Dividend shines at Utility stocks were star performers last year as the overall market melted down and energy prices heated up.

Hawaiian Electric

The generous 7.2% yield helps

cushion lumps the company took

in its Philippines ventureBy Dave Segal

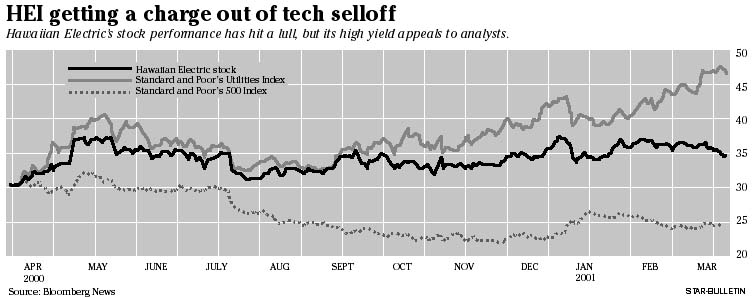

Star-BulletinInvestors couldn't unload their technology holdings fast enough, and that proved good news for companies like Hawaiian Electric Industries Inc., which finished 2000 up 28.8 percent to rank among the state's top-performing publicly traded companies. That was in spite of an ill-fated Philippines power plant venture that saw the company take a $36.6 million after-tax write-off in the fourth quarter.

Now, with the end of the first quarter a week away, HEI finds its stock down 6.7 percent for the year. But, in an economic environment where cash is king, it's the company's 7.2 percent dividend yield that is running at high voltage. It's nearly 3 percentage points better than the 4.4 percent average yield of the company's counterparts in the Standard & Poor's Utilities Index.

High yield attractive

"We think given the businesses they have (Hawaiian Electric Co. and American Savings Bank), and the fact that there are good earnings outside their international business -- which has been a drag on earnings -- that the stock ought to do much better," said Dave Parker, an analyst with Robert W. Baird & Co. in Tampa, Fla."Its yield is one of the best in the utility industry and that's a positive," said Parker, who has a "strong buy" rating on the stock. "The company is very well run and the state economy is doing much better and that will help earnings do better."

HEI, whose stock closed yesterday at $34.70, is in about the middle of its 52-week trading range. Its stock hit $37.50 last Dec. 28 and sank to a low of $30.25 on March 24 last year. It's the dividend yield, though, that is gathering attention at a time when investors are reeling from the stock market's vicious selloff.

Sometimes, when a company's dividend yield appears out of line with the rest of its peers, it reflects a falling stock price and signals that the company is paying out too much in relation to its earnings. It also sends up a red flag that a dividend cut could be looming.But Robert F. Clarke, chairman, president and chief executive of HEI, said there are no plans to trim the dividend.

"There's been no discussion about cutting the dividend," he said. "I realize the dividend payout is high and the payout ratio is high (the percentage when the dividend is divided by earnings per share). We've held the dividend constant for several years (the current quarterly payout is 62 cents a share) and the expectation is that we'll hold it constant for another year or so before an increase."

HEI posted a 16 percent increase in net income last year from its Hawaiian Electric Co. subsidiary, which services all the main islands but Kauai. The parent company also had a 14.7 percent return from its American Savings Bank unit.

Loss in fourth quarter

However, it was its $88 million investment in a 46 percent stake in East Asia Power Resources Corp., an independent power producer in the Philippines, that put a damper on the company's bottom line. Due to its write-off, HEI posted a fourth-quarter loss of $24.4 million compared with a $31.7 million profit a year earlier. Without the one-time charge, it would have shown a fourth-quarter profit of $12.2 million."They got into the Philippines early last year but obviously there were troubles because of what happened with the Philippines government," Parker said. "Pressure was put on the currency and fuel prices spiked. I don't fault management. I think they did their due diligence. But sometimes circumstances happen that are out of control. I think they did the tough decision and wrote the investment off."

Clarke, though, doesn't make any excuses. "It's easy to blame circumstances," said Clarke, whose company still has outside investments in the Philippines, China and Guam. "But we probably were too slow in putting in currency and fuel hedges that in hindsight would have been helpful."

Analysts mixed

Of the six analysts listed by Bloomberg who cover the company, two rate HEI a "buy," three rate it a "hold," and one rates it a "sell."The one who recommends selling the stock, analyst Joe Coyle of brokerage Edward Jones in St. Louis, is negative on the company's future prospects.

"The main reason for the sell rating is that the growth outlook for the company is limited over the long term," Coyle said. "Their utility business is a mature business. I also think Hawaii has a challenging regulatory environment.

"I think the bank has been sensitive to the Pacific Rim economies -- and the Hawaii economy in general -- and has felt the impact. I don't think it's been a very good fit for the company. It's difficult to manage a bank and a utility. The only similarities are that they're both regulated."

Clarke disputes Coyle's conclusions. But one thing he doesn't dispute is the lack of visibility regarding how Hawaii's economy will fare the rest of this year.

"Hawaii's economy has definitely rebounded, but the questions now are the downdraft in the stock market and the problems with the power industry in California," Clarke said. "The impact it will have on the tourist industry here is still in doubt."