MICHAEL HARTLEY paid the price for failing to meet investors' expectations.

After the bottom lines were calculated,

the heads of more than half of Hawaii's public

companies saw raises last year.

But when companies don't measure up,

CEOs get hit where it hurts.

Hawaii CEO compensation packages

By Rick Daysog

Star-BulletinThe chairman and co-founder of locally based travel company Cheap Tickets Inc. saw his annual compensation cut by more than a third last year after the company failed to meet lofty growth targets.

Despite a 60 percent rise in Cheap Tickets' 2000 earnings, a 34 percent leap in gross bookings and rapid growth in the company's online business, Hartley received no bonus last year, lowering his overall compensation package to $496,494 from 1999's $758,260.

"When we don't reach (our targets) everybody has to feel the pain, including us," said Hartley, who stepped down as Cheap Tickets' chief executive in February.

Hartley -- whose company enjoyed a 590 percent increase in earnings in 1999 -- was one of a handful of local executives who took pay cuts last year, according to a Star-Bulletin review of pay policies at Hawaii's largest publicly traded corporations. Filings with the Securities and Exchange Commission show that six of the isles' largest corporations paid their bosses less money last year than they did in 1999, while seven received raises.

The documents also show four of these executives earned $1 million or more last year.

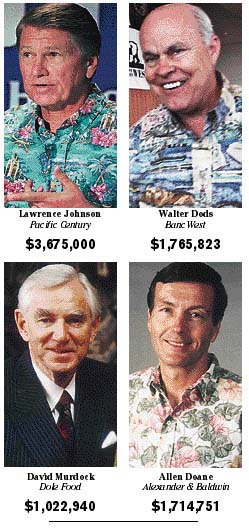

The Million-Dollar Club

Four Hawaii CEOs earned more than a million dollars in 2000

On average, Hawaii's biggest companies paid their bosses $873,877, a 26.6 percent increase from the 1999 average of $690,229. The average CEO's pay works out to about $2,394 a day and is more than 30 times the average per capita income in Hawaii.However, last year's pay figures are skewed by a $2.9 million retirement payment that Pacific Century Financial Corp. handed to its former chief executive, Lawrence Johnson.

Minus Johnson's severance pay, the average CEO's pay was more like $677,914, a 1.8 percent decrease from 1999's figure.

Here's a snapshot of what Hawaii's largest publicly traded companies paid their top executives last year:

>> Thanks to his retirement package, Johnson topped the list with a total compensation package of $3.67 million. That's in the face of a 11.9 percent slide in earnings and a 23.8 percent fall in Pacific Century's stock price through November, when Johnson stepped down.

>> Johnson was followed by Walter Dods, BancWest Corp.'s chairman and chief executive officer, whose $1.77 million in total compensation last year was down 10.7 percent from his year-earlier pay of $1.98 million.

Dods, who earns more than $600,000 a year as a trustee of the Estate of Samuel Mills Damon on top of his BancWest salary, was also granted options to purchase 203,914 company shares last year at a price of $15.125.

When BNP Paribas completes its $35-a-share offer for the remaining BancWest stock it doesn't already own, Dods' 2000 options could net him an additional $4.1 million.

>> Allen Doane, president and chief executive officer of Alexander & Baldwin Inc., received two pay raises last year, boosting his overall compensation by 29.7 percent, or $393,436, to $1.72 million. The pay increases -- the largest in this year's salary survey -- reflected A&B's strong year. Company earnings jumped 32.4 percent and its stock price rose 15.1 percent.

>> David Murdock, Dole Food Co.'s chairman and chief executive officer, also received a hefty pay raise as his total compensation rose to $1.02 million from 1999's $864,410. For the year, Dole posted a 42.3 percent jump in earnings.

>> Robert Clarke, Hawaiian Electric Industries Inc.'s chairman and chief executive, barely missed the cut to the million dollar club with a total compensation package of $987,852.

But Clarke's 2000 compensation is an 8.1 percent decrease from 1999's $1.08 million, due in part to the company's sluggish performance last year. Significant write-downs put the company's net income off 53.3 percent last year.

To be sure, local executives' pay lagged those of their mainland counterparts. A recent study conducted by BusinessWeek magazine found that the average CEO of the 365 largest publicly traded U.S. companies earned $13.1 million last year, a 6.3 percent increase from 1999.

The BusinessWeek report, compiled for the magazine by sister company Standard & Poor's Institutional Market Services, listed former Citigroup Inc. Chief Executive Officer John Reed as the top-paid executive in the country, with an compensation package worth $293 million, followed by Citigroup Chairman Sanford Weill, whose 2000 pay package came out to $224.9 million.

AOL Time Warner co-Chief Executive Officer Gerald Levin was third, with a total of $164.8 million while Levin's counterpart at AOL Time Warner, former isle resident Stephen Case, was 18th on the list with total pay of $73.4 million.

The majority of the fortunes amassed by Reed, Weill, Levin and Case last year were the result of stock options the executives exercised. Benefiting from a 28 percent rise in Citigroup's stock, both Reed and Weill received more than $200 million each largely by exercising their stock options.

Ruann Ernst's stock options did not fare so well. The chairman and chief executive officer of Digital Island Inc. last year exercised options on 146,600 shares of company stock at around $49 a share.

But shares in the Hawaii-formed company, which provides Internet and networking solutions for companies like Charles Schwab Corp. and J.P. Morgan Chase & Co., slumped to $18.75 at the end of the company's Sept. 30, 2000 fiscal year, resulting in a loss of about $4.4 million in value.

Digital Island shares have since been hammered by the stock market downturn and are now trading at $3.69 a share.

Excluding the stock options, Ernst's 2000 compensation was $327,553, a 19.2 percent increase from the year-earlier's $274,831.

In addition to reduced stock option awards, some executives saw their bonuses cut significantly. In fact, Paul Casey, Hawaiian Airlines Inc. chief executive officer, and Gerald Cysewski, chief executive officer of Cyanotech Inc., were denied bonuses after their employers' performance sagged last year.

Casey's 2000 compensation was $336,520, a 17.7 percent decline from the year-earlier's $409,030 while Cysewski's compensation package was down 4.4 percent to $102,808.

Typically, bonuses are tied to short-term performance measures, such as the company's recent stock price and its annual earnings. Last year, Hawaiian Airlines suffered an $18.6 million loss and its stock was down more than 14 percent. Cyanotech had a $4.5 million loss in its 2000 fiscal year.

Cysewski said that he and other Cyanotech managers voluntarily reduced their salaries by about 10 percent during much of 2000 after the Big Island microalgae producer ran into financial hardship.

"In the big scheme of things, it wasn't a big amount," Cysewski said. "But it was a symbolic gesture to show that all of the officers were solidly behind the company."

Hawaii CEO compensation packages

Four local CEOs earned more than $1 million last year. Here is the pay for heads of publicly traded Hawaii companies.

| Executive |

Salary |

Bonus |

Other1 |

2000 |

1999 |

% difference |

Earnings |

Stock price |

| Allen Doane, Pres., CEO Alexander & Baldwin Inc. |

$575,000 |

$435,032 |

$704,719 |

$1,714,751 |

$1,321,315 |

+29.78 |

+32.4 |

+15.1 |

| Walter Dods, Chair, CEO BancWest Corp. |

$973,548 |

$637,868 |

$154,407 |

$1,765,823 |

$1,977,470 |

-10.70 |

+25.5 |

+33.9 |

| Morton Kinzler, Chair, CEO Barnwell Industries Inc.2 |

$300,000 |

$150,000 |

$12,497 |

$462,497 |

$412,497 |

+12.12 |

+841.0 |

+69.9 |

| Ronald Migita, CEO, President CB Bancshares Inc. |

$250,008 |

$200,000 |

$4,534 |

$454,542 |

$356,336 |

+27.56 |

+32.7 |

-11.8 |

| Joichi Saito, Chair, CEO CPB Inc. |

$405,344 |

$119,130 |

$21,354 |

$545,828 |

$427,078 |

+27.81 |

+25.5 |

-2.2 |

| Michael Hartley, Chair, ex-CEO Cheap Tickets Inc.3 |

$496,494 |

-- |

-- |

$496,494 |

$758,260 |

-34.52 |

+64.5 |

-28.8 |

| Sam Galeotos, CEO Cheap Tickets Inc.3 |

$450,000 |

$140,959 |

-- |

$590,959 |

$461,154 |

+28.15 |

-- |

-- |

| Gerald Cysewski, Chair, CEO Cyanotech Inc.4 |

$102,808 |

-- |

-- |

$102,808 |

$107,561 |

-4.42 |

-- |

+150.0 |

| Ruann Ernst, Chair, CEO Digital Island Inc. |

$218,174 |

$71,000 |

$38,379 |

$327,553 |

$274,831 |

+19.18 |

-- |

-27.9 |

| David Murdock, Chair, CEO Dole Food Co. |

$800,000 |

$180,000 |

$42,940 |

$1,022,940 |

$864,410 |

+18.34 |

+42.3 |

+0.8 |

| Paul Casey, CEO Hawaiian Airlines Inc. |

$325,000 |

-- |

$11,520 |

$336,520 |

$409,030 |

-17.73 |

-- |

-14.7% |

| Robert Clarke, Chair, CEO Hawaiian Electric Industries Inc. |

$532,000 |

$427,349 |

$28,503 |

$987,852 |

$1,075,339 |

-8.14 |

-53.3 |

+28.8 |

| Gary Gifford, CEO, President Maui Land & Pineapple Co. |

$389,917 |

0 |

$2,054 |

$391,971 |

$395,138 |

-0.80 |

-90.8 |

+35.9 |

| Lawrence Johnson, ret. CEO5 Pacific Century Financial Corp. |

$735,000 |

0 |

$2,940,000 |

$3,675,000 |

$822,790 |

+346.70 |

-11.9 |

-5.4 |

| Mike Oí Neill, CEO Pacific Century Financial Corp. |

$143,654 |

-- |

$88,931 |

$232,585 |

0 |

-- |

-- |

-- |

|

Average: |

$873,874.87 |

$690,229.21 |

+26.6 |

1. Includes restricted stock awards, payments under the companies' long-term incentive plans and other compensation.

2. For fiscal year ending Sept. 30, 2000.

3. Hartley stepped down as chief executive officer in February 2000 and his duties were assumed by Galeotos, who previously served as president of Cheap Tickets.

4. For fiscal year ending March 31, 2000.

5. Johnson retired from Pacific Century on Nov. 3, 2000, and was replaced by O'Neill.

-- Figures for James Schuler, chief executive officer of Schuler Homes Inc. were not available. Due to a recent merger with a mainland home builder, Schuler Homes will not file its proxy statement until July.

Source: Company filings