Advertisement - Click to support our sponsors.

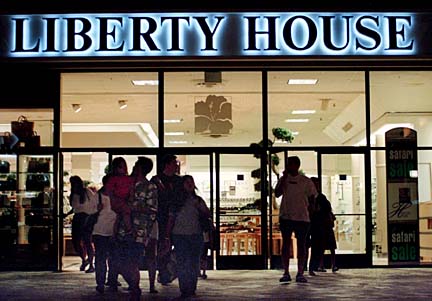

Mall owner’s bid Local retail analysts are applauding the owner of Ala Moana Center's plan to buy bankrupt Liberty House Inc. for $195 million, a move that could potentially reshuffle Hawaii's retail sector.

for Liberty House

may reopen door

for Nordstrom

Analysts laud the plan of

Ala Moana Center's parent to

offer $195 million for

the bankrupt retailerBy Tim Ruel

Star-Bulletin

"Brilliant move," said Marty Plotnick, president of Creative Resources Inc. "It's a substantial cash offer that no one else has made."

Commercial real estate agent Joseph North Jr., a former retail consultant, said: "Frankly, I think it's a move that's long overdue."

In a Tuesday filing in U.S. Bankruptcy Court, Chicago-based General Growth Properties Inc. said it would pay $100 million in cash up front and write a $95 million promissory note to buy all assets of Liberty House, including its flagship store at Ala Moana Center.

The offering should appease Liberty House's main creditor, Bank of America, Plotnick said. The courts could then divvy up the rest between secured and unsecured creditors.

The plan would not only end the 150-year-old Hawaii retailer's debt woes, it could potentially introduce new players to the retail scene, said Plotnick, who stressed he did not know specifics of General Growth's intentions.

In a supplemental filing, General Growth said it wanted the right to give any of Liberty House's current leases statewide to other mainland retailers seeking to build their presence in Hawaii.

Plotnick contends that the leases are Liberty House's most valuable assets, and would open the doors of prime retail space to much-needed competition.

Liberty House's major leases are downtown, in Kailua and Waikiki, North said. Others located at many of Oahu's malls, are not as significant, he said. Liberty House has about 20 outlets, including 10 department stores, in Hawaii and Guam, and about 3,000 employees.

"Their only plum, as far as I can see, is Ala Moana," North said today.

At least one retailer, Seattle-based Nordstrom Inc., is a likely candidate to move into the Ala Moana space, Plotnick said.

"The market has clearly wanted Nordstrom," he said.

Nordstrom signed a letter of intent with General Growth in 1996 to open a 268,000-square-foot department store at Ala Moana. Liberty House successfully blocked the deal, however, saying it violated the company's lease.

Nordstrom is interested in the new development and will be watching closely, company spokeswoman Paula Weigand said yesterday, noting the company still wants to bring a full-line store to Hawaii.

Nordstrom most likely would not want Liberty House's entire 345,000-square-foot space at Ala Moana, North noted. Smaller, more upscale tenants could also move in, providing a rent boost to General Growth.

Even if General Growth did not move Nordstrom into Ala Moana, General Growth's aggressiveness would at least breathe life into Liberty House, Plotnick said. "We would like to see traffic built up again in the center."

The Waikiki side of Ala Moana, where Liberty House has its store, used to be the main center of attention at the mall, partly because it is close to the Ala Moana Hotel, North said. He thinks the retail traffic has since shifted to the middle of the mall, but still has the potential to return to the Liberty House side. "A lot of new revenue generation is ahead for Ala Moana," North said.

Liberty House filed for Chapter 11 reorganization bankruptcy in March 1998. The case has bogged down in a legal battle between Liberty House owner JMB Realty Corp. of Chicago and the chain's major creditors, led by Bank of America.

The two sides have filed competing reorganization plans that were being discussed today at a bankruptcy court hearing before Judge Lloyd King.

John Monahan, Liberty House president, declined comment yesterday.

General Growth's attorney, Michael Molinaro, said yesterday that the company already has a strong presence in Hawaii with Ala Moana Center, which it bought from Japan-based Daiei Inc. for $810 million last year. "They feel that the Liberty House name and business is something they could develop and expand," Molinaro said of General Growth.

General Growth started developing its purchase proposal only recently, he said.

The company needs the bankruptcy court to approve a disclosure statement, which provides the details of the proposed offer.

General Growth's plan calls for a deal to close before March 31.

Plotnick, however, said Liberty House's bankruptcy would most likely drag on for several more years, since he expects JMB not to accept General Growth's plan.

Plotnick said he feels the most for Liberty House's unsecured creditors, including local cottage industry retail producers who may not get a penny of the money owed them.