No quick relief IT TOOK JUDY JAKOBOVITS nearly 30 years to build a $400,000 nest egg. It took only several months to lose most of it.

for investors, but

pros say use time

to prepare

Thousands lost big, but the

experts say don't panic, diversify:

Some areas thriveBy Rick Daysog

Star-BulletinThe 60-year-old Niu Valley Realtor got caught up in the irrational exuberance of the stock market last year and started placing big bets on high-tech companies in her 401k account.

The result: Jakobovits' retirement portfolio has lost more than $250,000, forcing her to postpone any plans to retire within the next year.

"I got attracted by the bubble and the bubble burst," she said. "I was hoping to wind down next year, but there's no chance of it now. I'm tired. I am depressed."

Jakobovits' plight presents a cautionary tale for investors who turned to their retirement money to play in the high-tech casino.

Lured by double-digit and triple-digit returns, many investors rolled the dice on tech stocks, believing they would continue to rise despite meager earnings.

They didn't.

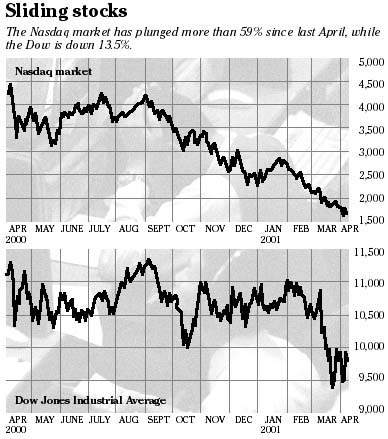

Since last April, the Nasdaq market -- dominated by high-tech issues -- has tumbled more than 59 percent to Friday's close of 1,720.36.

The broader Standard & Poors 500 index has dropped 24.8 percent to 1,128.43, while the bellwether Dow Jones Industrial Average is off 13.5 percent, to 9,791.09.

The downturn has wiped out the retirement funds of thousands of investors and is forcing many more to rethink their financial plans.

"A lot of people became enamored of technology and they're getting crushed," said David Kirkeby, manager of Investmart Inc., which serves as retirement plan adviser for about 150 small- and medium-sized employers in Hawaii. "Many are panicking."Jakobovits was one of those investors.

Following the advice of her brokers, she starting buying widely touted companies such as Sun Microsystems Inc., JDS Uniphase Corp. and Cisco Systems Inc.

Jakobovits also bought lesser-known tech issues, such as Copper Mountain Networks, Sycamore Networks Inc. and Veritas Software Corp., after her brokers convinced her that high-tech stocks couldn't go down.

Jakobovits said that she got into the market at its peak and that her portfolio showed a gain of 5 percent to 7 percent before the market began to nosedive. Her Sun stock plunged to about $13 from $60, said Jakobovits, who said her brokers didn't believe in placing stop-loss orders.

"It was like buying real estate in Honolulu in 1990," she said.

Novices weren't the only investors burned by the bear market.

Dwight Melton, an avid investor for more than 17 years, said the value of his portfolio -- including his 401k plan and an individual retirement account -- fell 55 percent this year to $119,000 from $266,000.

Melton, a master gunnery sergeant in the U.S. Marines and an investment instructor for the local chapter of the National Association of Investors Corp., said his portfolio would have dropped even more if he hadn't placed stop-loss orders on most and hedged his bets in various ways on other stocks.

"It's been pretty rough the past year," said Melton, an Ewa Beach resident. "But you knew it was coming."

Paul Loo shared that sentiment. The senior vice president of Morgan Stanley & Co. said he began liquidating his stock holdings in his 401k plan last year.

Part of the reason is that he needed the money to buy a condominium. But Loo, often described in the local media as a stock market optimist, also believes that we are near the middle of a three-year bear market, saying he expects corporate earnings to continue declining. ket, Loo believes that investors should consider re-evaluating their financial plans and making a list of diversified investments that they could make during the next five months.

At the top of his list are municipal bonds and select high-yield bonds.

He also likes growth companies such as The Gap Inc. and Pfizer Inc. and global companies such as Goldman Sachs Group Inc., Citigroup Inc. and Chevron Corp.

Kirkeby -- whose company has held nearly a dozen hourlong brown-bag meetings during the past two weeks with clients to answer questions about their retirement holdings -- has this simple message: Don't panic.

Kirkeby said he doesn't know when the bear market will subside. But he said that investors need to prepare for that day by diversifying.

"Investing in the stock market is ... like living on an island where hurricanes are frequent," Kirkeby said. "You don't flee the island. Instead, you always prepare for the disaster. The hurricane will blow over."

Investors who want to learn more about investing and the stock market can turn to the following organizations: INVESTMENT TIPS

American Association of Individual Investors:

625 N. Michigan Ave. Chicago, IL 60611 Phone: (800) 428-2244, (312) 280-0170

Fax: (312) 280-9883

Web address:

http://www.aaii.comAARP:

601 E St., NW Washington, DC 20049

Phone: (800) 424-3410

Web address: http://www.aarp.org/moneyguide/National Association of Investors Corp.:

P.O. Box 220, Royal Oak, MI 48068

Phone: (877) 275-6242 or (248) 583-6242)

Web address: http://www. better-investing.org