Advertisement - Click to support our sponsors.

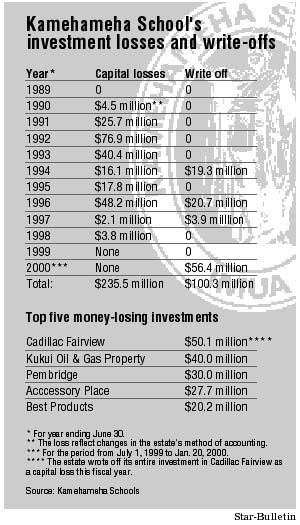

Despite unprecedented financial growth, the Kamehameha Schools recorded more than $335 million in losses and writeoffs during the past decade.

An internal trust document included in recent court filings reveals the $6 billion charitable trust declared more $235 million in capitol losses and wrote off more than $100 million in bad investments since 1989.

The losses and write-offs -- more than three times the Kamehameha Schools' annual $100 million educational budget -- were covered by about $3 billion in revenues that the trust took in during the same 10-year period. But the troubled investments underscore criticisms that the estate's embattled former trustees mismanaged assets and took ill-advised bets on speculative ventures.

"The former trustees like to tell the public about their home runs but not their strikeouts," said Randy Roth, University of Hawaii law professor and co-author of the 1997 "Broken Trust" article that prompted the state to open its investigation of the former trustees.

"One gets the impression that the investments were made on an ad hoc basis without much attempt to diversify in meaningful ways."

A write-off means that the estate considers the complete investment a loss. A capital loss, on the other hand, represents that portion of an investment that is impaired.

The trust's statement of losses -- which covers the period between June 30, 1989 and Jan. 20, 2000 -- will likely serve as a key exhibit in Attorney General Earl Anzai's suit seeking multimillion-dollar surcharges against former trustees Henry Peters, Richard "Dickie" Wong, Lokelani Lindsey, Gerard Jervis and Oswald Stender.The state's suit, which is scheduled to go to trial Sept. 18, alleges the ex-board members took excessive pay, mismanaged Kamehameha Schools' educational programs and incurred more than $200 million in investment losses during their tenures.

The former trustees have denied wrongdoing, citing the estate's recent string of record revenues. They point to the $552 million windfall from last year's initial public offering of Goldman Sachs Group, which pushed the trust's 1999 revenues to more than $800 million.

An estate spokesman had no comment. But the Kamehameha Schools' interim trustees are taking steps to clean up the trust's investment portfolio. They recently wrote off $50 million in bad investments and are implementing a new investment policy that focus on blue-chip investments.

The loss statement compiled by the interim board of trustees provides a broad and more detailed look into the estate's troubled holdings, many of which were initiated in the mid-1980s by former trustee Matsuo Takabuki.

The estate's largest write-off was for $50 million. It involved a 1987 investment in Cadillac Fairview Corp., a Toronto-based office and retail property developer.

The estate, following the advice of Chicago-based JMB Realty Corp., joined 38 institutional investors in the $2.6 billion leveraged buyout of Cadillac Fairview, but the investment went south after the mainland recession of the early 1990s forced the developer into bankruptcy protection.

In 1996, the Kamehameha Schools suffered a $40 million capital loss in McKenzie Methane Inc., a Houston-based natural gas producer. The loss came after McKenzie Methane was placed under federal bankruptcy protection.

McKenzie Methane has since emerged from bankruptcy and has been producing operating income for the estate.

The estate also recorded a $30 million loss in 1992 from its investment in Pembridge Associates, a mainland investment company that acquired a large England-based paper products and packaging materials conglomerate named DRG in a $900 million leveraged buyout in 1989.

The Kamehameha Schools partners in the deal included Frederick "Ted" Field, an heir to the Marshall Field department store fortune and an investor in McKenzie Methane, and North Carolina investor Clay Hamner.

Hamner figures in a number of money losing ventures for the estate, including Hanford's Inc., a North Carolina ornament maker founded by the family of former presidential candidate Elizabeth Hanford Dole, and DC Land Group, which developed the posh Robert Trent Jones golf course in Virginia. During the year ending June 30, 1993, the Kamehameha Schools realized a $7.4 million loss in Hanford's and a $2 million loss from DC Land.

Bishop Estate Archive