Reported by Star-Bulletin staff & wire

Monday, June 14, 1999

Outage to reduce EBay's revenue

SAN JOSE, Calif. -- EBay Inc., whose Web auction site was down Thursday and Friday for a total of 21 hours, said it will reduce revenue by $3 million to $5 million in the second quarter. The company said it will send refunds to those customers impacted by the outage. The stock plunged $29.87 today to close at $136 on the Nasdaq.

Japan planning version of Nasdaq

TOKYO -- U.S. securities dealers plan to set up a Japanese version of the computerized Nasdaq stock market as early as next year, a Japanese paper reported today. The new exchange will focus on listing stocks of start-up firms based mainly in the United States and Japan.

Airplane investments may hit $1.38 trillion

LE BOURGET, France -- Boeing Co. expects airlines to invest $1.38 trillion on new commercial airplanes during the next 20 years. The largest amount, more than $570 billion, would go for intermediate, twin-aisle airplanes.

TWA, union agree to tentative pact

ST. LOUIS -- Trans World Airlines Inc. and its biggest union have reached a tentative contract agreement, avoiding a potentially devastating walkout and ending two years of negotiations.

In other news . . .

LONDON -- Stagecoach Holdings Plc, Britain's biggest bus and train company, agreed to buy Coach USA Inc.

NEW YORK -- Internet advertiser DoubleClick Inc. has agreed to acquire market research firm Abacus Direct Corp. in a $1 billion stock swap.

PARIS -- Vivendi SA, the world's largest water and environmental services company, agreed to buy Superior Services Inc. for about $1 billion.

HOUSTON -- Dynegy Inc., a natural-gas and electric company, agreed to buy Illinova Corp. for about $4 billion in cash, stock and assumed debt.

EVANSVILLE, Ind. -- Sigcorp Inc. and Indiana Energy Inc. agreed to a $866 million merger.

Of Mutual Concern

News for mutual fund investors

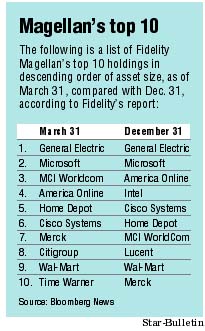

Magellan pares holdings in technology stocks

BOSTON -- Fidelity Investments' flagship Magellan Fund devoted a lower percentage of assets to technology stocks in April than any month since last August, according to a company report.The $91.4 billion Magellan Fund, the world's biggest mutual fund, had 19.3 percent of assets invested in tech stocks at the end of April, down from 20.8 percent at the end of March and down from 25.8 percent at the end of December, Fidelity reported.

Tech stocks still accounted for the largest holdings of Magellan manager Robert Stansky. The fund's second largest allocation was in finance stocks, representing 13.6 percent of assets on April 30, according to the Boston-based company.

Fidelity reported last month in a regulatory filing that the company's funds sold a net $11.3 billion worth of tech stocks during the three-month period ended March 31, including reducing its stake in Microsoft Corp. and America Online Inc. Fidelity Magellan has risen 6.7 percent this year through Friday, exceeding the 5.2 percent return of the Standard & Poor's 500 index and the 5.8 percent advance of the world's second-biggest fund, the $87 billion Vanguard 500 Index Fund. The Vanguard fund is designed to mimic the S&P 500.

'Socially responsible' index pondered by S&P

NEW YORK -- Standard & Poor's Corp., a leading creator of U.S. stock indexes, is in early discussions with mutual fund managers about forming a new index to track companies perceived as being "socially responsible.""We've held discussions with Vanguard (the second-biggest U.S. fund company) and other market participants about the possibility of creating a socially screened index," said William Jordan, a S&P spokesman.

Investing in socially responsible companies is gaining popularity as more and more Americans look to put their money with companies that aren't involved in the making or marketing of alcohol, tobacco, nuclear power, weapons or gambling.

Harris to launch fund for global investments

CHICAGO -- Harris Associates LP, manager of the Oakmark mutual funds, plans to open a fund later this summer to invest in global stocks.Oakmark Global Fund, Harris' seventh offering, is expected to be introduced in early August, the Chicago-based company said, declining to disclose who will manage the new fund.

Harris Associates, which oversees a total of $11 billion of assets, already offers two funds to invest in stocks outside the United States, Oakmark International and Oakmark International Small Cap. The two funds are managed by David Herro and Michael Welsh.

Oakmark Global will invest the bulk of its assets in stocks both inside and outside the United States, the company said.