Barnwell finds Hardly anyone likes high energy prices.

right blend

The isle-based firm has parlayed

oil, gas, water and real estate

into soaring profitsBy Dave Segal

Star-BulletinAirlines are forced to pay more for fuel. Automobile drivers foot increased costs at the pump. Homeowners shell out more for electricity and heat.

And, for the state of California, well, look no further than Pacific Gas & Electric's recent bankruptcy.

But despite the negatives associated with high energy costs, not everyone is eager to see low prices.

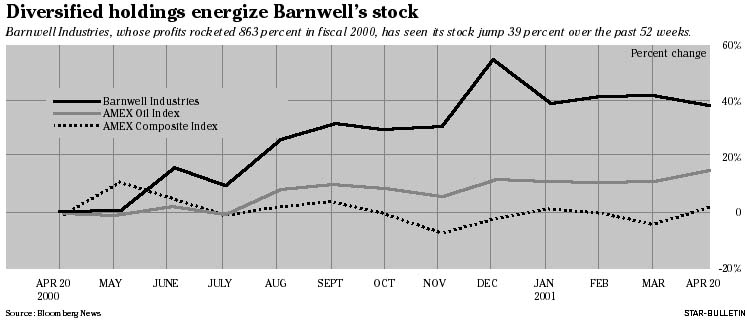

Take, for example, Barnwell Industries Inc., the Honolulu-based company whose primary business is oil and gas exploration. Barnwell's profits soared 182 percent in the 2001 fiscal first quarter that ended Dec. 31, 2000. That's on top of fiscal 2000 earnings gains of 218 percent in the fourth quarter, 620 percent in the third quarter, 8,900 percent in the second quarter and 980 percent in the first quarter. For the entire 2000 fiscal year, Barnwell's earnings were up 863 percent from the previous year as the company earned $5.01 million, the third-best yearly profit in the company's 44 years.

"We don't relish the negative impact on the economy that higher gas and oil prices have for consumers because it affects us too. But we're in the business of selling oil and gas, and obviously higher prices make a more lucrative business," said Alexander C. Kinzler, executive vice president and secretary for Barnwell and president of Barnwell Hawaiian Properties Inc., the company's land development subsidiary.

"It's a business with high risks and rewards. We'd like to see the commodities at a moderately stable price so that the consumers can benefit and the producers can make a reasonable return. There were times when oil and gas prices fell to 30-year lows as recently as five or seven years ago, and at those low prices, a lot of companies were forced out of business. One reason we weren't is because we were able to keep our costs for producing gas and oil pretty low. We feel we're entitled to some reward when prices go way up because we've had to pull in our horns when prices have gone way down."In fact, things have been going so well for the company that last month it paid out a dividend of 20 cents per share, its third distribution in the seven months since it reinstated its dividend in September. Prior to that, the company had not paid its shareholders any dividend since March 1995.

"We're not trying to pay a regular dividend but we pay special dividends several times a year when we're confident the results of the company will allow us to pay a dividend and reward the shareholders who have been investing in our stock," said Kinzler, whose father, Morton Kinzler, is chairman, president and chief executive officer of the company. "We have a lot of long-term shareholders with fair-sized positions who have been in the market for a long time. We feel it's important to pay a dividend to differentiate us from other companies."

Barnwell's stock, like many others in the energy sector, shot up last year in conjunction with rising energy costs and finished 2000 up 62.7 percent. The AMEX Oil Index, which comprises companies involved in the exploration, production and development of petroleum, rose 6.6 percent over the same period. The biggest gains, though came from those involved in the production of electrical energy, with many companies posting high double-digit gains. So far this year, Barnwell's thinly traded shares are down 11.8 percent. But its stock, which closed at $18.31 yesterday on the American Stock Exchange, is still up 39 percent over the past 52 weeks.

So how long can the good times roll?

That answer may lie with Barnwell's Big Island leasehold land, according to analyst Dan Pratt of John S. Herold Inc., an energy research and consulting firm in Norwalk, Conn.

"I think the company's exploration and production performance could improve as their reserve replacement and finding (exploration) cost have been somewhat high compared to the industry average," Pratt said. "We think a lot of upside in the stock lies in the company's real estate valuations."

Barnwell, which generates about 60 percent of its revenues from Canadian oil and gas exploration, primarily in Alberta, gets another 15 percent from its water drilling and pumping operations in Hawaii. The remaining 25 percent of its business comes from Kaupulehu Developments, a Hawaii partnership that has land investments in Kona. On Monday, the company announced that it was boosting its ownership interest in its Kona property to 77.6 percent from 50.1 percent.

"I think it was a logical move for them," Pratt said. "It increased their ownership as a majority interest partner and basically reaffirmed their position in Hawaii real estate."

Kaupulehu Developments owns development rights on approximately 80 acres of residentially zoned leasehold land in the vicinity of the Hualalai Golf Course and leasehold rights to an adjacent 2,000-acre parcel near the Four Seasons Resort Hualalai. The residential development rights for the 80 acres are under option to Hualalai Development Company, an affiliate of Japan-based Kajima Corp.

Last year, HDC exercised options for approximately 20 acres of residentially zoned land, paying Kaupulehu Developments $6.54 million. Barnwell, after paying down debt, received about $2.5 million for its 50.1 percent share of the property. Options for the remaining 80 acres expire in six years. If HDC exercises the options on the remaining amount, Pratt estimates it could fetch Kaupulehu Developments about $25.5 million.

In addition, Kaupulehu Development is in the process of obtaining zoning and use approvals for development of a residential community on 1,000 of the 2,000 acres in which it holds leasehold rights. The proposed developments include 500 multifamily units, 530 residential single-family home sites, a commercial center and two 18-hole golf courses. The state Land Use Commission initially approved the application but the state Supreme Court remanded the case back to the Land Use Commission for further review due to a dispute over native Hawaiian rights.

The remaining half of the 2,000-acre parcel, on the eastern portion of the property, is classified within the State Land Use Conservation District and zoned as unplanned by the county.

Real estate valuable

"There's substantial value in the (Big Island) property," acknowledged Kinzler, who declined to put a value on its worth. "But it's subject to a lot of variables as to what the marketplace will look like.

"The real estate segment has provided cash to the company at times it was needed, back in 1989 and '90 particularly, and we believe the current real estate market will continue to be a valuable asset to us. We are believers in the Kona-Kohala coast on the Big Island. It has the best weather in the world and it is reaching a critical mass of high-quality projects that fit various niches in the market."

Barnwell, due to its size, is not covered by any Wall Street analysts listed by Bloomberg News. The company, which will report its fiscal second-quarter earnings in early May, has only 1.3 million outstanding shares, with 29.4 percent of that owned by directors and executive officers. However, Herold analyst Pratt evaluates the company not by a rating but rather by assigning it an "appraised net worth" of $26.20 a share, estimating the stock is about 30 percent undervalued.

"The stock historically trades at a discount to our appraised net worth, partially due to its lack of liquidity (few available shares in the marketplace)," Pratt said. "Our $26.20 a share is valuing the real estate at book value (which is typically less than the market value), so if the land remaining for development sells for what it sold for in the past, there's significant value there."

Kinzler said another reason why the stock is undervalued is because of its diverse holdings.

"We're sort of a different animal," Kinzler said. "We're primarily an oil and gas company but we also have real estate investments. And I think a number of people who invest in oil companies don't really understand the real estate business. On the other hand, people who invest in real estate companies are not particularly savvy when it comes to the oil and gas business."

Barnwell, in fact, trades at a price-earnings ratio (stock price divided by earnings per share) of 4.2 and has a market capitalization, or worth, of $24.25 million. "By keeping ourselves small and maintaining our level of investment we're able to protect ourselves on the downside and maintain an upward trend in earnings," Kinzler said. "I've been working here 18 years and during that time there's been an upward trend more or less. The company has earned more in the last 10 years than the previous 35 years."

Pratt, though, sees an oil slick, or lack thereof, in the company's near-term future. In a research report, he notes that Barnwell's exploration and production performance over the past five years has been "dismal."

"Barnwell has had a decline in its major oil and gas property, the Dunvegan Unit, which accounts for about 57 percent of the company's reserves," he said. "They haven't been able to replace that decline.

"Unless they have a turnaround in their operating performance, we expect production to continue to decline slightly over the next couple years. We believe earnings and cash flow will grow in 2001 as the company realizes higher prices, and then, excluding any land sales they might have, expect a decline in the company's earnings the next couple years due to lower production."

Kinzler said the company has been addressing the shortfall.

"One of the things we've done is we've put a new management team in place starting two years ago," he said. "And we're now starting to see the results of that team's efforts. It takes a few years for an oil and gas company to make changes because programs are done a couple years in advance. We think our management team will bear fruit for us in the next several years. Production is up this year already and we believe the reserves will start to grow again."

The company, which became involved in Canada about 35 years ago, sends its natural gas by two major pipelines into the Midwest while the oil generally is kept in Canada.

"That's dictated by the market," said Russell Gifford, Barnwell's executive vice president, chief financial officer and treasurer. "There's a lot more gas in Canada than Canada needs for its own use. As for oil, there's not that much excess capacity over consumption. What we do is send our gas and oil to aggregators, who buy it from other people and turn it around and decide where it goes."

Of the company's three divisions, its water drilling and pumping operations produce the least revenues for the company. "The water drilling business is an extremely tough business," Gifford said. "First of all, there's not really much demand for water wells. And the overall development activity has slowed from what was being done in the '80s."