Advertisement - Click to support our sponsors.

Kauai students LIHUE -- Kula High and Intermediate School doesn't have a football team, a basketball team or a baseball team. The upscale private prep school on the northeast shore of Kauai has only 69 students in grades 7 through 12 -- hardly enough to put together a full squad in any major sport.

butt heads with

stock market

Kula School students use

computer software and $100,000

in real money to play the marketBy Anthony Sommer

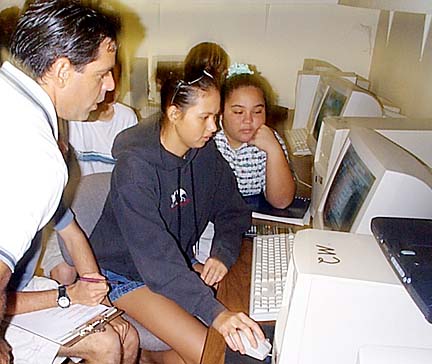

Kauai correspondentKula does, however, have an investing team: six students who now gather at a computer between 10:30 a.m. and 11 a.m. -- the final 30 minutes of trading on the New York Stock Exchange -- to play the market online.

Indigo Investment Software, the Florida-based company that produced the computer program they are using, set up a $100,000 account for them to buy and sell stocks. Indigo will absorb any of their losses and keep any of the profits.

Their first team meeting was Tuesday and their first trading session was Wednesday. Levi Star, 16, sat at the keyboard staring at an online trading screen anxiously waiting to start.

"Don't enter anything on that page because we're playing with real money," warned their coach, Scott Mijares.

"It's kind of exciting because you're really doing something," said Kaimana Goo, 17, of Princeville. "It's real and it's kind of cool."

On the other hand, all six agreed, they're very much aware that it isn't their money or their parents' money, so they know they won't be homeless if they lose it all.

Mijares, who moved to Kauai a year ago and has two children attending Kula School, is Indigo's only software salesman in Hawaii. He taught an investments class at Kula last year.

This year he coaches the investment team.

The plan for the students consists entirely of doing what the Indigo software tells them to do. When it says to buy, the players buy; when it says to sell, the players sell.

Indigo has picked 10 stocks with good recent performance records for the students to buy and sell during the next five months.

Mijares said if they had been investing the $100,000 using the same stocks and the computer software in November and December, they would have made a $28,000 profit.

The computer program looks at such things as the opening price, high price, low price and sales volume of each stock just before the market closes for the day and weighs those factors based on historical patterns.

"Our buy and sell decisions are based on theories of probability built into the software," Mijares said.

The computer program, which costs $4,000, conducts what's called a "technical analysis" based on trends. It is totally unlike the traditional "fundamental analysis" that studies the strengths and weaknesses of the companies behind the stocks.

Mijares described it as sort of the home version of the type of system used by large institutional investors whose buying and selling are triggered by the day's activities.

"It's the cutting edge," he said. "Even here in the most isolated place on the globe, people can make a lot of money without ever having to leave home."

Last Wednesday, the students started out with five companies for the computer to consider. They will work their way up to the full 10 eventually.

The first company the computer advised the students to invest in was CLS. None of the students asked what CLS is and Mijares told them, very parenthetically, that it's called Celestria and makes microchips and circuit boards for computer manufacturers. They bought 163 shares.

"We're officially in the market," Mijares announced.