City Bank parent CB Bancshares' stock hasn't moved much in eight years.

gets new life

By Dave Segal

Star-BulletinBut in the past 13 months, it's been making up for lost time.

As recently as April 19, 2000, the stock for the parent company of City Bank was at an all-time low of $23.25 on the Nasdaq -- $8.25 below its secondary offering price of $31.50 on April 7, 1993.

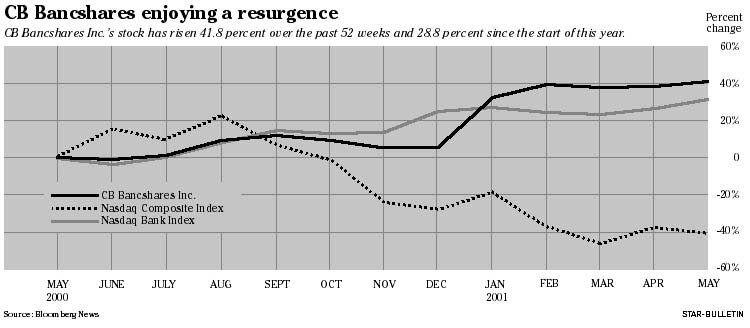

Just more than a year after its low, the stock has risen 43.7 percent, including a 28.8 percent gain this year that has lifted the shares to $33.40 at yesterday's close.

Not coincidentally, the timing of the stock's move follows the Honolulu-based company's decision last year to merge International Savings & Loan into its City Bank subsidiary. Last year, the company also posted the best earnings in its history.

"I would attribute the gain to steady improvement in the overall financial performance of the company, starting with the merger between City Bank and International Savings in July of 2000 and the streamlining of operations as a result of the merger, as well as improvement in noninterest income and the improvement of overall asset quality over the last two years," said Dean K. Hirata, CB Bancshares' senior vice president and chief financial officer.

Analysts, though, say the impetus for the turnaround started before last year. They credit a new management team that includes Hirata and President and Chief Executive Officer Ronald K. Migita for providing the catalyst.

Migita, employed by Bank of Hawaii for 29 years, joined CB Bancshares as president and chief operating officer in May 1995. He stepped down as president of City Bank and International Savings in November 1996 when CB Bancshares said it would merge the two subsidiaries in the first half of 1997. That merger was postponed, though, after the company found other ways to cut costs. Early the following year Migita was named CEO of CB Bancshares when longtime Chairman and CEO James M. Morita retired."The company has made great strides in the last couple years in trying to turn the company around," said Evergreen Funds analyst Peter Kovalski, whose company holds 100,000 shares of the stock in its Evergreen Equity Income fund and is the second-largest mutual fund holder of the company's stock.

"They brought in new management," said the White Plains, N.Y.-based Kovalski. "The company was kind of undermanaged before Ron Migita got there and he brought some new people into the company and strengthened the back-office areas and increased the technology investment of the company.

"The company was a little behind the curve with new software-type investments, and that was one of the first things he implemented. And now what he's trying to do is broaden their product mix by offering some new products and building a commercial client base."

Last quarter City Bank launched a new corporate branding campaign that focuses on the small- to medium-size business in which the bank customizes products based on specific customer needs.

"There was always something for the retail -- or individual -- customers but not too many products to offer the small businessman," Kovalski said. "Now they have a business checking debit card and a business sweep account to offer when they call on a potential customer. They can show a broad mix of services that are helpful in gathering new accounts. On the retail side, they're adding investment advisory services to provide additional investment vehicles like mutual funds and annuities."

In addition, CB Bancshares last year formed a new subsidiary, Datatronix Financial Services, which offers outsourcing services, such as check processing, to banks. Hirata said Datatronix has signed deals with two local financial institutions.

The latest changes in the company come at a time when there has been an increased focus on the Hawaii banking industry. Just in the past month, Pacific Century Financial Corp., parent of Bank of Hawaii, said it would sell its California branches and most of its South Pacific and Asian operations. The announcement was followed shortly thereafter by French bank BNP Paribas' announcement that it was making a $2.45 billion offer to acquire the remaining 55 percent of First Hawaiian Bank parent BancWest Corp. that it doesn't already own.

For investors who have been with CB Bancshares since the stock moved from the over-the-counter market to the Nasdaq eight years ago, the changes couldn't come soon enough. Five years ago, the company was under fire from some of its bigger investors, who waged a proxy fight to place two independent directors on the board in the hope of pressuring executives to boost shareholder value and the company's earnings. The bank responded by adopting a plan to provide 19 executives with payouts of about $11 million -- about 10 percent of the bank's value -- in the event of a takeover or potential change in control of the company. Ultimately, the bank's own slate of directors were elected and the following year the bank slashed its dividend 85 percent, from 32.5 cents a share to 5 cents, due to its lagging financial condition.

"It was run in kind of an old-fashioned way that didn't keep up with the changing times in the banking history with the increased use of technology and with the new products being offered for individual and business customers," Kovalski said. "They basically lent residential mortgages and had savings accounts and CDs. It wasn't a very sophisticated company. It was more like a savings and loan company than a commercial one.

"There was not a lot of drive from senior management to grow the company. They raised additional capital but they weren't anxious to deploy it and their earnings basically stagnated during that period. It was kind of a sleepy type of management.

"They weren't really aggressive in building market share and weren't keeping up with the competition with the products they were offering. It was difficult for them to grow. They didn't really broaden out to the general community and had a limited potential customer base."

It was no surprise then that the bank's stock at the time traded below book value, essentially meaning the company would be worth more if it were liquidated. Even today, the bank, which has 18 branches on Oahu, two on Maui and one on the Big Island, trades at about 83 percent of its book value of $40.11. Eight years after its secondary offering, the stock is up less than two points from where it began, though it briefly hit an all-time high of $45 in October 1997.

"For Hawaii companies, that's not unusual right now," said Randy Havre, chief executive officer of Hawaii Venture Group. "You go back and look at (Honolulu-based) Alexander & Baldwin. Alexander & Baldwin, in 1988, hit a price of 3912 and within a couple years was down in the 20s. It's been in the mid- to low 20s for a solid 10 years and it's a good little company that makes money. That stuff is a function of our Pacific market in Hawaii and where the economy has been in the last 10 years.

"A lot of the banks in the mid-'90s had to write off a bunch of loans because of the economy. There were a lot of layoffs and they were doing early retirements. Most of the banks went through that. There was some retrenchment due to the economy more than anything else. We only saw recently -- in the last two years -- where things are starting to get better. But now with the U.S. economy struggling and Asia continuing to struggle, things are looking bad again."

Still, Hirata said the bank has not been affected by the economic slowdown and analysts Kovalski and Havre both agree that the stock is undervalued.

In the first quarter, CB Bancshares posted a 15.1 percent gain in net income to $2.8 million, a 4.9 percent rise in assets to $1.7 billion and a 10 percent jump in deposits to $1.3 billion.

"It's an undervalued bank with turnaround potential," Kovalski said. "One thing, though, is that it's not well-followed by analysts. It's not a very large company and not a lot of investors know about it. And the ones who do, know about it having had a lackluster history in the past under old management and are probably hesitant to invest at this time, They probably want to wait for some events to transpire."

Havre said the company's recent selections for its board of directors proves it's moving in the right direction.

"Duane Kurisu is a real dynamic guy," said Havre, singling out one of the new board members who is a real estate partner with Kurisu & Fergus.

"He's been very successful in different types of business activities on the mainland. He's got great contacts and he brings a lot to the company. The other guys have got good backgrounds too. It shows the company is trying to expand itself and bring in the expertise to do that."