Kaiser seeks

average rate

increase of 3%

The rise will affect all private

employers covered by the HMO

Kaiser Permanente Hawaii, the state's largest health maintenance organization, had a $600,000 net loss in the second quarter and said yesterday it recently asked the state Insurance Division to approve an average 3 percent rate increase for next year.

![]()

Kaiser said it is reviewing all vacant positions to identify those that can remain unfillewithout hurting the quality of care or patient safety.

The medical provider is proposing the new rates on the heels of breaking ground in May for a $150 million construction project at Kaiser's Moanalua Medical Center that will include a new $90 million tower and additional renovations over four years.

Lynn Kenton, spokeswoman for Kaiser, said the requested increase was lower than in past years because the nonprofit is predicting operational efficiencies will improve due to recent investments in new clinics and KP HealthConnect online, an automated medical records system.

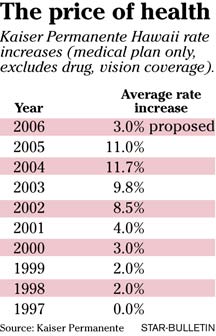

Kaiser's rate increase, the smallest since a similar request in 2000, is significantly less than the 11 percent and 11.7 percent average increases that the health care provider imposed on employers this year and in 2004, respectively.

The increases affect Kaiser's premiums for basic health care and not for prescription drug or vision coverage.

State Insurance Commissioner J.P. Schmidt acknowledged Kaiser's recent rate increase request was much lower compared with rate filings of the last two years.

"Obviously, any increase for consumers of health insurance is a strain, but I do believe it is reflective of a general softening in the increase of health-care costs," he said. "The health-care costs are continuing to increase -- however, at a much slower rate than they had in the past."

Hawaii Medical Service Association, the state's largest health insurer, previously won approval for a 4.9 percent rate increase for small businesses that took effect July 1. That increase covered drug, dental and vision coverage in HMSA's preferred provider plan, its most popular coverage.

Kaiser's loss last quarter marked a turnaround from the year earlier, when the HMO had net income of $2.2 million because of Medicare law changes and improved investment performance.

"While this has been a challenging quarter, our net income for the year remains positive," Kaiser President Janice Head said. "However, we are monitoring first-quarter trends impacting our bottom line that continued into this quarter."

Kaiser, which operates 17 outpatient clinics statewide and one hospital for 227,000 members, had net income of $3.9 million in the first quarter. But the medical provider continues to be challenged by rising expenses.

Kaiser posted an operating loss of $1.6 million last quarter compared with an operating gain of $1.3 million a year earlier. Although operating revenue rose 6.4 percent to $207.7 million from $195.2 million a year earlier, operating expenses climbed 7.9 percent to $209.3 million from $193.9 million.

"We are executing plans to address these financial challenges," Head said. "The recent groundbreaking for the Moanalua Medical Center tower equates to future increased inpatient capacity. This will significantly reduce our outside hospital expenses."

Kaiser attributed its operating losses to costs for internal hospitalization and outside hospital and medical services. The HMO said use of these services continued to grow throughout the first six months of this year.

Arnold Matsunobu, vice president of finance for Kaiser, said he was "very concerned" that operating expenses exceeded revenue last quarter.

"We are looking for opportunities where additional efficiencies are possible and make sense," he said.

Net investment income helped the bottom line, rising 11.1 percent to $1 million from $900,000 a year ago. For the year, Kaiser's investment income has nearly doubled to $3.5 million from $1.8 million.

"Due to sound investment and financial decisions, our 2005 investment income has minimized the overall impact of the increasing expenses this quarter," Matsunobu said. "However, this is not a long-term solution."

E-mail to City Desk

[News] [Business] [Features] [Sports] [Editorial] [Do It Electric!]

[Classified Ads] [Search] [Subscribe] [Info] [Letter to Editor]

[Feedback]