French acquirer First Hawaiian Bank is about to shed Hawaii ownership.

expects to keep

status quo at

BancWest

BNP Paribas signs

CEO Walter Dods to a 3-year

contract and retains other

top managementFirst Hawaiian parent's

directors approve saleBy Russ Lynch

Star-BulletinThe bank, founded as the Bank of Bishop & Co. in 1858 in the Kingdom of Hawaii, and moving on to become First National Bank of Hawaii, eventually became headquarters of the $19.4 billion BancWest Corp.

If BancWest's directors and shareholders -- and various regulators -- agree, BancWest in about six months will become a private company and its shares will no longer be traded on the stock exchanges.

It will become totally owned by BNP Paribas, an international retail and investment banking firm based in Paris. The company is the former Banque Nationale de Paris, which has owned 45 percent of BancWest since November 1998.

Will that make a difference to its account holders, borrowers and employees?

No, say officials of BancWest and the pending owner, which plans to buy all remaining shares for $35 each, an investment of about $2.45 billion, and take the company private.

After all, they say, the bank in Hawaii and on the mainland will still be under U.S. and federal rules. All the deposits will still be insured by the Federal Deposit Insurance Corp. and customers should see no change. The name won't change, managers and tellers will stay, accounts and credit cards won't change, the company said.

Top management will stay, too. Walter A. Dods Jr., chairman and CEO, told a news conference today that the buyer made it a condition of the deal that top management stay. BNP Paribas wanted to give him a five-year contract, Dods said at a news conference, but he settled for three years because he wants to do other things with his life.

Three other top executives have signed two-year contracts: John K. Tsui, BancWest vice chairman and First Hawaiian Bank president; Howard H. Karr, BancWest executive vice president and chief operating officer.

On the West Coast, Don J. McGrath, BancWest president and chief operating officer, will stay on as will other key officers.

Dods said today that BancWest is looking for acquisitions and it will have the French bank's deep pockets to finance them. He said the goal is to bring BancWest into the top 25 banks in the United States, which would mean increasing its assets to about $35 billion from the present level close to $20 billion.

One aspect of the deal will be good for Hawaii charities, Dods told reporters. BNP Paribas has promised to give $5 million to First Hawaiian Foundation, the bank's charity arm, when the deal closes, he said.

BNP Paribas was founded in the mid-1800s, eventually becoming Banque Nationale de Paris, and entering the U.S. market.

In 1981 it acquired Bank of the West, a retail bank with branches in California and other Western states.Under Dods' direction, First Hawaiian Inc., the holding company for First Hawaiian Bank, had been looking to expand beyond what it saw as a limited market in Hawaii, Guam and Saipan.

In 1998, discussions began with Bank of the West and its parent BNP, itself embarking on an expansion quest.

In November of that year the deal was completed. First Hawaiian Inc. issued 25.9 million new Class A shares, equal in value to its common shares, and put them into a new combination that had BNP in effect owning 45 percent of a new BancWest Corp., and having the right to appoint nine of the 20 BancWest directors.

Relations were good. Dods stayed in the top job but had to get used to frequent trips to France and, even more often, to San Francisco for meetings with Bank of the West. BancWest went on to buy more branches in the Western states.

At the end of March this year, BancWest had total assets of $19.4 billion and says it serves 1.1 million households and businesses in the Western United States through 252 branches in Hawaii and six Western states: California, Nevada, Oregon, Washington, Idaho, and New Mexico.

BNP has total assets of $646 billion, making it France's largest banking group and the 10th largest in the world. It has extensive international networks, with offices in 87 countries.

The buyout stands to make a lot of money for BancWest investors.

Alexander & Baldwin Inc. is an example. Through various investment accounts, A&B is outright owner of 3.4 million BancWest shares. At $35 a share, if that is the price shareholders settle for, that will be a total of $119 million for A&B. From that must be deducted A&B's costs for buying and handling those shares, but the company says historically the amounts were small.

The Damon Estate owns some 15.4 million BancWest shares, worth $525 million under the buyout.

Shareholders, many of whom took big profits yesterday as they sold their shares to cash in on the buyout announcement without having to wait until the deal is consummated, already should be happy.

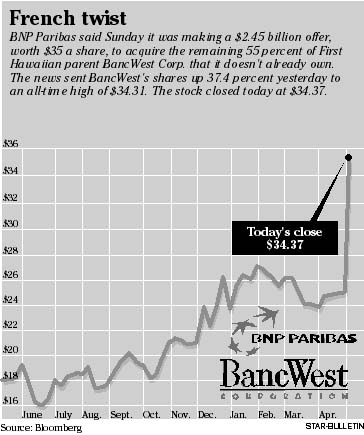

The stock has sold as low as $14 in the past 12 months and getting well over twice that has induced shareholders to sell, causing the stock to close at $34.31 on the New York Stock Exchange yesterday, up $9.33, or 37.4 percent, from Friday's close of $24.98.

BancWest closed up another 6 cents today to $34.37.

Not everyone thinks the deal is good.

One shareholder has filed suit in Delaware, where BancWest is incorporated, claiming that BancWest was influenced by BNP to accept an "unfair and inadequate" price of $35 per share.