A&B hunting Alexander & Baldwin Inc. is feeling a little richer these days -- $77.4 million richer to be exact.

for acquisitions

The company, armed

with $77.4 million from stock

redemptions, is seeking to

snap up more propertiesBy Dave Segal

Star-BulletinAnd now the Honolulu-based company is preparing to do what others often do when they come into a big sum of money: Go shopping.

"We're in the process of potentially buying more real estate in Hawaii. So don't be surprised that having done nine deals (in the past two-plus years) that we might be announcing some more soon," said W. Allen Doane, A&B's president and chief executive officer.

Doane, who declined to be more specific, has seen A&B's financial options increase as a result of stock investments in Hawaii's two largest banks. In April and May, A&B received $9.4 million in after-tax profit by selling its shares in Bank of Hawaii parent Pacific Century Financial Corp. A&B's bank account will swell by $68 million in the next few months when French bank BNP Paribas is expected to complete its acquisition of the 55 percent of First Hawaiian Bank parent BancWest Corp. that it doesn't already own.

Despite the huge lump sum, Doane said he won't have any problem figuring out what to do with it.

"It will go into a pool to be used partly to pay our dividend of 90 cents a share, which is $36 million on an annual basis," Doane said. "Part of it will be used to finance our ongoing capital program for the company. We're now spending a large sum to improve (ocean transportation) operations on Sand Island for Matson. And we have a number of real estate projects that are active and that require capital. We could use part of it to make more acquisitions and to grow our business in real estate or perhaps even in shipping. And the last use of it is we have authorization to buy 1 million shares of the company's stock. How we apply any other monies we'll have to see about other opportunities. Given the fact that the capital program is significantly in excess of $100 million and we pay a dividend of $36 million a year, it's not a big sum."

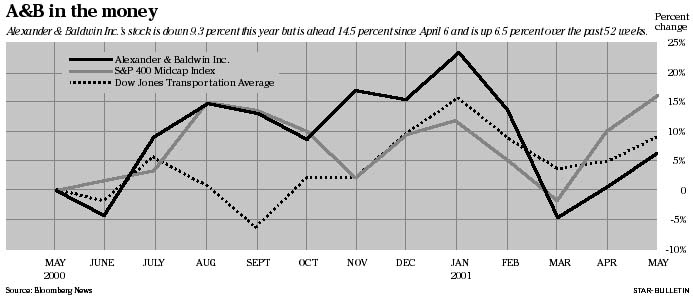

A&B, which was founded in 1870 and is one of the state's oldest companies, operates three businesses. Its two principal divisions are its Matson ocean transportation division, and its property development and management unit. Its food products division, which is involved in sugar and coffee, accounts for a smaller portion of the company's revenues.It's the cyclical nature of the company's businesses that convinces Standard & Poor's Corp. analyst Stewart Scharf to maintain a "hold" rating on A&B's stock, which closed yesterday at $23.82, down 9.3 percent for the year. He had the stock rated "avoid" until upgrading it to his current rating last June.

"They're a cyclical type of company and have to have all of their segments performing on all cylinders at the same time, which hasn't been the case in recent years," Scharf said. "Their food business has been bad with the sugar crop, their real estate has picked up and the ocean transportation has been hurt with the Hawaii economy weak for a long time. It's hard to get everything running at the same time on all cylinders. I think if the worldwide economy was showing some signs of strengthening and all their businesses were starting to reflect that, there would be a chance for a better (stock) return."

Last quarter was a mixed one for A&B, whose overall net income was down 15.1 percent but up 58.2 percent when a one-time accounting charge from the year-ago period is factored out. Matson's operating profit fell 12 percent from the year-earlier quarter due to low growth in its container volume, flatness in its automobile shipments, poor results from two joint ventures and higher rate competition. A&B, though, has taken steps to shore up its shipping operation by adding its seventh and eighth cargo ships last year. It also has long-term contracts with DaimlerChrysler, Ford and General Motors that will limit the attempt of Pasha Hawaii Transport Lines to enter the West-Coast-Hawaii auto-freight business.

Meanwhile, A&B's real estate operating profit last quarter jumped 165.8 percent. Its food division operating profit, benefiting from a one-time distribution from a sugar transpor- tation cooperative, rose 146.9 percent.

"Matson and real estate comprise about 90 percent of the company and food products are a small part," Doane said. "So if you leave food out, the two major drivers in the company the last two years performed very well. We were up 26 percent in earnings in 1999 and 15 percent in 2000 if you strip out one-time recurring items. So we have had two very good years of results where the two principal parts of the company performed very well.

"We had a continuation of that in the real estate business in the first quarter of this year. The Matson division was down 12 percent but the real estate division more than doubled."

While a prolonged slowdown in the economy certainly would affect A&B's profits, Doane doesn't share the pessimistic outlook put forth by the analyst Scharf.

"With the mainland economy heading into kind of a soft landing, we don't see recession in sight on the mainland," Doane said. "We see slowing growth but certainly not a recession. Everything I'm able to see would indicate the economy is going to get stronger on the mainland. At the same time, I think Hawaii has gone through the worst of it in the '90s and I believe economic growth (in Hawaii) in 2001 will not be too much less than the 3 percent growth achieved in 2000. So given where we've been for many years with little or no growth, the growth (Hawaii) got last year and (the growth) we're looking to get this year is OK. It's not booming growth, but certainly it's a much better picture than it has been for several years."

A&B's stock, which hit a 52-week low of $20.81 on April 6, has risen 14.5 percent since that time. Whether the increase can be attributed to the overall stock market recovery, the company's $77.4 million in redeemed bank equities or some other reason is impossible to tell. Nevertheless, Doane said he is satisfied with how A&B's stock has performed since he took over as president and CEO in October 1998.

"The 21/2 years I've been in this position our stock price has increased about 20 percent," he said. "Our dividends (which currently yield 3.8 percent a year) represent about another 10 or 11 percent return to our shareholders. So in 21/2 years we've provided our shareholders a 30 percent return, which is about 121/2 percent a year. I think some of us have been deluded in the last two years by the enormous run-up in high-tech. So I feel good about a 30 percent return to our shareholders in the 21/2-year period -- not that we couldn't do better in the future, but it's a good return."

A&B has been busy during that period. It launched a $32 million investment program last year to improve the operating efficiency of Matson's Sand Island Terminal. That project follows a joint venture with Stevedoring Services of America the previous year to improve A&B's three major West Coast terminals in Los Angeles, Oakland and Seattle.

On the real estate side, it finalized its purchase in February of the 18-story Pacific Guardian Tower, an office building across Kapiolani Boulevard from Ala Moana Center. It was the company's ninth Hawaii acquisition overall and sixth on Oahu in just more than two years. Its three other isle acquisitions have been on Maui. A&B also is in the process of seeking approval to develop a small business-oriented hotel near Kahului Airport on Maui. Altogether, A&B and its subsidiaries own 91,091 acres of land, of which 90,834 is located in Hawaii and 257 spread throughout California, Texas, Washington, Arizona, Nevada and Colorado.

The company's current development projects include one in Poipu, Kauai, and two in Kaanapali, Maui. The Kukui 'Ula, a 1,045-acre residential-resort community in Poipu, Kauai, has 330 acres zoned for up to 1,450 single-family units, 36 acres zoned for up to 520 multifamily units, and plans for 700 time-share units and 200 hotel rooms. The Vintage at Kaanapali and The Summitt at Kaanapali will offer 73 and 55 single-family homes, respectively.

"We continue to see opportunities in real estate acquisitions," Doane said. "If we see something that looks attractive for Matson and that part of the business, we'll make an acquisition there as well. We still see good opportunities and expect to do more real estate acquisitions in Hawaii, and may do some transportation acquisitions as well in the future."