Hawaiian’s 717 era When Hawaiian Airlines flight 106 to Maui left Honolulu Airport at 5:35 a.m. today, Hawaiian Airlines Inc. launched a $430 million improvement it believes will keep it competitive -- and profitable -- in the interisland market for the next couple of decades.

takes to skies today

The first of 13 new planes

Will fleet lift earnings? By Russ Lynch

begins service today

Star-BulletinThe airline's newest plane, the first of 13 new Boeing 717-200 jets, began commercial service this morning. The plane is the first step in phasing out Hawaiian's fleet of aging DC-9s.

Hawaiian took delivery of the 717 last week to perform trial runs among the islands. The plane has already increased fuel efficiency by more than the 25 percent Boeing promised, Hawaiian says.

"Fuel is either the most expensive or number two in operating costs," said Robert W. Zoller, Hawaiian's president and chief operating officer.

Watching media and invited guests take a look at the first new 717 at Continental Airlines' hangar at Honolulu Airport yesterday, Zoller said the cost of fuel "obviously has our attention.""This aircraft was designed for its fuel efficiency," he said. "We've been very careful not to overestimate (the savings over the DC-9)."

Test conditions are not the same as ordinary daily operations and how the anticipated savings shakes down remains to be seen, but "we believe we are seeing (savings) in excess of 30 percent," Zoller said.

More space, less noise

While fuel efficiency is important to the airline's bottom line, air travelers and anyone within earshot will be more impressed by other aspects of the new design, Zoller said."This airline already qualifies for what is being contemplated as the Stage Four noise limit," Zoller said. Hawaii has been exempt from the current national standard, Stage Three, and interisland airlines are allowed to operate at the more permissive Stage Two noise level, he said.

The plane also meets upcoming industry standards for reduced emissions.

A Boeing engineer who sees the 717 as his baby pointed to other features on a tour of the plane. Thomas J. Croslin, chief project engineer on the 717 program, said he spent nine years on the project.

Opening an overhead luggage compartment, Croslin showed how much bigger it is than anything previously available in the interisland market.Each compartment will take three 25-inch stroll-along bags side by side, he said.

Along the front bottom edge of the overhead baggage compartments is a lighted hand rail. No longer do flight attendants have to grab the seat backs as they make their way through the plane, Croslin said.

The seat "pitch" -- the space between the seats -- may not sound great, at 31.4 inches in part of the coach section and 30 in the rest, compared to 33 in Aloha Airlines' 737s. But Croslin said the seat back itself is a slimmer design that leaves more space.

Is bigger better?

But as more and more flights are available directly to the neighbor islands from the mainland, some question whether the new plane's 123 seats may be too many."The question will be, over what period of time do both of the companies (Hawaiian and competitor Aloha) decide how they want to serve local demand as against multi-island leisure traffic," said airline industry analyst Robert Mann, of R. W. Mann & Co. in Port Washington, N.Y.

That will not be clear for a while. Meanwhile, the 717's higher reliability and faster turnaround should reduce the number of aircraft Hawaiian needs to complete its daily schedule and the lower maintenance of the 717 will help financially, Mann said.

Aloha is in a position where it can wait and see, although it is exploring possible replacements for its interisland jets, Boeing 737s.

"The urgency for replacement was much greater for Hawaiian than Aloha, because their DC-9s were substantially older" than Aloha's 737s, said Glenn R. Zander, Aloha president and chief executive officer.

Aloha's jets average 16 years old, against a 22-year average for Hawaiian's DC-9s.

"They had a sort of imperative," Zander said. "We're not in that position. Our fleet is younger. But nevertheless we've been looking at alternatives."

Zander said it is more complicated for Aloha to replace its jets than it was for Hawaiian. The biggest difference is that Aloha is heavily into transporting interisland cargo and would like planes that can be converted from passenger format to run as freighters at night, Zander said.

Aloha has six of the "quick-change" 737s and wants something similar.

Aloha also suspects that a smaller passenger capacity, say 100, would be better for Hawaii's changing interisland market. But Zander said his airline can afford to wait to see how the market goes.

"The right size is probably about 100 seats, in an aircraft that can be converted to freight," Zander said. "We're in discussions with a couple of manufacturers who meet those specifications."

Hawaiian's Zoller said that even though more flights go directly from the mainland to neighbor islands, traffic through Honolulu is expanding overall.

"Over the last few years, we've continued to see the traffic expand into Honolulu," he said. "That's why we see the larger aircraft as appropriate. We have to look forward 18 years or so."

Popular plane

Neither Hawaiian nor Boeing will disclose the exact price Hawaiian is paying for each 717. The $430 million figure is the combined list price of 13 planes -- a price that is usually discounted when actual fleet sales take place -- with other costs such as spare parts and crew training.In addition to the 13 firm orders, Hawaiian has options to buy another seven at an estimated additional cost of $200 million. Hawaiian will receive another 717 later this month and one each month through the year, except for a couple of months when it will get two.

As each comes in, one or more of the airline's DC-9s -- now down to 14 -- will leave the fleet. By year's end, Hawaiian will have an all-717 fleet.

Hawaiian is in good company in choosing the 717, said Warren Lamb, the Boeing spokesman for the 717 program.

The Long Beach, Calif., plant making Hawaiian's planes won firm orders for 154 of them. Of those, 49 have been delivered.

"In addition, there are 147 options to buy," Lamb said.

The first 717, with 117 seats, was delivered in September 1999 to AirTran Airways, based in Orlando, Fla. AirTran ordered 50 and has options for another 50.

Trans World Airlines also ordered 50 plus options for 50 more. The pace of delivery has been slowed by TWA's financial troubles but the orders are going ahead, Lamb said.

Others have been ordered by leasing companies based in Ireland and Germany.

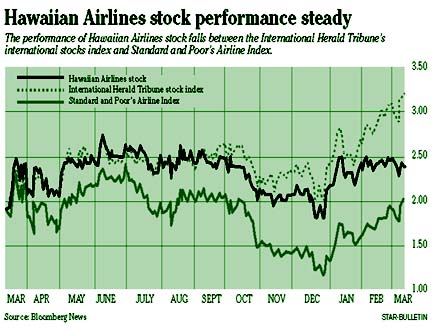

Though Hawaiian Airlines has maintained decent profits while undergoing massive change, its stock market performance has not taken off. Airline hopes fleet

By Russ Lynch

change will provide boost

for inconsistent bottom line

Star-BulletinReplacing Hawaiian's fleet with fuel-efficient, passenger-friendly Boeing 717s should help -- but it will take time, analysts said. In the past 12 months, Hawaiian stock has hovered around $2, hitting a low of $1.81 on Dec. 29 and a high of $2.50 on Feb. 28. It closed up 6 cents today at $2.45.

When will it start on an upward track?

"I'm still waiting," said Lantz Stringham, a financial analyst who follows Hawaiian for Red Chip Review in Portland, Ore.

"The problem they've had in the past few years is being able to string together consistent earnings," Stringham said. "The first three quarters of 1999 were positive but in the fourth quarter of 1999 and the first quarter of 2000 they lost 6 cents (a share)."Hawaiian lost $2.6 million in the first quarter of 2000, made a profit of $1.9 million in the next quarter and lost $218,000 in the third quarter. The airline has yet to report fourth-quarter and full-year results for 2000.

"The fleet transition certainly should be a big positive for them," Stringham said. "They will have some training costs and personnel costs in the first half of this year as they begin the transition to those new planes, but once they get past that, in the next six to nine months" the new fleet will begin to add to earnings.

Hawaiian was faced with mounting maintenance costs for its DC9-50 fleet, which has an average age of 22 years per plane, and the 717 was a logical choice, said airline industry analyst Robert Mann, of R. W. Mann & Co. in Port Washington, N.Y.

"I think it is an airplane that has been slow to build a market, but it has a great commonality with the DC-9 that Hawaiian has a great familiarity with," Mann said.

Major carriers would not be interested in acquiring Hawaiian, despite its low stock price, Mann said. Neither would they look at its island competition, privately owned Aloha Airlines.

"Everything's for sale, but the answer is, probably not," he said. "To put it more forcefully -- if you can get the milk for free ... "

Major airlines reap big savings by purchasing seats on interisland carriers at discount prices. Even if the big airlines were paying retail prices for the seats they buy from Aloha and Hawaiian, Mann said, it would still be "a heck of a lot less expensive than acquiring either and subsidizing all interisland travel."