Advertisement - Click to support our sponsors.

Hawaii brokers

see divergence

continuing

They say investors will

By Russ Lynch

keep migrating to the

'new economy' stocks

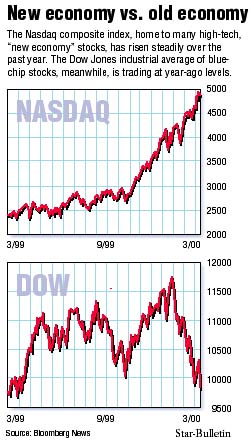

Star-BulletinThe stock market trend that has the older, blue-chip companies dropping while the new technology-based businesses soar is likely to continue, Hawaii stockbrokers say.

Yesterday's dramatic swing -- with the Nasdaq composite index briefly passing 5,000 while the Dow Jones industrial average had its fourth-biggest point drop -- was based on underlying factors that aren't going away, they said.

"I think it's relatively simple," said Paul Loo, senior vice president for the Pacific at Morgan Stanley Dean Witter. "Go back to just before 1900, when the automobile and the electric light were getting started. There was a new technology and people were leaving the whaling ships, the great three-masted schooners and moving (investments) into steamships," he said.

Today, the new technology is comprised of the businesses -- from Amazon.com to Yahoo! -- that create or take advantage of instant communication.

"It's not a whim, it is not a fluke and it is not a short-term thing," Loo said.

People wouldn't have pulled out of the concrete road-building business early this century when the whole country was yet to be paved, he said. The "roads' of today are the new-technology companies, those that are developing new ways of doing things and new ways to deliver their services, he said.

Another a big factor in the switch to those fast-growing stocks, mainly on Nasdaq, is tax-related, Loo said.

"If you construct your wealth out of growth stocks, you pay 20 percent (in capital gains tax) when the growth takes place," Loo said.In other words, sell a stock that has grown and you pay capital gains. Hold on to a good, stable, blue chip stock that earns dividends and you pay the full income tax on that money, he said. That's often much more than 20 percent.

But investing in those fast-moving stocks with a constantly rising market value isn't a guaranteed road to riches, Loo said.

"The dangers are apparent. I don't want you to say 'Paul Loo says buy growth stocks,' because the dotted lines don't always go where they should go," he said. Buying growth stocks can be a passport to wealth, he said. "But it's also a passport to a lot of disappointment. Therein lies the word 'diversification,' " he said.

Loo also noted that since the Dow is down nearly 2,000 points from its Jan. 14 peak of 11,722.98, there are some great buys now in the value stocks.

Brian Kearns, manager of the Wedbush Morgan Securities Inc. office on Bishop Street, said the market for shares of the traditional companies have been affected by high oil prices and Federal Reserve Chairman Alan Greenspan's repeated statements that higher interest rates might be needed to slow the economy's rapid growth.

"The market has had such an incredible run. When you have these factors that have historically been negative, people take their profits," Kearns said.

The traditional "old economy" companies get adversely affected by falling oil prices and higher interest rates and while the technology companies are not entirely immune, it's hard to envision them being affected to the same extent, he said.

And the effect on the traditional companies is severe.

"In 1998, when the Dow slipped to about 7,500, a lot of the larger capital companies came down. A lot of them (now) are trading below where they were two years ago. Some stocks are at four- or five-year lows," Kearns said.

Ted Jung, senior vice president and head of the Honolulu office of Salomon Smith Barney Inc., like other brokers, said his office was very busy yesterday but Hawaii investors tend to be "a lot more long-term" than their counterparts on the mainland.

"We probably don't see the panic-type effect here," he said.

As for the drop in the Dow and the rise in Nasdaq, that's a trend that is likely to continue, Jung said. "You hear all the buzzwords about the 'new economy' and so on," he said. "That's what, I guess, is the belief by the guys with the big money. Wall Street has a lot of big followers. There's not a whole lot of original thinking."

Jung said he believes that the Nasdaq will continue to gain, but he cautioned that not all the rising companies will stay that way. "A lot of people are going to get hurt," he said.

And Jung said there is new factor making it even harder to predict what the markets are going to do. "Years ago, when we had these flashes, people used to have to come to stockbrokers and we'd give them the best advice we could," he said.

Now, with online trading, many investors are going it alone, invisible and unpredictable, Jung said.