Advertisement - Click to support our sponsors.

RETAIL gasoline prices in Honolulu surged by one-third last year even though the cost of the crude oil commonly used to make the fuel fell slightly, a Star-Bulletin analysis shows.

Crude oil costs fall,

but pump prices riseChevron, however, says the

marketplace dictates the

price of gasolineBy Rob Perez

Star-Bulletin

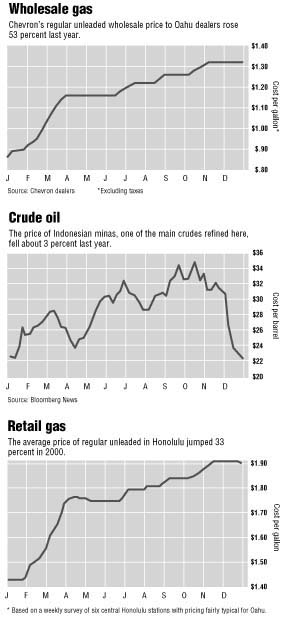

What's more, the wholesale prices that the oil companies charged Oahu dealers -- and what the dealers used to base their pump prices -- soared roughly 50 percent. That pushed the spread between the cost of oil -- the largest expense in making gasoline -- and the price dealers paid at year's end to what some consider unprecedented levels.

But Albert Chee Jr., spokesman for Chevron Corp., Hawaii's market leader, said the marketplace, not the cost of making gasoline, dictates pricing. He also said gas prices are not directly linked to crude costs.

To underscore the latter point, Chee noted that Chevron's dealer wholesale price rose only 11 percent in 1999, while crude soared more than 130 percent -- a disparity he said helps put last year's pricing in context.

"I think 2000 could be characterized as we're catching up -- that lag effect," Chee said.

One day after the Star-Bulletin asked Chee why local wholesale prices hadn't fallen in light of the decline in crude late last year, Chevron dropped its regular unleaded price to Oahu dealers for the first time since October 1999. The 1-cent-per-gallon reduction took effect Saturday.

Steadily rising wholesale prices helped push the average pump price of regular unleaded in Honolulu to $1.90 a gallon at the end of 2000, compared with $1.43 a year earlier, according to a weekly Star-Bulletin survey of six stations with pricing fairly typical for Oahu. That's a 33 percent increase for the year.

What the oil companies charged Oahu dealers rose even more. Chevron last year raised its regular unleaded wholesale price 53 percent, going from 86 cents to $1.32 a gallon, excluding taxes. Saturday's adjustment lowered the price to $1.31. Other major oil companies typically charge the same price Chevron charges or stay within a few cents of it.While retail and wholesale prices rose, the per-barrel spot market price of Indonesian minas, one of the main types of crude used to make petroleum products in Hawaii, ended 2000 at $22.15, about 3 percent less than when the year started, according to industry data tracked by Bloomberg News. In the last two and a half months of the year, the price plunged roughly 35 percent.

The price of Alaskan north slope, another crude commonly used at Oahu's two refineries, fell about 12 percent last year, to $21.04 a barrel, according to Bloomberg. In roughly the last month of the year, the price fell more than 35 percent.

The price of crude often is cited nationally to explain trends or major movements in pump prices. Those pump prices, however, usually are slower to follow crude costs down than up.

Ron Planting, a spokesman for the American Petroleum Institute, a major industry trade group, said changes in crude and pump prices "tend to follow each other fairly closely" on a national level.

If crude prices go up the equivalent of 20 cents a gallon, pump prices generally will rise by a similar amount, Planting said.

Other factors, such as seasonal demand and manufacturing requirements, can affect retail pricing, "but the price of crude is certainly the big one," he added.

Mainland pump prices drop

TO be sure, mainland pump prices have fallen in recent weeks, reflecting significant drops in crude costs. The benchmark West Texas intermediate crude, for instance, fell more than 25 percent in late November and December, though it has regained some ground this month.As crude costs fell, the national average for regular unleaded gasoline, after peaking at around $1.66 a gallon in June, ended the year at $1.46, up only 13 percent for all of 2000, according to the Lundberg Survey, which tracks prices across the country.

Oahu's weekly retail average, on the other hand, dropped only once in the last six months of 2000, and that was by a penny at the end of the year, the Star-Bulletin's analysis shows. As a result, the price gap between here and the mainland widened substantially.

When 2000 began, the average for regular unleaded in Honolulu ($1.43) was only 14 cents per gallon higher than the U.S. average. By year's end, the local price of $1.90 was 44 cents higher than the mainland average.

With local wholesale prices moving up steadily throughout the year, the spread between what Oahu dealers paid and the price of oil grew to levels not seen in at least the past decade, some dealers said.

By the end of 2000, the spot-market price of Indonesian minas dropped to the equivalent of 53 cents a gallon. Oahu dealers, however, were paying about $1.32 a gallon for regular unleaded, a difference of nearly 80 cents.

Even when oil dropped to a decade-low of about $10 a barrel in 1998 and local residents were complaining about Hawaii's highest-in-the-nation pump prices, the difference between the cost of oil and dealer wholesale prices was in the mid-60 cents range.

Using the industry estimate that crude represents more than 80 percent of the cost of refining petroleum products, the year-end spread suggests the oil companies were making tremendous profits on gas sales, said Chevron dealer Frank Young, who believes prices should be lower given current crude costs.

Some consumers are equally dismayed that pump prices haven't fallen and are at record levels on Oahu -- and much higher on the neighbor islands.

"I point to the greed of the oil companies," said Makiki resident Roger A. Hutchings. "They're trying to ride (high pricing) as long as they can."

Fereidun Fesharaki, an East-West Center petroleum expert who has done consulting work for major oil companies, said refineries worldwide benefited as crude prices fell and wholesale prices of their refined products didn't drop as quickly.

"On the whole, refineries these days are making a lot of money. It's a worldwide phenomenon, and Hawaii is no exception," Fesharaki said.

Chee said he didn't have information to comment on Chevron's profitability at its Oahu refinery, one of two on the island.

A spokesman for Tesoro Petroleum Corp., which operates the other refinery, declined comment, citing the state's pending $2 billion antitrust lawsuit against the major oil companies here. The state accused the companies of conspiring to keep gas prices artificially high in the 1990s -- a charge the defendants denied.

Most profitable gas market

TESORO reached a settlement with the state and is no longer a defendant, but it still maintains a no-comment policy on pricing issues.In court papers, the state describes Hawaii as the most profitable gasoline market in the country by a substantial margin for much of the past decade. Chevron, for example, sold only 3 percent of its national gasoline volume in Hawaii, yet 23 percent of its U.S. gas profits were generated here, the state said.

Although Oahu's wholesale gas prices didn't follow crude prices down late last year, at least one other petroleum product made at Oahu's two refineries did.

The price Hawaiian Electric paid for low-sulfur fuel oil from the two refineries dropped from a peak of more than $45 per barrel in November to $31 at the beginning of this year, according to Heco spokeswoman Lynne Unemori. That's a drop of more than 30 percent.

The utility was paying $26 at the beginning of 2000, Unemori said.

Fuel oil, like gasoline, is among the products refined from crude.

Chee said fuel oil prices dropped late last year because they, unlike gas prices, are more directly tied to crude costs.

While changes in gas prices tend to track what happens to crude in the long term, that isn't necessarily the case over short periods, he said.

"It's not proper to watch crude and expect crude to dictate what price (gasoline) is," he said.

Fesharaki, making a similar point, said crude costs are irrelevant to Hawaii gas prices. What's more relevant are gas prices in Singapore and on the U.S. West Coast, the two markets that supply Hawaii with its crude and potentially can be competing sources for gasoline, Fesharaki said.

Singapore wholesale prices and California pump prices would be more meaningful benchmarks, he said.

But even looking at those benchmarks, Hawaii's market stands out.

Singapore wholesale prices rose about 10 percent last year, well below the roughly 50 percent jump on Oahu.

And the average retail price of regular unleaded in California rose 22.5 percent, according to AAA. Honolulu's jumped 33 percent.

Rising tanker costs blamed

FESHARAKI attributed the larger Hawaii increases to higher expenses here, especially the cost of shipping oil to the islands. Tanker costs last year soared 250 percent, hurting a relatively small and isolated market such as Hawaii much more than places like California and Singapore, he said.Chee recommended taking a longer view of pricing -- over the past two years, not one. Chevron's wholesale price during that period increased 65 percent, while the cost of West Texas crude rose 175 percent, he said.

Chee used the West Texas crude because it is a benchmark followed industrywide but that type of oil isn't refined in Hawaii. "Maybe that's not an accurate comparison," Chee acknowledged.

Indeed, the West Texas benchmark rose substantially more than Indonesian minas, which was up about 112 percent in the two-year period. Alaskan north slope rose 108 percent.

By any of those measures, however, Oahu's wholesale gas prices have not kept pace with increases in oil prices the past two years.

That's primarily because 1999 was unlike any other year of the past decade. It marked the first year in which Oahu pump prices didn't move in the same direction as mainland prices.

While the average U.S. price for regular unleaded climbed 40 percent in 1999, Honolulu's fell 4 percent.

Some analysts attributed the market's unique behavior that year mainly to the extra scrutiny following the October 1998 filing of the state's antitrust lawsuit.

And what about this year?

Analysts expect oil prices to climb if OPEC, as expected, decides next week to cut crude output. That, in turn, is expected to put upward pressure on gas prices.