Advertisement - Click to support our sponsors.

Cayetano proposals

would affect state

health benefits

The bills would increase

Proposals at a glance

the costs of health care

to some state workers

Consultant won't talk By Rob Perez

Star-BulletinAfter Sarah Moriyama heard about Gov. Ben Cayetano's State of the State proposals last month, she told her fellow retired teachers not to worry.

Moriyama was put at ease by the governor's pledge not to cut benefits for current workers and retirees.

Then she read the bills Cayetano subsequently submitted to the Legislature. She contacted her retired friends again.

"I told them 'I'm sorry, I take it all back. We have to watch out for these things after all,' " said Moriyama, 74, who taught for 30 years and now lobbies for the Oahu Retired Teachers Association.

While Cayetano publicly has assured current workers and retirees their benefits would not be reduced, changes he's proposing to rein in the escalating cost of public-worker medical insurance would amount to reductions for certain groups.The state, for instance, would cut in half the amount it pays for premiums for surviving spouses and dependents of workers who retire after 2001 and die, according to one administration bill before the Legislature.

Another calls for the Hawaii Public Employees Health Fund, which administers health benefits for state and county workers, to change its basic medical coverage to a so-called preferred provider plan. That would result in higher out-of-pocket expenses for people who use the coverage extensively -- but savings for many others and the state.

The same bill would establish a managed-care system for Medicare-eligible retirees, resulting in co-payments for some retirees who currently pay nothing out of pocket.

Also proposed is a change in the way prescription drugs are obtained for workers and retirees. Users of generic drugs would see their costs go up a few dollars per prescription, while those opting for nongeneric drugs would have more choices. Again, the state would save money.

Critics argue that such proposals amount to benefit reductions because the cost to the employee, retiree or survivor would increase.

What's more, the centerpiece of Cayetano's proposals, scrapping the health fund for an employer-union trust, is so sweeping that no one can be certain what the ultimate impact on benefits will be -- until everything is in place.

But while administration officials acknowledge that some people may end up paying more if all their proposals are enacted, they say the system would be greatly improved, perhaps resulting in better benefits overall, and the government would have a better handle on containing costs. In addition, the state would continue to honor basic commitments, such as covering 100 percent of premiums for current retirees.

"We're trying to make reasonable tradeoffs," said Neal Miyahira, Cayetano's budget director.

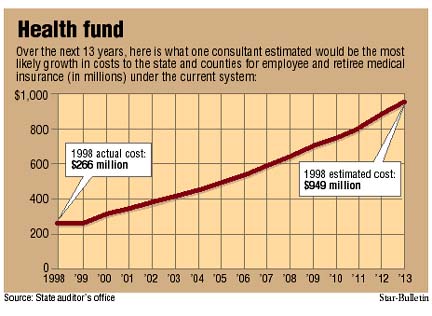

The driving force behind the governor's initiatives is an escalating medical insurance tab that one independent expert said likely would grow to nearly $1 billion annually for the state and counties by 2013 -- about what the state now spends on education.

Some union officials question the reliability of those projections. But they acknowledge that the problem of mounting costs can't be ignored.

And if nothing is done to start reducing that liability, legislators and administration officials say, the state eventually may be forced to take drastic action, such as raising taxes, chopping services or laying off employees.

"This is like a time bomb in the budget," Miyahira said. "The sooner we start to deal with it, the better."

While some legislators say the administration measures don't go far enough, targeting mostly benefits for future hires, Miyahira said the proposals are a start.

"A start is not good enough," said Rep. Ed Case, the House majority leader. "Without cutting either benefits themselves or the current agreement on what the government contributes (financially) or both, I don't believe we will make any substantial dent in this fiscal crisis."

Just how far the administration proposals go in getting the cost problem under control is unclear -- a situation that means the Legislature will be making decisions "on the fly," according to Rep. Nathan Suzuki.

The employer-union trust measure, for example, calls for setting a specific dollar amount -- subject to negotiations with the unions -- that the government would contribute per employee, compared with the current method of paying 60 percent of a premium that changes periodically. The dollar amount would be renegotiated each time the labor contracts are up for renewal.

The retiree contribution also would be a set amount, adjusted annually based on a medical inflation index.

But until the specific dollar amounts are set and other factors become known, it's difficult to project potential savings to the government.

The measures to establish a preferred provider plan, change the drug coverage and convert to managed care for Medicare-eligible retirees would save the state an estimated $81.6 million over the first four years and bring the plans more in line with industry norms, according to the administration.

Those are seen as interim measures until the union-trust system is in place. How precisely that system would work, however, is not clear, creating even more anxiety among workers and retirees who fear their benefits could change considerably.

"Nobody's actually presented the details, so it's hard to make a judgement," said Jimmy Yasuda, a retired state worker.

The idea behind the administration's plan is to scrap the competing coverages offered by the health fund and unions and bring everyone, employees and retirees, under one system. Benefits would depend on what the trust board, which would have equal representation among employers and unions, could purchase, based on contributions from the state and county governments.

Switching to an employer-union trust would bring Hawaii more in line with how other local governments nationally provide health insurance and is one of the recommendations in a 1999 study by state auditor Marion Higa.

Such a system would be more efficient and flexible and create savings through economies of scale and greater bargaining clout with insurance carriers, according to Miyahira.

But the unions are skeptical, saying a single system would be bogged down in bureaucracy similar to what has plagued the health fund. They want to retain the ability to offer separate plans, subject to the oversight of the employer-union trust, and cite their track records in doing so. "To put us all under one, that would put the government at a disadvantage," said United Public Workers state director Gary Rodrigues.

One of the most controversial issues is what to do about coverage for retirees, which by 2013 is projected to cost the state and counties $455 million annually -- or more than half the overall total.

Many legislators have expressed reservations about cutting any retiree benefits, currently among the most generous in the nation. But if such benefits are left untouched, the burden of solving the problem will fall entirely on active workers, some legislators say.

Case makes the distinction between elderly retirees on fixed incomes and younger retirees -- some in their 40s -- who are still capable of working. The latter group is in a better position to help solve the problem, Case said.

"I don't think there's any one answer to this," Miyahira said, reflecting on all the issues that would make any solution controversial. "You have to tackle it in little ways and look at tradeoffs."

Whether legislators will be willing to take action this session remains to be seen.

But Moriyama, the retired teacher, had a word of advice for them: "Don't try to fix this on the backs of the old-timers."

The Cayetano administration's proposals for reeling in soaring medical insurance costs for state and county workers: Proposals at a glance

Replace the Hawaii Public Employees Health Fund with an employer-union trust that administers coverage for all workers and retirees.

Convert existing health fund medical plan to a preferred provider organization plan, which would change the level of out-of-pocket expenses for those covered.

Switch to a new system for prescription drug coverage. Users of generic drugs would pay more, but those using nongeneric drugs would have more choices.

Change the health fund's coverage for Medicare-eligible retirees to a health maintenance organization plan, which would have a smaller group of physicians and a requirement for a co-payment.

For employees hired after July 1, 2000, eliminate employer's post-retirement contributions for dependents.

Cut in half the employer contributions for surviving spouses and dependents of workers who retire after 2001 and subsequently die.

State auditor Marion Higa has refused to authorize a California consultant to talk to the Star-Bulletin about a key administration proposal to change the way the state funds health insurance for employees and retirees. Consultant won't talk

The Star-Bulletin contacted John Fritz, an Ernst & Young expert who has studied Hawaii's public-employee health fund, to get his assessment after several lawmakers noted a lack of information about the proposal's potential financial impact.

Fritz, who did the study for Higa's office last year, agreed to comment if the auditor's office gave its blessing.

Higa, however, said no. Her office gave no reason.

Assistant auditor Jim McMahon did say the consultant was made available to legislative committees before the current session.

"Any decision to make the consultant available to the Legislature in the future is subject to discussion with legislative leadership," McMahon said. The auditor's office presented a report to legislators last year that included Fritz' findings.

http://www.hawaii.gov/