BancWest IN BANKING, size is sometimes in the eyes of the beholder.

banking on growth

First Hawaiian's parent has been

on a buying binge since nearly

doubling in size in a 1998 mergerBy Dave Segal

Star-BulletinMore than two years ago, when First Hawaiian Inc. merged with BancWest Corp., it leapfrogged over Pacific Century Financial Corp.'s Bank of Hawaii to become the largest financial institution in the state.

BancWest Corp., which has holdings throughout the West, is now first overall in assets, deposits, net income and market capitalization.

Look around the islands, though, and Bank of Hawaii's presence is pervasive as well. Bank of Hawaii has more branches in the state, more automated teller machines, more full-time equivalent employees and leads in several other categories when only Hawaii operations are considered.

So while there is room for argument about who is the biggest, there is little question that the banks have traveled down different roads to get to this point.

Brock Vandervliet, a New York-based analyst for Lehman Brothers who has a "strong buy" rating for BancWest and a "market perform" rating for Pacific Century, sums up their situations succinctly.

"Pacific Century is a turnaround story and BancWest is a Western U.S. growth story," he said.

BancWest, which reports its earnings after the market closes Tuesday, has been on the acquisition trail since the new company was formed Nov. 1, 1998. Most recently, it acquired 30 branches that First Security Corp. was divesting in connection with a merger with Wells Fargo & Co. BancWest picked up 22 branches in Albuquerque, N.M., one of the fastest-growing U.S. cities, one in Las Cruces, N.M., and seven in Las Vegas. The New Mexico acquisition closed in February and the Las Vegas deal closed in January.

"When we merged in 1998, we said we would grow our existing markets, which we've done both in Hawaii and on the West Coast," said BancWest Chairman and Chief Executive Officer Walter Dods. "We also want to acquire banks in the $500 million to $1.5 billion range in states where we operate. That's why we acquired SierraWest, a $900 million bank in Northern California and Nevada."We also look at one-of-a-kind opportunities outside our existing footprint. That's what we did in Albuquerque and Las Vegas. ... We got instant market share as the third-largest bank in Albuquerque. When we merged with Bank of the West in 1998, our combined asset size was $14 billion. Now it's over $19 billion (counting this past quarter), which is pretty good for two-plus years."

Pacific Century, meanwhile, has been shedding some of its holdings and trying to clean up its loan portfolio in order to make the bank more profitable. The company sold nine branches in Arizona, unloaded its interest in banks in Tonga and Samoa and sold its credit-card division to a unit of American Express Co. Chairman and CEO Michael O'Neill plans to unveil the bank's strategic plan for the future when it announces its earnings April 23.

Nevertheless, Vandervliet believes BancWest will continue to cut into Pacific Century's home turf.

"BancWest has the benefit of a recovering Hawaii economy and its primary competitor on the island, Pacific Century, is primarily internally focused," Vandervliet said. "So BancWest can steal market share on the retail and commercial side.

"I would consider BancWest more the hybrid franchise as it has both Hawaiian and mainland presence. Pacific Century is more of a pure-play Hawaiian franchise, with the exception of a very small mainland U.S. presence (in California). That's important in terms of valuation because Hawaii is a stable market but not growing at all geographically. That limits the market potential there. BancWest is a growing presence in the Western U.S., which is growing pretty rapidly. They've been able to position themselves to capture more growth."

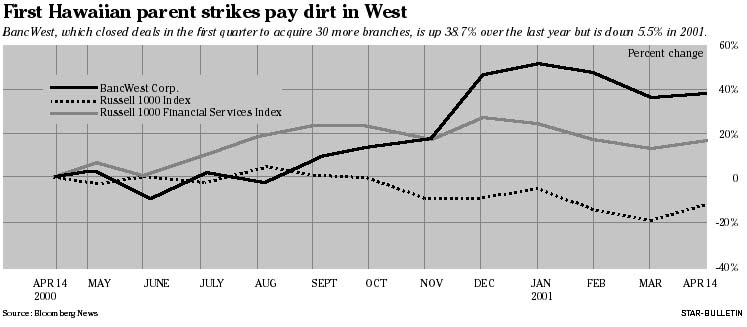

BancWest's stock, which closed the holiday-shortened week at $24.70, has tailed off despite the company's growth spurt. Its shares, up 34 percent last year and ahead 23.9 percent since the Nov. 1, 1998, merger, are down 5.5 percent so far in 2001.

By comparison, Pacific Century, which began streamlining its operations after O'Neill took over Nov. 3, has seen its shares rise 19 percent this year after falling 5.4 percent in 2000. Pacific Century's stock, which closed Thursday at $21.04, is ahead just 3 percent since the First Hawaiian-BancWest deal closed but is up 55.2 percent since O'Neill took charge.

"I think (the divergence in stock prices) is reflective of the broader trend seen throughout the banking industry," said analyst Joe Morford of Dain Rauscher Wessels in San Francisco.

"Some of the best performing stocks last year were higher-quality companies that had good appreciation last year, especially at the end of the year," said Morford, who has a "buy" rating on BancWest and a "neutral" rating on Pacific Century. "This year we saw some profit-taking as investors shifted into names with perceived higher risk after the initial Fed cut. The motivation there was that investors recognized that (Fed Chairman Alan) Greenspan and the Federal Reserve were going to aggressively cut rates to try to keep the country out of a recession.

"And while the next couple of quarters could be sluggish, the economy was expected to rebound, in which case you could buy some of the names that had asset-quality problems last year and had cheaper valuation. There was perceived more upside in those stocks. There had been a shift in investor sentiment and money began flowing to stocks like Pacific Century."

BancWest, which had $18.5 billion in assets at the end of 2000, is now comprised of 252 branches with the completion of its recent acquisitions. Its Bank of the West subsidiary has 193 branches, including 118 in California, 30 in Oregon, 23 in New Mexico, 10 in Nevada, nine in Washington and three in Idaho. First Hawaiian Bank, the other principal subsidiary, has 56 branches in Hawaii, two on Guam and one on Saipan. As of Dec. 31, the company had $14.1 billion in deposits and $216.4 billion in net income. Its market capitalization, or worth of the company, stands at $3.08 billion. But excluding the 56 million unlisted Class A common shares owned by French bank BNP Paribas, which controls 45 percent of BancWest, then BancWest's market cap for its New York Stock Exchange tradable stock is $1.69 billion.

Pacific Century, which had $14 billion in assets at the end of last year, now has 163 branches, including 75 in Hawaii. As of Dec. 31, the company had $9.1 billion in deposits and $113.7 billion in net income. Its current market cap is $1.68 billion.

While BancWest clearly is the larger company overall, in Hawaii it's a different story. Bank of Hawaii has more branches (75 to 56), more automated teller machines (483 to 175) and more full-time equivalent employees (3,785 to 2,188).

In addition, according to Federal Deposit Insurance Corp. filings of Dec. 31, 2000, Bank of Hawaii led First Hawaiian Bank in total assets ($12.63 billion to $7.45 billion) and total deposits ($8.25 billion vs. $5.94 billion). But, due to more Bank of Hawaii charge-offs, First Hawaiian had more in net income ($112.35 billion vs. $107.24 billion).

"There's been a real sea change (in Hawaii)," Dods said. "Thanks to our growth, First Hawaiian Bank now has the most Hawaii deposits from individuals, corporations and partnerships (a $5.38 billion to $5.25 billion advantage although it still trails Bank of Hawaii in total deposits in the state). That's the first time we've been No. 1 in almost 50 years ... Bank of Hawaii is a good competitor, but so are we. The battle for customers never ends."

The consensus of analysts polled by research firms I/B/E/S, Nelson and Zacks Investment Research is that BancWest will report first-quarter earnings of 45 cents a share.

Vandervliet, though, said in a March 27 research report that BancWest could do the analysts one penny better.

"Our estimate is a penny higher than consensus," he noted. "Despite the impact of the closing of the branch acquisition (in New Mexico and Las Vegas), we expect BancWest will come out of the blocks solidly this quarter."

Of the six analysts listed by Bloomberg News as covering the company, four rate BancWest as a "buy" and two rate it a "hold".

"I generally expect a continuation of recent trends, particularly steady revenue growth," said Morford, the Dain Rauscher Wessels analyst, whose earnings-per-share estimate is 45 cents. "Perhaps there will be some improvement in the net interest margin. But it's going to be somewhat of a noisy quarter because there are likely to be charges associated with the acquisition.

"They haven't had the New Mexico and Nevada branches that long, and because of that their impact this quarter should be fairly modest. I think with the strengthening economic recovery in Hawaii, (BancWest) may see some pickup in lending activity in that market. I think some of Bank of the West's consumer businesses have experienced strong quarters. In terms of loan quality, I generally expect that to be relatively stable."