Home sweet Compared with a decade ago, Hawaii residents are living in less crowded conditions, are more apt to own a house and are more satisfied with their overall housing conditions.

home in isles

A study finds that despite

spending more on housing, residents

say they are more satisfied

By Gordon Y.K. Pang

Star-BulletinAt the same time, Hawaii families continue to spend a big portion of their monthly income on housing although that amount appears to be stabilizing.

Those are among the conclusions drawn from the Hawaii Housing Policy Study Update 2000, a compilation of statistics by state housing officials as a side study to the Hawaii Health Survey 2000 by SMS Research.

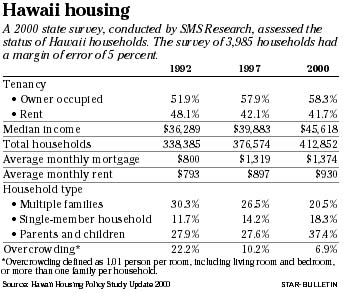

The survey polled 3,985 Hawaii households between the last quarter of 2000 and the first quarter of 2001. The margin of error is plus or minus 5 percentage points.

Officials say improved housing conditions are due to construction of more housing units.

The numbers mirror some of the statistics found in U.S. Census reports released this month, which also pointed to a trend toward improved housing conditions for Hawaii residents.

The percentage of families living in overcrowded living conditions plunged to 6.9 percent in 2000 from 22.2 percent in 1992.An overcrowded living condition is defined as a situation where there is more than one person per living room and/or bedroom, or multiple families within the same household, said Ronald Lim, the governor's special assistant for housing.

Consistent with those numbers are a decrease in the percentage of multiple-family homes (to 20.5 percent from 30.3 percent) and an increase in single-person households (to 18.3 percent from 11.7 percent).

Average monthly mortgage and rental payments -- as a percentage of income -- have stabilized somewhat.

According to the study, 40.7 percent of homeowners spent more than 30 percent of their income on mortgage payments, up dramatically from the 23 percent of 1992, but only slightly from the 40.1 percent of 1997.

The average home-owning family pays about $1,374 a month toward mortgage. That amount was $1,319 in 1997 and $800 in 1992.

The study also says 49.8 percent of renters paid more than 30 percent of income toward rent -- up from 43.7 percent in 1992 and 42.4 percent in 1997. The average rental household paid $930 a month in 2000, up from the $897 of 1997 and the $793 of 1992.

Lim said that typically, a family should pay no more than 30 percent of income toward housing.

But a number of Hawaii households continues to spend more than 40 percent of incomes on housing costs despite rising median household incomes over the last decade.

Lim said that means for many Hawaii residents, the more they make, the larger percentage of their incomes they're willing to devote toward housing.

Householders are also less likely to want to move from their current homes than they once did. Some 60.4 percent of households said they had no desire to move from their current homes.

Asked the same question in 1992, only 46.2 percent said they didn't want to move. In 1997, 48.1 percent said they wanted to stay put.

"This means that housing demand probably will drop a little bit because if they don't want to move, they won't buy another home," Lim said.

What the numbers tell him, Lim said, is that the state still needs to work on helping put more affordable rental units into the market.

Real estate economist Mike Sklarz said the numbers are not surprising.

"The fact that we went through a 10-year period of declining home prices and rents, in the last year or two, have made things more affordable," he said. "And the winners have been the potential homeowners and renters who have been able to find much lower prices than they did 10 years ago."