13 on the Big Island.

The business is growing rapidly, nearly 14 percent a year over the past 20 years and more than 40 percent in the past five years.

And the satisfaction level is high, the study showed. Nearly 85 percent of the survey respondents said they were satisfied with their Hawaii purchase.

What really gives the business credibility these days, Nusbaum said, is that the average timeshare owner now owns more than one time unit, or interval. With a high satisfaction level from their first experience, they have gone out and bought more, he said.

And the business doesn't hurt hotels, he said. For one thing, the average Hawaii timeshare visitor stays about 11 days and since only seven of those are in the timeshare unit, the other four are being spent in hotels, including trips to other islands.

The business also has huge growth potential since less than 5 percent of the traveling public owns timeshare, he said.

Units: 4,603 in 1999, a 40% growth in five years. More than 3,000 to be added next 5-10 years Timeshare in Hawaii

Sales: $276.4 million in 1999, a growth of 26.5 percent a year from $107.8 million in 1995

Visitors: 410,000 a year to stay in timeshare units

Wealthy visitors: Hawaii timeshare owners have an $89,000 median household income, stay an average of 11.2 days and the average travel party is three people.

Spending: Average timeshare party spent $2,608 per trip in 1999, slightly more than the average U.S. visitor party's $2,540. But timeshare visitors spend more on food and beverage, entertainment and local trips since they don't have accommodation expenses.

Company spending: Timeshare marketers spend about $50 million a year in Hawaii and had capital expenditures of $540 million from 1995 to 1999 to build and remodel units.

Employment: 2,470 in timeshare sales and operations, plus an estimated 6,300 in the visitor industry supported by timeshare visitors' spending

Tax revenues: $40.8 million a year in state tax revenues -- $25.3 million in excise tax, $2.8 million in transient accommodations tax, $12.7 million in income tax and individual taxes.