Flurry of Oahu home

sales sends prices up

A broker warns that waiting

six months could add another

$100,000 to the cost of a house

Oahu's fast-paced housing market hit high gear last month as home buyers paid record premiums and scooped up single-family residences at an unprecedented rate.

More than half of the island's homes were sold within 15 days and nearly one in three fetched more than the asking price. Last month was the first time that more than 30 percent of the single-family homes on Oahu sold at a premium, said Harvey Shapiro, research economist for the Honolulu Board of Realtors, which released the data yesterday.

More than half of the island's homes were sold within 15 days and nearly one in three fetched more than the asking price. Last month was the first time that more than 30 percent of the single-family homes on Oahu sold at a premium, said Harvey Shapiro, research economist for the Honolulu Board of Realtors, which released the data yesterday.

"It sounds like prices right now are astronomically high, but people are paying those prices and they are willing to spend more," he said.

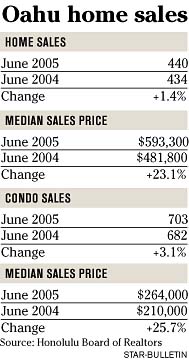

The median price of Oahu homes fell 2.7 percent in June to $593,300 from a record $610,000 in May but still finished up 23.1 percent from $481,800 in June 2004.

Shapiro attributes the dip in prices mostly to the mix of June sales, which favored West Oahu properties over higher-priced regions. There were only six more sales, 440, than in June 2004 as the lack of available homes slowed purchases, if only temporarily.

Historically low interest rates, demand for Hawaii and pressure from offshore buyers, especially baby boomers, have continued to drive Oahu's market, said Jim Wright, president and principal broker at Century 21 All Islands.

"A lot of people are sensing that it's a bargain time to buy because of the extraordinarily low interest rates," Wright said. "They know that if they see something that they want, they need to get it now. If they wait six months, it could cost another $100,000."

Condominium resales on Oahu followed the same trend. The median price slipped 0.4 percent from a month earlier to $264,000 but jumped 25.7 percent from $210,000 in June 2004.

About 29.4 percent of Oahu condominiums sold for a premium last month.

The number of condo sales on Oahu rose 3.1 percent to 703 from 682 a year earlier. Buyers purchased nearly two condominiums last month for every single-family home as rising prices pinched wallets, Shapiro said.

More than half the condominiums sold in June moved within 16 days. The record for condominium resale movement was 15 days in June 2004, he said.

More than half the condominiums sold in June moved within 16 days. The record for condominium resale movement was 15 days in June 2004, he said.

Oahu's quickening sales pace reduced the number of homes for sale, Shapiro said.

The number of available Oahu single-family homes dropped 12.6 percent to 592 from the year-ago 677 homes listed for sale, while condominium inventory dropped 19.6 percent to 879 from 1,093.

Fewer Oahu owners are listing their properties for sale, said Judith Kalbrener, president of the Honolulu Board of Realtors.

"Either they have already sold or are wondering when the best time is for them to make a move," she said.

Maui's residential market, which posted a record $780,000 median single-family home price in May, followed Oahu's pattern in June of a dip in prices accompanied by a boost in sales.

Single-family home prices declined 5.8 percent on Maui to a median $735,000 in June from the previous month. Condominium prices on the Valley Isle rose 14.9 percent to $405,000 from the month-earlier $352,500 median, according to data released yesterday by the Realtors Association of Maui.

The number of sales on Maui rose 26.4 percent for condominiums and 3 percent for single-family homes from May to June.

While some have speculated that rising prices will eventually slow the market, others say it has teeth that will carry it far past Hawaii's typical seven-year price cycle. Maui's single-family home and condo prices were up 42.4 percent and 37.3 percent, respectively, from a year earlier.

"We've been up on this cycle eight years with no end in sight based on economic indicators," Wright said. Even if the market gives kamaaina buyers pause, baby boomers will continue to fuel prices to 2028, he said.

"They've got their house paid off in places like Michigan and now they're out buying their dream house -- that's putting extraordinary pressure on Hawaii and the Sunbelt," Wright said. "These folks are investing in homes and they are creating a speculative process out of dirt."

E-mail to City Desk

[News] [Business] [Features] [Sports] [Editorial] [Do It Electric!]

[Classified Ads] [Search] [Subscribe] [Info] [Letter to Editor]

[Feedback]