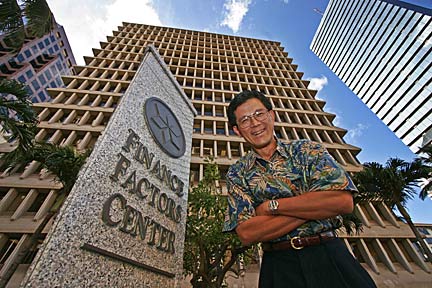

Russell Lau, vice chairman and chief executive officer of Finance Factors Ltd., has just been appointed a director of the Federal Home Loan Bank of Seattle. On Wednesday, the 29-year banker stood outside his company's offices on Bishop Street.

Lau won’t be

sleepless in Seattle

Russell Lau

Russell Lau, vice chairman and chief executive of Finance Factors Ltd., has been appointed to an 18-month position as a director of the Federal Home Loan Bank of Seattle, one of 12 Federal Home Loan Banks that enable its member institutions to offer customers greater access to mortgages and commercial lending.

Lau and Don Rhodes, of Washington state, were appointed last week to fill vacancies left by the resignations of two other board members, including Allan Landon, Bank of Hawaii's chief executive officer. Lau's term expires Dec. 31, 2006. Lau, 53, is married to Connie Lau, president and chief executive of American Savings Bank. They have three children.

|

Answer: Eighteen months ... it is a fairly lengthy term.

First off, the (Seattle) bank provides a ready source of funds and liquidity for its member institutions. Finance Factors is one of the members. The (Seattle) bank helps us meet our consumer demands for mortgage loans, commercial loans and affordable housing projects that we finance.

Specifically, they've asked me to be on their audit committee and their organizational development committee. I should clarify that organizational development relates to the organizational structure of the institution itself. I do so much nonprofit work, where development refers to fund-raising, but for the corporate environment, it relates to organizational structure.

The audit committee, as you know, has become the most critical board committee among boards of directors because of Sarbanes-Oxley. I am very honored to have been chosen for the audit committee.

Q: It is so critical because of the increased accountability everyone now expects?

A: Right. Any CEO of any banking institution knows the importance of the audit committee. The audit committees are really the power brokers within a corporation. I deal with the audit committee of Finance Factors all the time. I've also been the chair of the audit committee for the Hawaii Community Reinvestment Corp.

Q: What kind of time commitment will be required of you?

A: My understanding is that there are six face-to-face meetings a year, of which five are going to be located in Seattle. The trips up to Seattle are going to be somewhat lengthy as a result of the different committee meetings that will go on which precede the Federal Home Loan Bank board meetings. So, several days, as opposed to one or two days for a board meeting.

Q: Who will pay for your travel?

A: The Federal Home Loan Bank has a travel policy for which they reimburse us for prudent travel expenses booked through their travel agent.

Q: So you won't be watching tons of on-demand movies in your hotel room?

A: (Laughs) I don't do that anyway. I hear stories about people watching movies and doing all kinds of dry-cleaning, but no, no, we don't do that.

My organization, Finance Factors, has really four major corporate values and of those four corporate values, integrity is the first one on our list.

So we run our company with the highest level of integrity we possibly can. It's so important now, as it always has been, that people will watch management and watch the organization on how it treats its business dealings and how it treats its customers.

The other three corporate values are aloha, we want to be fair with everyone; another one is excellence, we try to do everything as best we can; and the fourth one, and you may be surprised by this, is enjoyment.

We want our employees to be able to enjoy what they're doing and we have various programs.

The fitness program that we have has been going on for two years. It's really a wellness program.

Q: Are you related to (American Savings Bank President and Chief Executive) Connie Lau?

A: She is my wife. We are both in banking.

Q: How long have you been married?

A: We got married in 1977, so 28 years.

She got into my business. (Chuckles). I've been in banking really my entire career. She just recently got into banking, but obviously I'm very proud of her and all of her accomplishments and the children are all very proud of their mother and her accomplishments, all her hard work.

Q: And your children's names and ages?

A: My daughter is 19, Jennifer, she's at Wellesley College in Massachusetts. We have a 17-year-old son, Gregory, he's a senior at Punahou; and then we have an eighth-grader, Eric, he's also at Punahou.

Q: What kinds of community activities are you involved in?

A: I'm the treasurer for Assets School, the secretary of Catholic Charities, the chair of St. Andrew's Priory.

Q: With such a busy schedule, how do you stay connected with your kids?

A: We have a weekly dinner, with all the kids, at Taco Bell and Pizza Hut, and it's fun and all the people at both places know us. It's like family.

The purpose is to get together at least once a week, where we can all sit down and talk, and make sure we're all on the same page.

Connie and I take the children on trips frequently, on vacation, as much as we can break away. In fact, we're going to be going to China very shortly, with my extended family.

It'll be a way for us all to bond together. The family's been doing this for a couple years now.

Q: Do any of you speak Chinese?

A: My daughter, the 19-year-old, will be translating (in Mandarin). So it's going to force her to practice her language skills. She'll become the most important person in the family. She can ask "Where is the bathroom?" (Laughter)

Q: Has your 29 years in banking all been with Finance Factors?

A: No, actually with Security Pacific Bank in California, in San Francisco. That bank is unfortunately not around any longer -- and Crocker Bank in San Francisco. Neither bank is around anymore. I left before they collapsed.

Q: Are you originally from Hawaii?

A: Yes, I was born and raised here and graduated from Punahou. For college I went to the University of Puget Sound in Washington state, and then I went to the University of Oregon for my MBA.

Q: Then you went to San Francisco for your first job?

A: Yes, and then in 1983 when we came back, I started at Finance Factors. My first position was in strategic planning, so I'm back to strategic planning for the Federal Home Loan Bank -- I'm coming full circle.

E-mail to Business Desk

[News] [Business] [Features] [Sports] [Editorial] [Do It Electric!]

[Classified Ads] [Search] [Subscribe] [Info] [Letter to Editor]

[Feedback]