Advertisement - Click to support our sponsors.

By Rob Perez

Star-Bulletin

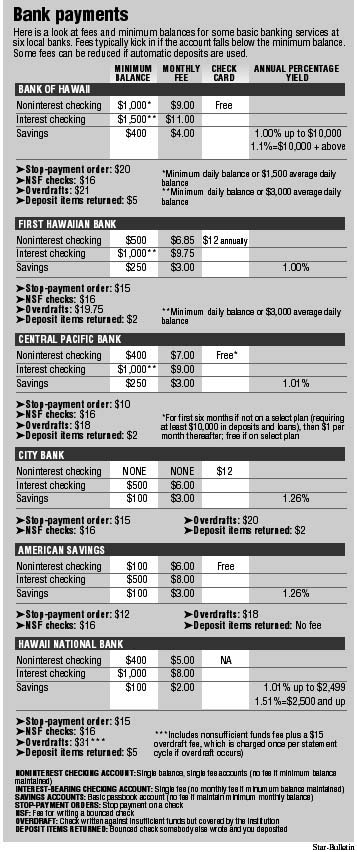

BANK OF HAWAII, the state's biggest bank, generally charges the highest fees and requires the highest minimum balances for basic accounts and related services, according to a Star-Bulletin survey of six of the largest banking institutions here.For the three basic checking and savings accounts surveyed, Bankoh led the way in both minimum balances and the monthly fees charged if balances fall below the minimum.

Of the 10 fees and balances surveyed in all, Bankoh had the highest for seven and tied for the highest on one other.

In addition, Bankoh and First Hawaiian Bank pay the lowest annual percentage rate -- 1.0 percent -- to customers with a basic interest-bearing checking account, although Bankoh ups the yield to 1.1 percent if a customer's balance totals $10,000 or more.

Lori McCarney, Bank of Hawaii's executive vice president, said the survey was misleading because it focused on a handful of items and did not reflect the overall value to customers. Bankoh clients, for instance, have access to a wide array of services and the largest network of branches and automated teller machines in the state, she said.

"We definitely deliver the value," McCarney said.

The Star-Bulletin did the survey twice -- in October and late November -- after several banks recently cited rising fee income as one reason their profits have risen. The newspaper used the Federal Reserve's annual national survey of bank fees as a guide.

In recent years, banks across the country have been boosting minimum balances and fees and establishing new fees for new services.

They have also been charging for services, such as returning canceled checks, that once were free or bundled with other services.

The trend has drawn criticism from consumer advocates, who note the industry nationally posted record profits for much of the 1990s.

'Jumping on fee bandwagon'

In Hawaii, banks generally have not been as aggressive as mainland institutions on the fee front, partly because of the sluggish economy, according to industry officials. But the fee picture, just like the economy, is changing."The banks only now have been jumping on the fee bandwagon, if you will," said Rodney Shinkawa, executive vice president of the Hawaii Bankers Association.

Bank of Hawaii, which has been restructuring its operations the past few years, easily has been the most aggressive locally, industry officials say.

For its basic non-interest-bearing checking account, for instance, Bankoh requires a minimum daily balance of $1,000, twice as much as First Hawaiian's $500 and 10 times the minimum for American Savings Bank's basic account, according to the Star-Bulletin survey.

If a Bankoh customer falls below the $1,000 minimum (or a $1,500 average daily balance), that customer pays a $9 monthly fee, easily the highest charged for basic non-interest-bearing checking accounts at the six institutions. (The next highest was Central Pacific Bank's $7.)

For stop-payment orders on checks, Bankoh charges $20, a third more than the next most costly stop-payment fee of $15, charged by First Hawaiian, Hawaii National Bank and City Bank.

Paying more for convenience

McCarney said competitors underprice Bankoh because they cannot match it in terms of overall value for customers. In the area of convenience, for example, Bank of Hawaii has 75 branches and 450 ATMs statewide, according to McCarney.The next biggest bank, First Hawaiian, has 56 branches and 171 ATMs statewide.

Bankoh also said the majority of its customers with basic checking and savings accounts maintain minimum balances so they do not pay the monthly fees.

In addition, the company said it offers other types of accounts, including one geared for people who do online banking. That checking account has no minimum and a $2 monthly fee, but customers are charged $2 per teller visit, effectively encouraging them to do their transactions electronically.

Consumer advocates and analysts say it is not surprising that Bankoh charges the highest prices for basic accounts. They say national surveys have shown that the largest institutions in a market tend to charge the most.

"There's a certain amount of pricing power that comes with a dominant market share," said Greg McBride, financial analyst with bankrate.com, a Florida company that tracks the banking industry.

Ed Mierzwinski, consumer advocate for the Washington, D.C.-based U.S. Public Interest Research Group, said major banks have pushed the pricing envelope because they realize many customers will not bother taking their business elsewhere.

"The banks can get away with it because of that stickiness with changing accounts," Mierzwinski said. "It's a lot of trouble to switch."

Bank officials justify rates

Industry officials, however, say the rise in fees and the establishment of new ones reflect an effort to more closely match costs to services and to give consumers more choice.Executives from several local banks, including American Savings and Central Pacific, did not respond to a request for comment or declined comment.

Don Horner, vice chairman of retail banking for First Hawaiian, issued a general statement about fees, but the company declined to make an executive available to answer questions.

"From time to time we review our bank's fee structure in comparison with our cost structure, the value of the services we provide and the competitive marketplace," Horner said.

"We also try to discourage behavior that's against the law and incurs extra costs for us -- such as writing checks with insufficient funds."

He said customers can avoid paying fees or fee increases by maintaining minimum balances, having more accounts at First Hawaiian and not bouncing checks -- something true for other institutions as well.

Lloyd Nakao, senior vice president at Hawaii National, said local banks have not been as aggressive as those on the mainland because the market here is more competitive. But he acknowledged that fees have been rising steadily.

"Banks will continue to look at fees as a source of income," Nakao said.

City Bank bucks fee trend

Bankoh officials said they review their fee structure annually and made changes in March. While the company eliminated a few fees, it raised others and increased some minimum balances, sparking complaints from customers.The minimum daily balance for Bankoh's basic noninterest checking account, for example, jumped to $1,000 from $500. The $12 fee for a debit card, however, was eliminated.

To retiree Ruth Marie Derigo, a Bankoh customer for almost 11 years, the changes were too much. Angered by the increases, Derigo moved her checking account to American Savings.

"When it gets to the point where a bank doesn't give a hoot about its customers, to hell with the bank," Derigo said.

Bankoh's McCarney said the company does not like to lose any customers, but when price increases are implemented, some customers will go elsewhere.

Still, the other value-enhancing changes the bank made has attracted more customers than the number lost because of the March increases, she said.

While other institutions, including First Hawaiian and American Savings, also raised fees this year, some saw Bankoh's aggressiveness as a marketing opportunity. American Savings ran a TV ad campaign, trying to lure disgruntled Bankoh customers. City Bank touted its "totally free" (no minimum, no fee) checking account -- the only one offered among the six institutions.

"Obviously, we feel it's a good product -- good for consumers," said Wayne Miyao, City Bank senior vice president.

At the company's downtown branch, it displays a chart showing how many checking-account customers City Bank has lured from other institutions.

About 8,000 former Bankoh clients have made the switch, more than from any other bank, according to the chart. Roughly 6,000 customers -- the next-highest total -- have been lured from First Hawaiian, the chart shows.

Better deals at credit unions

While Hawaii banks tend to charge the highest auto loan rates and pay the lowest certificate of deposit rates in the country, the comparisons to the mainland are more fuzzy with fees and minimum balances.In some cases, local fees or minimums are as good as or better than the national average -- from the consumer's perspective.

All six surveyed institutions, for instance, charge $16 when a customer writes a check that bounces. The national average is $23.87, according to bankrate.com.

But Bankoh (at $9), Central Pacific ($7) and First Hawaiian ($6.85) charge customers more than the $6.18 national average if their balances in a non-interest-bearing checking account fall below the minimum.

The minimum balances for those accounts at Bankoh ($1,000) and First Hawaiian ($500) also top the national average of $416.57, according to bankrate.com.

Consumer advocates say customers who are not satisfied with their bank offerings should check credit unions.

Because credit unions are nonprofit organizations, they often have better deals.

One example: Honolulu Federal Employees FCU, the 10th-largest credit union in the state, offers a lower fee, lower minimum and better yield on a basic savings account than any of the surveyed banks.

Honolulu Federal charges members a one-time fee of $1 to open an account with a minimum of $5.

The annual percentage rate is 3 percent, more than double the best offering among the six banks.