INSIDE HAWAII INC.

CINDY ELLEN RUSSELL / CRUSSELL@STARBULLETIN.COM

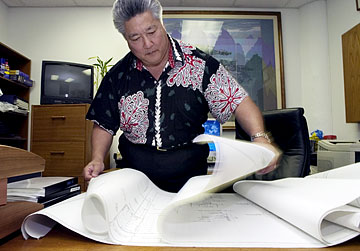

Jon F. Yamaguchi, president and chief executive of Yamaguchi & Yamaguchi Inc., has been named Hawaii chairman for the Counselors of Real Estate organization. On Wednesday, Yamaguchi sorted through blueprints that help assess property values.

|

|

Yamaguchi has concerns about downswing

The realty appraiser is proud of his firm's work quality despite heavy demand

Question: I understand you are a consultant for the Nuclear Claims Tribunal of the Marshall Islands. Tell us about that.

Answer: Back in 2000, I was requisitioned to do a job for the Nuclear Claims Tribunal to determine the loss of value of Rongelap, Rongrik and Ailinginae atolls for the periods of alienation resulting from the U.S. nuclear testing program going back to March of 1954, when they had the Bravo test on Bikini Atoll. I partnered with Randy Bell from California.

JON F. YAMAGUCHI

Jon F. Yamaguchi has been named chairman for the Counselors of Real Estate Hawaii chapter.

» Day job: President and chief executive of real estate consulting firm Yamaguchi & Yamaguchi Inc. at the Gentry Pacific Design Center. He also owns Pacific Rim Consulting Group and Allstate Home Inspection.

» Other posts: He serves on the CRE's national board of directors and executive committee. He has been designated a fellow of the London-based Royal Institution of Chartered Surveyors. He is also a Honolulu Liquor Commission member.

» Age: 54.

|

Q: How do you value the damage?

A: We've been through so many different things: The cost to cure, remediation, maybe loss of rent was one of the comparisons that we could have done. There are all different things, really no single thing is pointed out at this time. It's really looking at remediation costs. We looked at all different kinds of things. The question was, was it safe for the people to go back and how long they were restricted from their islands? One of the things that we're concerned about and disappointed in, they were sent back to the island when it was unsafe to be on it, so a lot of people have some health problems. Those are the things that have been considered, but we can't disclose whether or not that will be the methodology, because the litigation is not complete.

I'd say it's the most interesting job of my career.

Q: What is the outlook for home prices on Oahu?

A: Starting with residential, in general we see a slowdown in rising prices in the luxury single-family homes on Oahu. You can see the days on the market continuing to increase. For homes up to $1.5 million, there's still high demand as long as you have the vehicles of low interest rates and creative financing that's available to the consumer.

Existing condo sales have been brisk and will continue to be brisk until prices reach the lower end of the new-condominium prices. Again this is assuming interest rates are favorable. New projects -- that's one of my interesting topics -- we've had the remarkable resales that have occurred in new projects from the time that they were sold two years after building was complete. We've seen 50 percent to 75 percent more than the original prices. If you look at Hokua, you've seen close to almost double in some cases.

I have a concern about that. My concern is that the condo projects that are in the planning stages will be attracting the second and third wave of investors and speculators, and if history repeats itself in a cyclical real estate market, it usually results in unsustainable market and oversupply. And I guess you add to that double-digit increases in construction costs that have incurred in the past year and a half. So my worry is that, should these condominiums get off the ground, can we sustain or absorb the cost of the construction, and also the high prices and oversupply. We've seen that happen two times in my career as far as cyclical downswing.

Q: How big is your company?

A: We have a staff of eight for Yamaguchi & Yamaguchi. We cross over with our sister companies. We at one time had a staff of 43 in the 1980s, when I had merged my company with another company, and we found that the economies of scale didn't work. We're planning to increase our staff to about 12.

Q: Has business been at record levels?

A: I think 2003 was a banner year. 2004 was pretty close, and 2005 was about 15 percent off. This year looks like it will be up again.

Q: Why was 2005 a down year?

A: I think that the market started tightening up a little bit and there was a lack of product, so people were playing catch-up from the other two years. We do a lot of project appraisals. 2003 and 2004 were highly productive years and 2005 ran into some weather problems, not being able to work or construct and they fell behind. And there was a tightening of construction laborers. Mostly I'm speaking of projects that are out of town in suburban areas, such as Mililani. You had the concrete strike, too, and that had a delayed reaction. All in all, things have been pretty good.

Q: How has the residential real estate boom affected the appraisal industry?

A: We're no different from any other profession. Mortgage brokers, real estate brokers, they've popped up all over the place. We've seen more appraisers that are entering the business to take care of the demand that is there. I would say that it's a cyclical thing, where the good ones will stay and the marginal ones will disappear eventually. That's the nature of our business.

Q: How is the industry policed?

A: We have to be licensed in the state of Hawaii. I can really only speak of my people that are under my supervision that are under strict standards of quality and professional standards, but I think that the people that are here and do it for livelihood that have been around for a while put out good work. I tell people this from my clients on the mainland: You've got to understand that we can't pick up and set up shop in other states easily. So the quality of appraisals in Hawaii are pretty good.

Inside Hawaii Inc. is a weekly conversation with business and community leaders. Suggestions can be sent to

business@starbulletin.com