Castle & Cooke Encouraged by falling interest rates, Castle & Cooke Inc. plans to build and sell as many as 500 new homes in Mililani and Royal Kunia this year, up 11 percent from 450 homes last year.

to add homes

A tightening Oahu home market

By Tim Ruel

spurs plan for 500 more homes

in Mililani and Royal Kunia

Star-Bulletin

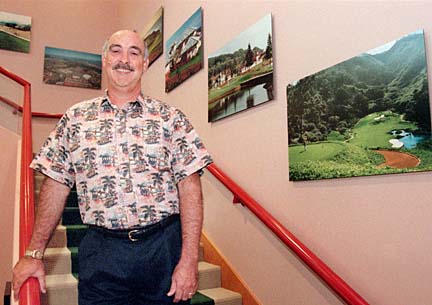

The privately held company plans to spend as much as $110 million on construction in West Oahu, compared with about $100 million last year, according to Harry Saunders III, who was recently promoted to president of Hawaii operations for Castle & Cooke.

The company's sales in Mililani and Royal Kunia have steadily increased from 400 units in 1997 to 450 units last year. Castle & Cooke typically tries to sell as many units as it builds.

Sales are normally slow in the first quarter, but not this year. Recent interest rate cuts have rewarded the company's confidence in the market for new homes, Saunders said.

Beginning Jan. 3, the Federal Reserve has cut rates four times, encouraging home buyers with cheaper loans.

"Every time the Fed would cut the interest rates, people would go out and buy houses," Saunders said.

Castle & Cooke has already logged 130 new orders for homes in the first quarter of this year, a 30 percent increase from 100 orders in the same period last year.The company's move to build more homes drew a nod from a competing West Oahu home builder.

"I bet you they can do 500, especially if interest rates stay low," said Vicki Gaynor, assistant vice president of Haseko Homes Inc.

Haseko seen its first-quarter sales of new homes in Ewa jump 32 percent, to 58 units from 44 last year, she said.

"This has a much better feel than last year did," Gaynor said.

Haseko plans to sell off the last 200 units of the first phase of its master-planned Ocean Pointe community by the end of this year. The development comprises 650 town houses and single-family homes built on 90 acres in Ewa. Haseko broke ground on the project in 1997. Prices range from $187,990 for a two-bedroom townhouse to $300,000 for a four-bedroom single-family home.

With the first phase of Ocean Pointe nearly wrapped up, Haseko plans to break ground on its second phase -- another 650 units on 84 acres -- in early 2002, said Gaynor.

Beyond the cuts in interest rates, demand is increasing for Leeward Oahu homes because of a tighter real estate market in East Oahu, which started seeing a comeback in demand for more expensive homes beginning in 1997.

Higher prices and fewer options east of Honolulu have given buyers more reason to look for less expensive homes in the West, Saunders said.

Castle & Cooke's prices in Mililani range from $220,000 to $500,000, while Royal Kunia prices are about 7 percent to 10 percent lower, Saunders said.

"People are looking for something new and different," he said.

Another factor in the demand for new Leeward homes is a drop in the number of existing homes up for resale, also known as inventory.

Currently, only 6.7 months of inventory remains in West Oahu, compared with 8 months at the same time last year, according to the Honolulu Board of Realtors.

Home resales on the Leeward side are on a pace 31 percent faster than last year, gobbling up inventory.

But that's not the only reason for the dip. Many people who purchased new homes in the early- to mid-1990s have seen their property values slip and stay there. Those buyers now make monthly payments on mortgages that are higher than what their home is worth.

Rather than lose money by selling, many homeowners have tried to hang on. Others have turned in the keys to their mortgage lender, which drove the statewide number of completed foreclosures up 70 percent last year.

Saunders acknowledged new development can keep prices from rising, but said current demand is strong enough to take on the new units and allow for increases in home values. He expects resale prices to rise a modest 2 percent this year.