ML Macadamia ML Macadamia Orchards LP has endured some growing pains lately.

seeks growth spurt

The Big Island nut company is

hoping to put bad weather and

a legal dispute behind itBy Dave Segal

Star-BulletinJust this week, the company went to court over a dispute about whether its exclusive purchaser was required to buy all nuts regardless of condition.

The decision was in ML Macadamia's favor and now investors are scooping up shares of the company.

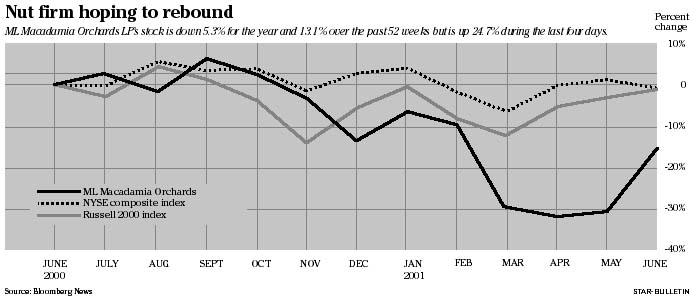

ML Macadamia's stock, which had been the worst-performing Hawaii-based company in 2001, jumped 24.7 percent after a Circuit Court judge in Hilo ruled Monday that Mauna Loa Macadamia Nut Corp. is contractually obligated to buy all nuts from the grower, including "unusable" ones.

The summary judgment, which still could be appealed, may be worth as much as $1.5 million for ML Macadamia and provides a boost for the company at a time in which it is recovering from weather-related setbacks and competing against lower-priced Australian imports.

"We expect the ruling to have a favorable effect on our profits, but it's still a difficult time for all the macadamia growers," said Dennis J. Simonis, ML Macadamia's chief financial officer and executive vice president.

ML Macadamia's stock price, which closed yesterday at $3.73 and is down 5.3 percent for the year, at one time had tumbled more than 40 percent from its 52-week high of $5.00 last June 22 amid uncertainties for the company and the industry. Rain and flood damage in the Ka'u region of the Big Island in November (causing the loss of more than 2 million pounds of nuts), the nut purchasing dispute with Mauna Loa and lower nut prices all contributed to the stock plunging to a one-year low of $2.96 on May 29.

Despite recent setbacks, the company has long been a favorite of Corning, N.Y.-based John G. Ullman & Associates Inc., a 23-year-old investment management firm that as of March 31 was the largest institutional shareholder of ML Macadamia with 123,550 shares, a 1.6 percent stake. President John Ullman said his firm, which manages about $500 million in assets, this quarter has added to its position of ML Macadamia and now owns slightly in excess of 175,000 shares, or approximately 2.4 percent of the company."Mauna Loa Macadamia Orchards is included in our value-based category," Ullman said. "We've had a position in Mauna Loa for many years. It provides tax-efficient distributions (because of its limited partnership status) for unitholders. From a value-based perspective, it possessed significant assets and has historically been in strong financial condition, most often without needing -- until recently -- long-term debt financing."

ML Macadamia, which posted a $1.5 million loss in the fourth quarter of last year and a $416,000 loss in the latest quarter, has blamed much of the red ink on Mauna Loa's refusal to pay for a total of 2.07 million pounds of "unusable" nuts during those periods.

Mauna Loa, sold by C. Brewer & Co. to the San Francisco-based Shansby Group partnership in September, argued in its court filings that the purchase of "unusable" nuts was not mandated in the purchase contracts that it inherited as a result of the sale.

However, ML Macadamia said the contracts clearly state that all nuts have to be purchased. The company went to court seeking $1 million it said it was owed by virtue of the agreements.

"The contracts were quite clear to us," Simonis said. "They were not ambiguous and there were 17 years of past practice, so we felt very good about our chances. The impact is about a million (dollars) annually but we hope to collect on interest for the underpayment and attorney fees, so a million and a half is probably a reasonable estimate.

"While we don't yet know whether the Shansby Group and Mauna Loa will appeal Judge (Greg) Nakamura's ruling, our hope is that they use their resources to focus on marketing the best macadamias in the world, which will benefit the entire industry."

ML Macadamia, which owns or leases 4,169 acres of orchards on the Big Island, sells its nuts exclusively to Mauna Loa under long-term purchase contracts. Mauna Loa then processes and markets the nuts under the Mauna Loa brand name. ML Macadamia has a complex pricing arrangement; the price it receives for its nuts is based half on the current year processing and marketing results of Mauna Loa and half on the two-year trailing average of U.S. Department of Agriculture macadamia nut prices. In the first quarter this year, ML Macadamia received an average of 49.5 cents per pound compared with 58 cents a year ago.

"We have a profit-sharing mechanism built into the price formula so if Mauna Loa does well in marketing our product, the profits get shared with the grower," Simonis said. "If it doesn't do well, that's shared with the grower also."

Marketing takes on an even more important role because of an increase in the amount of Australian imports coming into the United States at lower prices than Hawaii nuts.

"I think the answer (to improving Hawaii macadamia nuts' penetration) is in creative marketing by the Hawaii growers and processors," Simonis said. "Macadamia nuts are a specialty product that needs to be marketed not as a commodity but as a unique, special Hawaiian treat.

"Worldwide, the money has been put into supply -- growing more macadamia nuts. There hasn't been an adequate investment in marketing. Our hopes are that Mauna Loa and the Shansby Group will do that. I don't think foreign producers have invested adequately on the marketing side."

ML Macadamia, which Tuesday will celebrate its 15-year anniversary on the New York Stock Exchange, has made 60 consecutive quarterly cash distributions since the inception of the partnership. However, it slashed its dividend in each of the past two quarters. It cut its dividend 28 percent from 12.5 cents to 9 cents in February and then by an additional 44 percent to 5 cents last month. Its yield, now at 5.36 percent, is far below its 12-month average of 10.46 percent and its five-year rate of 14.29 percent.

That dividend yield was partly responsible for attracting the attention of portfolio manager Robert Beauregard of the National Bank Small Cap Fund in Montreal. The fund, with $47.64 million in assets, is ML Macadamia's second-largest institutional shareholder with 30,000 shares, or 0.4 percent of the company.

"Certainly the ruling earlier this week removed some of the uncertainty," Beauregard said. "I'm allowed to have international equities (in his Canadian fund) and I've selected a few strategies (to pick them). One is to invest in sectors not present in Canada ... or in special circumstances that are good investment opportunities. Every- body knows the saying about invest in what you know. Well, I've visited Hawaii in the past on vacation and I know the product and I became aware of Macadamia Nut (ML Macadamia Orchards) on the recommendation of another investor who's more of a value investor.

"When I started accumulating the stock, I saw, first of all, it was paying a very good dividend, which they've reduced but which at the time was about a 10 percent yield. The stock had been trading fairly stable and the company also was sitting on lots of land -- land worth much more than the total valuation of the company and more than the production of nuts that comes off that land."

One advantage that Ullman has over Beauregard is the U.S. tax benefit of owning shares in a company that is a limited partnership.

"It's quite different from any other investment that we have," Ullman said. "The distribution of dividends are not taxed fully as they would be with shares that are traded on the exchange in a traditional corporate format."

ML Macadamia, which makes most of its profits in the last four months of the year, currently is in its slow season. But Simonis is optimistic that the weather will cooperate this year.

"We believe the weather the last few years had been an anomaly," Simonis said. "The drought condition (throughout most of last year) was the severest we'd had in some time and the rainstorm that hit Ka'u was unprecedented. Looking forward, the trees look very good and we're optimistic the weather will give us a good crop this upcoming year. Our flowering and the nut sets look pretty good.

"Weather patterns in Hawaii seem to be normalizing, which should increase future production levels and reduce spoilage. Also, global demand for macadamias seems to be catching up with supply, which should help bring prices back to historical levels."