It’s a home run The economy is decelerating. The stock market is deteriorating. And Americans' net worth is depreciating.

for Schuler

The isle-based builder, one

By Dave Segal

of the 15 largest in its industry,

has seen its stock surge 80% in a year

Star-BulletinBut if there's a recession lurking in the wings, it's certainly not reflected in Schuler Homes Inc.'s stock price, which has defied the market downturn and nearly doubled over the past year.

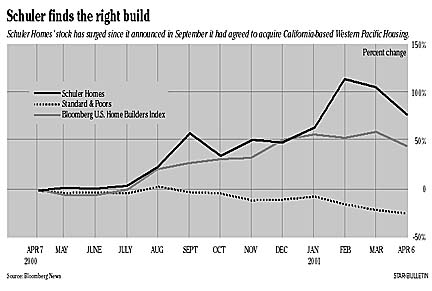

The Honolulu-based home builder, which this week doubled in size when it closed its deal to buy California-headquartered Western Pacific Housing, appears to have found a sweet spot amid the economic ruins. Its stock is up 22.2 percent since Jan. 1, ahead 79.6 percent over the past 52 weeks and up 97.8 percent since climbing off its 10-month low of $5.56 on June 21, 2000. Analysts expect the trend to continue not only for Schuler but for other home builders as well.

"The whole sector actually has performed quite well, Schuler included, over the last 12 months, " said UBS Warburg's John Stanley, a New York analyst who has a "buy" rating on the stock. "Financially, the smaller-cap home-building sector is showing consistently strong earnings growth despite the economy. We expect that to continue, and for the stocks to start moving up as investors realize the sector is a lot stronger than they anticipated in a tough economic environment. We expect the phenomenon to continue over the next three or four quarters."For its own part, Schuler Homes has been building its business by focusing on lower-priced houses, identifying growth areas and making acquisitions. The company, which went public March 20, 1992, builds homes that cater to entry-level buyers and first-time move-up purchasers. The company was formed in 1988 in Hawaii and quickly expanded to the point where it now has projects on Maui, the Big Island, Oahu and Kauai. It broadened its reach to the mainland in 1996.

Schuler Homes, whose major competitors on Oahu are Castle and Cooke, Gentry Homes and Haseko Realty, currently has projects under construction on Oahu in Hawaii Kai, Kalama Valley, Salt Lake, Waikele, Kapolei and Makakilo. It's also building in Wailuku and Kihei on Maui; in Puhi on Kauai and has a joint project with Parker Ranch on the Big Island.

But even though the company has its roots in Hawaii, the islands represent only about 5 percent of Schuler Homes' business in the newly combined company. Schuler Homes also has developments in California, Oregon, Washington and Colorado, with a startup division in Arizona.

"Right now we're seeing very strong sales in all our markets," said Jim Schuler, president, chief executive and co-chairman of the company that bears his name. "I think the primary reason is that there's not a supply of unsold homes in any of the markets. I think the supply of homes has kept up with market demand. We're not seeing a slowdown in the housing sector as a result of the current ups and downs in the stock market and the U.S. economy."

As a gauge of the company's growth, Schuler says it's noteworthy to point out that in 1996 the company closed 512 homes in Hawaii, at that time its only market. By comparison, he said, Schuler Homes and newly acquired Western Pacific project to close 4,650 homes for the fiscal year that just ended March 31.

With the acquisition of Western Pacific, Schuler Homes has transformed itself into one of the top 15 home builders in the country in terms of both market capitalization ($443 million) and in revenues (a projected $1.3 billion).

"I think (the Western Pacific deal) has positioned them as a major player now in California," said analyst Jim Wilson of Jolson Merchant Partners in San Francisco. "I'm certainly a believer in the long-term growth prospects in California and that it will be a good housing market."

Wilson, who has a "long-term buy" on the stock, and Stanley are currently the only two analysts that Bloomberg News lists as covering the company. It's perhaps because of that limited exposure that the stock has been flying under the radar of Wall Street. The shares, which closed yesterday at $11 -- down 12.4 percent for the week -- trade at a price-earnings ratio of just 5.6, its stock price divided by earnings per share.

Despite this past year's resurgence in the stock, Schuler Homes still trades lower than its initial public offering price of $15.50 and is 63.3 percent off its all-time high of $30 reached Oct. 15, 1993. But after falling as low as $4.88 on April 25, 1997, the stock stabilized in the $6 to $8 range and then broke out of single digits on Sept. 7, 2000, when it closed at $11.50. It marked the first time the stock had closed above $10 in nearly 212 years.

"In 1992 (when Schuler Homes went public), people were camping out in line for homes," said Pam Jones, Schuler Homes' executive vice president and chief investment officer. "There had been huge foreign investment from Japan in Hawaii in the '80s. And in the early '90s, mortgage rates started to come down, people were refinancing and there was a lot of money available for the purchase of new homes. There was pent-up demand for entry-level housing. And even though the economy started to slow, the real estate market in Hawaii stayed really strong until 1995 and 1996."

The housing market in Hawaii then entered into a slump, and even though it is now showing signs of emerging from those depths, the industry until recently had been largely ignored by Wall Street.

"The bottom line is that housing activity nationally has been trending up the last several months to where it has fully recovered from where it was back in 1999," Stanley said.

"It's a function of lower mortgage rates and a function of pent-up demand. Public builders like Schuler have seen growth the last several years as they've gained market share. The stock is still selling at very low valuations in contrast to the rest of the market."

Among similarly sized home builders, Hovnanian Enterprises Inc.'s stock, up 38.7 percent this year, is trading at a price-earnings ratio of 7.3. MI Schottenstein Homes Inc., up 21.1 percent, is at a P-E of 5.3. Beazer Homes USA Inc., down 0.5 percent, is at a P-E of 6.8. Ryland Group Inc., down 7 percent, is at a P-E of 6.4. And Standard-Pacific Corp., down 28 percent, is at a P-E of 5.0.

Schuler Homes, bolstered by the $234.2 million all-stock acquisition of Western Pacific, said it expects to see its revenue grow 10 percent to 15 percent in fiscal 2002 and exceed $1.5 billion in revenues compared with revenues projected to be in excess of $1.3 billion this past fiscal year.

It also sees earnings for fiscal 2002 topping $86 million vs. an anticipated $75 million in the 2001 fiscal year.

Schuler Homes will report its earnings May 9 and break out the results for its operations as a pre-merger company as well as counting the Western Pacific acquisition.

"One of the benefits (of the deal) is that we see with this acquisition an immediate impact to the size of the company and an immediate entrance into major markets into California," said Jones, who is Schuler's daughter and is a company officer along with husband, Michael, the division president for Hawaii.

"They have a very experienced management team in five strong suburban markets in California and they've spent the last several years putting together land positions that will really set the stage for future growth in California."

Schuler said there are no other acquisition plans "on the horizon for the moment," and the company intends to focus on strengthening its core business, improving all its systems and continuing to grow in its existing markets.

"Our strongest divisions in the housing market are in California and Colorado," Schuler said. "I would expect that in this next fiscal year we'll continue to see growth in basically all of the company's divisions.

"The Hawaii economy is starting to improve and we're seeing better employment and job growth numbers. I think that will translate into a better housing market.

"California, of course, is on fire and we can't keep up with the demand in California. The problem is not so much selling houses but getting them built. Washington and Oregon are seeing strength in their economies and Colorado is one of the strongest economies out there right now."