The bank's parent is scheduled

By Rob Perez

to announce significant job cutbacks

as part of an ongoing,

major restructuring

Star-BulletinOn Monday, Bank of Hawaii moves the cheese.

Figuratively.

In what has become one of the most anticipated days in the company's history, Pacific Century Financial Corp., the bank's parent, is scheduled to announce significant job cutbacks as part of an ongoing, major restructuring to become more efficient and competitive.

To help anxious employees deal with the planned changes, Pacific Century recently gave most of its 5,000 workers a hard-cover copy of the book "Who Moved My Cheese?"

Written by Hawaii author Spencer Johnson, the tale focuses on several mice in a maze and how they adapt -- or don't adapt -- when their supply of cheese is moved. The parable is designed to help employees deal with change in the workplace.

For some Bankoh workers, though, the restructuring will mean an actual change of their workplace.

Company officials won't say until Monday how many positions will be eliminated as a result of the reorganization.

"We need to create better

shareholder value."Richard Dahl

PACIFIC CENTURY PRESIDENT

But they acknowledge that layoffs over the next year or so will be inevitable as the restructuring takes effect. As with previous cutbacks, however, Pacific Century executives expect many workers whose jobs are eliminated to find positions elsewhere within the company.

When the bank last year cut 300 positions and closed 27 branches, a move that is saving Bankoh $22 million a year, only 14 employees actually were laid off, according to Richard Dahl, Pacific Century president.

Dahl also said a hiring freeze that has been in effect since last year and will extend into 2000 means some affected workers can fill vacant positions.

Investor pressure

Given the performance goals Pacific Century already has established, several analysts said they wouldn't be surprised if 5 percent to 10 percent of positions, or as many as 500 jobs, are abolished as part of the new round of changes.Dahl wouldn't comment on those numbers, saying they were speculative.

Erika Hill, an analyst with Pacific Crest Securities in Seattle, said she anticipates the bank will focus more on building revenue growth than laying off workers.

"I don't think it's going to be a slash-and-burn approach," Hill said.

Yet the company does face investor pressure to pare staffing.

"If they don't do anything along the lines of job cuts ... there would be a negative reaction on the stock," said Thomas W. Smith, analyst with Standard & Poor's equity research in New York.Pacific Century, one of the state's largest employers, launched its restructuring in early 1998 partly to address investor concerns about poor performance. By a variety of measures, the $14.6 billion financial services company in recent years has lagged industry standards, sometimes considerably.

That has been largely a reflection of Hawaii's sluggish economy, which meant little revenue growth -- a critical weakness -- in the company's main market.

Pacific Century, for instance, has an efficiency ratio of 65 percent, far worse than the industry average of 55 percent -- a target Bankoh hopes to reach next year. The lower the number, the better.

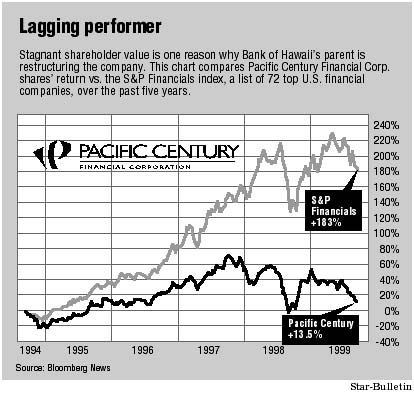

Its stock also has been a laggard. Over the past five years, the price has risen 13.5 percent, compared with a nearly 184 percent jump in the S&P index of major financial companies, according to Bloomberg News.

The S&P 500 and Dow Jones industrial average also increased more than 180 percent in that period.

Partly because of such poor shareholder returns, the California Public Employees Retirement System earlier this year named Pacific Century one of corporate America's poorest financial performers.

Employees nervous

Acknowledging its lagging performance, Pacific Century has set fairly ambitious goals for the end of next year, including improving efficiency and shareholder returns."We need to change," Dahl said. "We need to improve our performance. We need to create better shareholder value. We need to create better customer value."

Analysts say they are encouraged thus far by the steps management has taken to reach those goals.

One step was the hiring of Aston Group, a mainland consulting company that helps companies restructure and downsize.

As part of that process, 50 of Pacific Century's top performers were tapped to evaluate potential ways to improve operations, including whether more consolidations or hiring of outside vendors was warranted.

Employees say they haven't been clued in on what to expect Monday, so some say they are nervous because of the uncertainty. None the Star-Bulletin contacted would speak on the record.

"People don't want to think about it," one employee said. "They're just waiting until Monday. What will happen will happen."

Anxiety level 'full tilt'

Lawrence Johnson, Pacific Century's chairman and chief executive, acknowledged that employees are apprehensive. "The anxiety level in the company right now is full tilt."But Johnson said morale still is strong because employees understand why changes are needed.

One apparent manifestation of the anxiety is found on the Web.

An online bulletin board at Yahoo, a popular Internet search engine, has been set up by people to comment -- anonymously -- on the impending changes.

More than 250 messages have been posted, some spiced with name-calling and insults directed at other participants or company executives.

Even snide references to the cheese parable are found. In at least one message, Bankoh employees are referred to as rats.

Because no one knows for sure who is posting the messages, Dahl said he doesn't consider the bulletin board a credible gauge for how employees feel about the restructuring.