Advertisement - Click to support our sponsors.

Castle & Cooke

CEO seeks to

buy out companyDavid Murdock's offer sends

By Russ Lynch

the stock of the Hawaii home

builder soaring nearly 40 percent

Star-BulletinDavid H. Murdock, chairman and CEO of mainland and Hawaii home builder Castle & Cooke Inc., is offering to buy the company in a deal that, among other things, will give him personal ownership of more than 90 percent of Lanai.

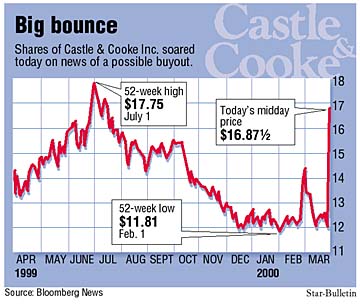

Castle & Cooke stock soared on the New York Stock Exchange today, the first day of trading since yesterday's late-night announcement that Flexi-Van Leasing Inc., a company owned entirely by Murdock, wants to pay $17 a share for the 73 percent of Castle & Cooke that it doesn't already own.

The stock closed up $4.81, or 39.9 percent, to $16.87. The stock was as high as $17.25 earlier in the session. Before today, the shares had fallen 15 percent in the past year.

"Right now, the stock market doesn't care about real estate and Murdock is taking advantage of that, buying the company for an attractive price," said Sutro & Co. analyst Craig Silvers, who has a "buy" rating on the stock.Perhaps "the pattern will repeat . . . and in a couple of years, he'll sell it back," he said.

Flexi-Van, a container and chassis leasing business, will pay about $213 million to gain full ownership of the company, in a deal that is subject to approval by a committee of directors other than Murdock, 76, the company's biggest stockholder.

Kenilworth, N.J.-based Flexi-Van Leasing appeared on the Hawaii scene in the mid-1980s, when Murdock used it to take control of Castle & Cooke.

Formed in 1851, Castle & Cooke was one of the original "Big Five" Hawaii companies in the sugar and pineapple business. The company, which had fallen on hard times after costly fights against takeover attempts, was suffering huge losses and owed several hundred million dollars when Murdock arranged to pay off the debt and restructure the company. He later changed its name to Dole Food Corp. and moved the company's headquarters to the Los Angeles area. In 1995, he spun off the home-building division into a separate company, Castle & Cooke Inc., keeping a substantial stake for himself.

During his tenure he pushed ahead with long-stalled development plans for Lanai, building two luxury resort hotels -- the Manele Bay Hotel and the Lodge at Koele -- a golf course and luxury homes that sell for $1 million or more.

Castle & Cooke also is spending more than $100 million on a new surge of Oahu housing development at Mililani Mauka and Kunia and has housing and commercial real estate developments in California, Arizona, North Carolina, Georgia and Florida. The company had a 1999 profit of $13.5 million on revenues of $316.9 million.

Flexi-Van owns 4.5 million shares of Castle & Cooke, about 26.4 percent of the total. Murdock retains the right to cancel the acquisition if a definitive agreement is not reached by May 15.

He has also been exploring options for the future of Dole Food, of which he owns 24 percent.

In January, Dole retained Goldman Sachs & Co. to study a possible sale of part or all of the company. This week, Philippine food and beer producer San Miguel Corp. said it was looking at buying into Dole. However, Dole said yesterday that those talks were dropped and there are no immediate plans to sell the company.