Central Pacific Central Pacific Bank's parent company is on quite a winning streak.

riding record run

CPB's stock has surged

35.6 percent since starting its

repurchase plan three years agoBy Dave Segal

Star-BulletinSeven consecutive quarters of record earnings.

Six straight years of increased profits.

Back-to-back 12-month periods of all-time returns.

It seems a far cry now from CPB Inc.'s humble beginning 47 years ago when the bank formed following World War II to serve the financial needs of Japanese Americans in Hawaii. In 1954, it took $1 million in capital pooled from Hawaii's Japanese-American community and the expertise of managers recruited from Sumitomo Bank to get the financial venture going.

Since then, CPB has maintained its focus as a community bank while watching two of its larger state rivals, Pacific Century Financial Corp.'s Bank of Hawaii and BancWest Corp.'s First Hawaiian Bank, expand beyond the islands.

Today, though, there are some CPB followers who wonder if the bank might be reaching a crossroad.

With Bank of Hawaii pulling in its reins to focus on its state operations and First Hawaiian Bank expanding its services, it's clear that competition for business only will get tougher. CPB experts are wondering what difference, if any, it will make that Osaka, Japan-based Sumitomo gradually has been decreasing its stock position in the company.

"I personally think it's positive for them as far as ventures go," said local stock analyst Randy Havre, chief executive officer of Hawaii Venture Group. "There was always a question about whether Sumitomo was going to buy them out or prevent them from doing things. Whether it was true or not, it was still a distraction.

"Historically, senior management has come from Sumitomo. This might give (CPB) the flexibility to get management from wherever they want, whenever they need it. I also think if the company were going to grow itself and do a secondary stock offering by selling additional shares to get money, they wouldn't have that controlling interest in there."

Sumitomo, which at one time held 13.4 percent of the company, has been selling back its shares to CPB in conjunction with the buyback program that CPB began in 1998. The Japan bank, which at one time held 1.4 million shares of the company, now holds just 2.57 percent, or 211,750 shares, of CPB's 8.2 million shares outstanding as of March 31.Despite Sumitomo's diminishing stake in CPB, one bank official dismisses the notion that Sumitomo had handcuffed CPB's maneuvers.

"From a management standpoint, they really had no part in operations," said Wayne H. Kirihara, CPB senior vice president and manager of the marketing and corporate development group. "We've enjoyed a good business relationship from the standpoint that we could refer customers to each other. We expect the business relationship to continue going forward with the referrals and the assistance. Our relations are still very strong."

Sumitomo's involvement with CPB began in the early 1950s after it became apparent that the local Japanese community needed its own bank. The three Japanese banks that were in operation in Hawaii just prior to World War II were ordered closed by the U.S. government after the bombing of Pearl Harbor and all assets were frozen. After the war, the deposits eventually were returned to customers but the banks never reopened. Thus, with no bank to serve the Japanese community, local Japanese businessmen and their families were finding it difficult securing loans and obtaining mortgages.

Today, CPB seeks business from all Hawaii residents and has seen its company grow to 24 branches, mainly on Oahu. Of that total, four branches are on the neighbor islands -- two on the Big Island (Hilo and Kona), one in Kahului, Maui, and one in Lihue, Kauai. The bank has 75 automated teller machines.

"We are very committed to being the best community bank in Hawaii," Kirihara said. "Our focus is really on Hawaii and to help the economy and businesses grow each year, as well as work on the local deposit base in Hawaii. There's no question the competitive environment is becoming much stronger in the banking industry. You've seen quite a bit of activity going on.

"We feel one of our strengths is in the relationship banking area. We have very strong relationships. We have a very strong commitment to our business customers and to work with them, and we pride ourselves on that relationship. We feel there's definitely a value to having a bank with that type of commitment. As long as we maintain competitive products and services -- because that's what the customers are demanding -- we want to take it up a notch with better relationship banking."

The bank also has made a concerted effort to boost the value of its stock. It has repurchased 23.18 percent, or 2.5 million shares, of the 10.6 million shares outstanding at the inception of the first repurchase program.

"The bank's board of directors approved the share repurchase program to increase earnings per share and shareholder value," Kirihara said. "We're fortunate to have a strong capital position and to be able to take the capital to buy shares back and benefit shareholders."

CPB's stock has risen 35.6 percent in the nearly three years since announcing the repurchasing program May 13, 1998. The stock has easily surpassed the performances of the other publicly traded Hawaii banks during that time.

In fact, only BancWest shows an increase over the three-year period, with a gain of 27.1 percent. Among the others, American Savings Bank parent Hawaiian Electric Industries Inc., which also is the primary utility in Hawaii, is down 3.1 percent. Pacific Century Financial Corp. is off 6.5 percent. City Bank parent CB Bancshares Inc. is down 19.5 percent.

And the Nasdaq bank index, which consists of 570 banks that are traded on the Nasdaq and the SmallCap Market, is down 13.3 percent.

"I'm really pleased that they've finally accelerated their buyback," said Private Capital Management Chairman and Chief Executive Officer Bruce Sherman, whose Naples, Fla.-based firm is CPB's second-largest shareholder, behind CPB's employees.

"I'm glad Sumitomo is getting out of the situation. "I think they (CPB) were astute in the prices they paid (for the repurchased shares) from a long-term valuation standpoint.

"With a conservative balance sheet they have a limited opportunity for excess capital. And a buyback is the best way to accrete value for existing shareholders rather than to pay out more in dividends (CPB boosted its quarterly dividend in January by 6.7 percent to 16 cents a share). It's a good decision for the longer-term value of the franchise."

Sherman, whose company owned 8.3 percent of CPB, or 703,162 shares, as of Dec. 31, said he has since increased his ownership of the company to about 9 percent with additional purchases in the first quarter.

"What's attractive about the company is that there's an active shrink going on in terms of (market) capitalization," said Sherman, since fewer shares in the marketplace increases earnings per share. "They also just reported one of the best quarter-to-quarter comparisons they've ever had."

CPB, which announced its first-quarter results April 24, showed a 16.2 percent gain in net income, to $5.3 million compared with $4.6 million from the year-ago quarter. It also posted increases in assets (up 9 percent to $1.77 billion), deposits (up 5.5 percent to $1.38 billion) and net loans (up 4.6 percent to $1.22 billion).

The bank also pared its nonperforming assets, loans delinquent for 90 days or more and restructured loans by 36.7 percent to 0.66 percent of total loans.

Stock has been stable

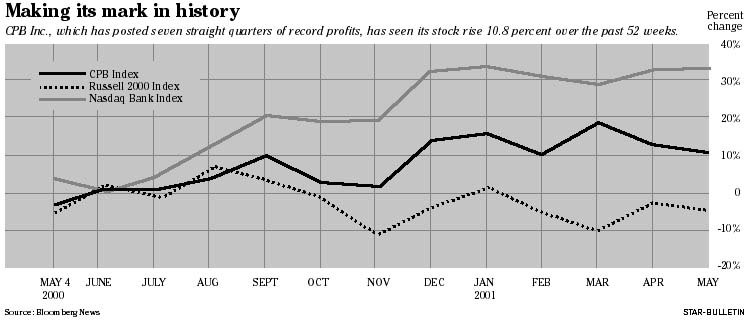

CPB's stock price, which closed at $26.10 yesterday, has been stable over the past year. The shares are down 6.4 percent since Jan. 1, but up 10.8 percent over the past 52 weeks."You just can't look at stock price because banks trade in a different way from other companies," Havre said. "You have to look at the return on assets and the return on equities (benchmarks that measure profitability). Banks frequently trade as a multiple to book value (a company's net worth). (CPB's) return on assets is over 1 percent and return on equity is almost 15 percent over the last 12 months.

"When you look at CPB's book value, it's $17. So these guys are trading about $10 over their book value. In that respect, they're doing quite fine. If you look at their 52-week range ($30 to $20.75), they're trading at midrange and holding their own the last 12 months -- considering other things going on in the market. They run themselves pretty conservatively and haven't run into the (loan) problems run into by Bank of Hawaii."

Kirihara said the bank's philosophy of working closely with customers accounts for the bank's loan success.

"Referring to assets and quality, I think Central Pacific Bank always has had a high priority and strong handle and focus on asset quality," he said. "We're not necessarily conservative but I think the credit department -- through the philosophy of the bank -- has done an excellent job at staying close to customers and working with them in anticipating problems. The fact they've had such a good handle on it is the reason for having a strong asset portfolio all these years."

Ultimately, though, CPB may need to start looking at other ways to grow its business other than through its share repurchases. It's long been speculated that one way to do that would be for CPB to merge with City Bank's parent, which at the end of the first quarter had $2.8 million in net income, $1.73 billion in assets and $1.26 billion in deposits.

"With any merger, there could be synergies and economies of scale," Kirihara said. "The antitrust laws currently prevent some of the larger banks from acquiring any more market share in Hawaii. We have to look at any merger or acquisition with the best interests of the shareholders and customers in mind. It's not a matter of putting the pieces together. It has to be a good fit.

"At this time, there's nothing on the books (with City Bank) but it's something that nobody can rule out. We really didn't have any formal discussions. Internally, we've discussed just about any possibility, not specifically with City Bank, involving acquisition and merger issues. In the past we've visited those areas, and concluded to date that right now it's in our best interest to remain independent and to continue on the course we're going."