After years of double-digit growth,

By Peter Wagner

filings increased by only 2.7 percent

in the first six months of this year

Star-BulletinFor the first time in nearly a decade, Hawaii's runaway bankruptcy rate has slowed to a steady chug.

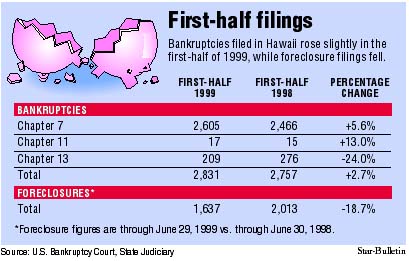

Figures released at the close of business yesterday by U.S. Bankruptcy Court showed 2,831 cases filed in the first six months of this year -- a modest 2.7 percent increase over the 2,757 filings in the same period last year.

The slight increase is in sharp contrast with the double-digit growth that has marked Hawaii bankruptcies in recent years, one of the fastest rates of increase in the nation.

For example, filings by the middle of last year were 31 percent above the 2,104 cases filed through June of 1997.

Foreclosures, meanwhile, often a consequence of bankruptcies, are down sharply so far this year.

The State Judiciary yesterday reported 1,637 foreclosure cases through June 29, down 18.7 percent from the 2,013 from Jan. 1 through June 30, 1998.

"I think it's very good news," said University of Hawaii economist Carl Bonham. "It tends to confirm some of the other tidbits of data we get that indicate some sectors of the economy appear to be improving."

Some of those indicators include improved housing sales and a slowdown in overall job losses following years of wholesale layoffs as businesses failed or cut back operations, he said.Bonham also noted a 1.9 percent increase in personal income in 1997 followed by a 2 percent increase last year, the first improvement since 1990.

"It's starting to look like there's enough out there that you can say, the bottom is in sight," Bonham said.

Pearl Imada-Iboshi, head of research and economic analysis at the state Department of Business and Economic Development, yesterday was encouraged by the positive signs but not surprised.

"It's a good sign that the economy is improving, but it's also following a nationwide trend," she said.

Imada-Iboshi said Hawaii has followed but lagged national bankruptcy trends, currently showing a slowdown in bankruptcy growth rate after years of skyrocketing filings. Nationwide, the number of bankruptcy filings fell by nearly 7 percent in the first quarter of 1999 versus the same period last year.

She said bankruptcies in Hawaii, as across the nation, reflect factors beyond a poor local economy -- including credit card abuse and lax federal bankruptcy laws that allow debtors to escape their bills by filing Chapter 7.

The great majority of bankruptcies here and across the country in the past decade have been Chapter 7s, personal bankruptcies that allow a debtor to liquidate assets and then walk away from remaining debt.

Of the 2,831 bankruptcies filed as of yesterday, 2,605 were Chapter 7; 209 Chapter 13; and 17 Chapter 11 cases.

A Chapter 13 bankruptcy is generally a personal bankruptcy allowing a debtor to keep his possessions while working out a schedule to repay creditors. Chapter 11 commonly applies to businesses trying to restructure debts while staying open for business.

Bankruptcies have been skyrocketing in Hawaii since 1991, when the state's economy began a long descent. Total bankruptcies -- personal and business -- shot up from 873 in 1990 to 5,774 last year.

Total bankruptcies last year were up 29.6 percent over 1997, which in turn was 44 percent over the year before.

Total foreclosures also have climbed in recent years. The 3,626 foreclosures filed in 1998 were 15.2 percent more than the 3,148 filings in 1997, which was 12.4 percent greater than the 2,800 in 1996, the Judiciary said.

Assistant U.S. Trustee Gayle Lau yesterday noted a crackdown on frivolous bankruptcy filers in the past six months may have had an impact on the state's filing rate.

"We've cracked down on people who file two, three, or four times to forestall foreclosures and things like that," Lau said.

'It tends to confirm some of the other tidbits of data we get that indicate some sectors of the economy appear to be improving.'