Advertisement - Click to support our sponsors.

Prisoner on As a successful producer in the entertainment industry, David Talisman made his name trusting his gut about people.

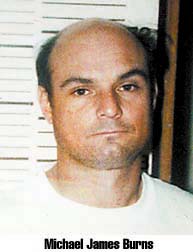

work furlough

accused of million-

dollar swindle

He promised millions he

didn't have to a local Web firm,

endangering its existenceBy Gordon Y.K. Pang

Star-BulletinBut when Talisman's own attorneys introduced him to Michael James Burns, his instincts failed him.

Burns claimed to be a venture capitalist from San Francisco and promised to pump $2.25 million into Talisman's software and Web page design company.

The millions never came. Burns is under investigation for stealing at least $43,000, and Talisman's company, Monster Software, is "in danger of going under because of this -- and we've done nothing wrong," he said.

Burns is back in a Hawaii prison cell after being extradited from Colorado earlier this month. He is serving the remaining time of a five-year sentence for theft and bail-jumping convictions on Kauai.

The alleged swindle of Talisman and others occurred while Burns was allowed to leave prison on work furlough.

Burns allegedly pretended to be a Silicon Valley multimillionaire and was even able to buy a Black Point home. But twice a week he checked in at the Laumaka Work Furlough Center.

Aspen police Detective Jim Crowley said Burns was captured in Colorado last month after he allegedly attempted to set up accounts with real-estate brokers by "claiming to have sold an Internet company and that he had a $70-million wire coming," Crowley said. "Obviously, the wire never appeared."The intended victims chose not to file charges against him, Crowley said.

But Aspen police checked national criminal databases and found Burns was being sought back in Hawaii by several different agencies -- including the Hawaii Paroling Authority.

Monster Software, a Hawaii-based Internet company with potential for success, had reached partnerships with companies such as Oracle. But like others in the fledgling but highly competitive industry, Talisman was searching for capital to give his company an advantage.

In January, Talisman said, his attorneys in California told him about Burns, describing him as "a very wealthy real-estate guy with heavy connections to Silicon Valley."

By April, Burns had promised to invest $2.25 million in Monster Software. Burns became its chief executive officer, drawing "a substantial salary" on a contract.

Talisman said: "We're a small company here in Hawaii and we're trying to go national and a guy comes along and says, 'I buy into your dream and I'm going to back your dream.' And then you find out it was a complete lie."

By early August, Talisman said, he and others in the company realized that the promised $2.25 million had not been delivered. Other discrepancies surfaced.

Talisman said he and other employees at Monster Software did not know that Burns was from the Laumaka Work Furlough Center. How much Burns cost Monster Software is a topic Talisman doesn't want to discuss.

"There's substantial money that wasn't invested and there is other money unaccounted for," he said.

The number of employees have been reduced from a high of 15 to eight.

The company demanded and received Burns' resignation on Aug. 8. Talisman said he then went to the FBI and police.

"I just want people to know that this is not something we did as people or a company," Talisman said.

Mark Nanamori, Burns' parole officer, said: "They appear to be a legitimate victim of this case."

Fred Wong, assistant special agent-in-charge with the FBI, and Honolulu police Lt. Pat Tomasu both confirmed that they have initiated cases involving Burns.

Tomasu said her case involves charges that Burns "was withdrawing money from Monster Software and getting cashier's checks to pay off his criminal fines."

Burns went on work furlough Nov. 23, 1999, said Clayton Frank, warden at Oahu Community Correctional Center.

He was granted extended furlough on April 26 -- allowing him to go home and only report to prison authorities twice a week.

That was about two weeks after Burns took over as Monster Software's CEO from Talisman.

Robbing Peter to pay Paul?

Under the furlough program, Burns was required to verify that he was employed by submitting stubs from his paychecks, Frank said. While under work furlough, Burns also was required to pay room and board at Laumaka."Somebody had to be paying this guy if he didn't have any money," Frank said. "The money has to be coming from somebody."

Burns listed as his employer a company called Sanco En Inc. which, according to documents filed with the Business Registration Division, was "in the business of exporting, importing and marketing for the distribution of food products."

Frank said Burns listed his position as business manager and his supervisor as Vijay Seth, listed at Business Registration as a vice president and secretary of Sanco En although the company appeared not to have filed a report since the end of 1998.

Frank said Burns was taking home $742 every two weeks.

On April 14, Burns gave a cashier's check for $40,789 to Kauai Circuit Court, Frank said. That check represented the restitution owed from his original Kauai case.

Frank said at no time did it appear that Burns had violated the terms of either his work or extended furlough.

"If he's fulfilling his obligation with us in terms of his employment, and he hasn't broken any rules -- he hasn't escaped -- as far as we know, he wasn't breaking any laws," Frank said.

Burns was serving a five-year sentence on counts of theft and bail-jumping based on 1998 convictions for offenses he committed on Kauai.

Nanamori, Burns' parole officer, said Burns accepted $10,000 in exchange for property he did not own.

Nanamori said Burns violated parole by failing to notify him that he no longer was working with Monster Software. He said he will recommend to the Paroling Authority that Burns' probation be revoked and that he now serve out the remaining three years of his original sentence.

$1.6 million property transfer

That's not all.In October, an Oahu man filed suit against Burns and Monster Software claiming he was duped into handing over his leasehold interest on a Black Point Road property to Burns in exchange for $1.6 million in AT&T and Monster Software stock.

Stephen T. Sawyer, in a lawsuit which also names Monster Software as a defendant, says Burns agreed to donate to Sawyer's charitable corporation -- the Harriet Bouslog Labor Scholarship Fund -- $1.6 million in AT&T and Monster stock.

"All of the representations made by Burns were false," the lawsuit states.

Further, Burns received $100,000 from Sawyer in July for 100,000 shares of Monster Software stock, which he never received, the lawsuit states.

The lawsuit also claims that Burns and Monster Software requested and got a $60,000 loan from Sawyer in August."We had nothing to do with that," Talisman said, noting that neither he nor Monster Software had been served in the suit. "(Burns) and Sawyer, as friends, worked out that deal.

We never knew about it. We never approved this transaction."

On Sept. 18, in a separate matter, a federal tax lien was filed against Burns by the Internal Revenue Service claiming that he owed $14,738.49 in back taxes, stemming from the 1996 tax year when he was still on Kauai.

Meanwhile, architect Daniel Moran, in a separate court action filed Sept. 7 known as a mechanic's lien, is seeking $6,300 he claims is owed by Burns as a result of work he did on the Black Point home.

Other questionable dealings

Parole officer Nanamori said he knows there are at least six other people who may have had business interactions with Burns.Business consultant Tom Foley knows there are other victims. He said he is part of a company that was asked to do financial-review work for Burns and was never paid.

Foley said he is aware of others who had questionable dealings with Burns and went to the authorities, but his company won't pursue charges.

"It's not something that professionals usually do," Foley said. "People don't pay their bills in this community, you sever the relationship and don't do business with them ever again."

Burns, on a Web page, also listed Foley as being affiliated with his Aspen Venture Group and gave the impression he was an officer when he was not. The page is no longer in existence.

"He was charming; he seemed reliable," Foley said. "And in perfect hindsight, I feel like an idiot saying that."