W.Hawaii projects

to surpass $1 billion

Large, upscale residential

By Rod Thompson

developments are slated for

the next two decades

Big Island correspondentKAILUA-KONA -- A series of large, upscale residential developments with an investment potential of well over $1 billion over a 20-year period are in preparation or under way in West Hawaii.

The projects offer economic prosperity not seen in the region since the boom in West Hawaii resort hotels in the late 1980s.

"This is an incredible economic engine at a time when we all are wringing our hands over economic development," said Richard Albrecht, vice president for development at Hualalai Resort.

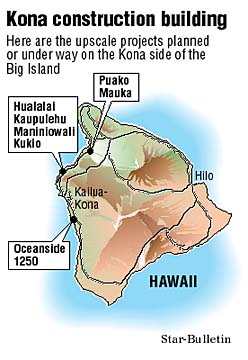

A major cluster of projects located 13 miles north of Kailua-Kona includes Hualalai, Kaupulehu Resort, Maniniowali and Kukio Resort, totaling about 3,900 acres.

An estimated initial $730 million will be spent there, much of it on infrastructure.

At Hualalai, buyers are already paying $800,000 to $4 million for house sites alone, Albrecht said. The houses they build will be comparable in value.Farther to the north lie 3,000 acres at Puako Mauka. Up to 2,600 homes and six golf courses are permitted there, said real estate broker and developer Eugene McCain.

Owner Bridge Puako LLC envisions a first phase with two golf courses and up to $50 million in investment, he said.

Nine miles south of Kailua-Kona lies the 1,500-acre Oceanside 1250 project.

Investment there will be over $100 million for 750 house sites, an 80-unit lodge open to members and their guests, and 5 miles of a new highway linking North and South Kona, said project manager Rick Humphries.

The scene for much of this growth was set by the building of a series of resort hotels in the 1980s. But the boom ended with the bursting of the Japanese economic bubble in the early 1990s.

Broker McCain did a recent market study of the Kona-Kohala coast which shows almost no residential property sales from 1992 to 1996. Sales picked up in 1997, reached $140 million in 1998, and are close to $200 million this year, he said.

Marnie Herkes at the Kona-Kohala Chamber of Commerce urged people not to call this a new boom, lest it be jinxed and turn into another bust.

Lin McIntosh, who operates Multiple Listing Service for the Big Island, said West Hawaii has gone through cycles of boom and bust every 10 years since the 1960s.

Hualalai's Albrecht predicted this upturn will be sustained by affluent baby boomers from the West Coast buying second and third homes.

Bill Mielke at Mauna Kea Properties, which is now marketing 24 house and lot packages called the Uplands, agreed.

Some investors used to buy 10 units at a time, he said. Now they buy one unit for their own use.

Unlike a hotel, which has to be built all at once, residential developments can be done a few units at a time, Albrecht said. That way, no unsold inventory is built up.

People who buy these properties as a second or third home put little stress on public services, Herkes noted.

Their children are grown, so they don't need schools.

The houses are well built, so they do not need much fire protection.

They may drive to the store during the day, but they are not driving to work, so they do not add to rush-hour traffic.

And they spend lots of money, she said.

"You don't just buy a house and say, 'Well, I'm going home,' and leave," Mielke said.

Gardeners, maids, pool caretakers and others are hired year-round to maintain the homes, he said.

County Councilwoman Nancy Pisicchio from Kona, who chairs the county housing agency, isn't convinced this is all good.

Pisicchio opposed Oceanside 1250 before becoming a Council member, and worries now that this upscale building is creating no housing for middle-income people.

Hilo Councilwoman Bobby Jean Leithead-Todd responded, "The sign of a real turnaround is not when we're selling high-priced homes, but when there's a demand for middle-income houses."

She said she thinks the demand will come once construction starts putting money into middle-income pockets.

Meanwhile, even with Big Island property taxes low by mainland standards, upscale homes pay their share in property taxes, she said.

There are 15,000 lots on the Big Island that pay only $25 a year in property taxes, Leithead-Todd said. A $1 million house and lot will pay $8,000 to $10,000 a year, she said.