ERS shows a loss

in third quarter

The value of the state's pension

fund slipped to $9.1 billion

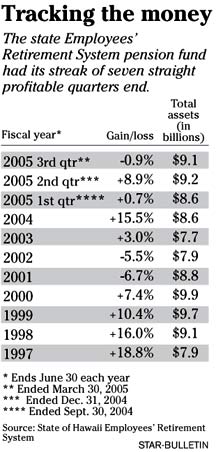

The seven-quarter winning streak is over for the Employees' Retirement System pension fund.

![]()

The downturn for the period ended March 31 followed an 8.9 percent gain in the previous quarter that marked the fund's best return in 18 months.

The value of the fund slipped to $9.1 billion from $9.2 billion.

Despite the down quarter, the ERS fund still managed to beat the minus 0.97 percent return of its benchmark, losing only 0.93 percent. For the first nine months of its fiscal year, the ERS fund is up 8.35 percent while its 12-month return of 8.77 percent ranks it in the eighth percentile -- lower numbers are better -- of the large public fund group.

The ERS provides retirement, disability and survivor benefits for about 99,000 city, county and state retirees and their beneficiaries.

Janet Becker-Wold, senior vice president of San Francisco-based fund adviser Callan Associates, told the ERS board yesterday that it's a difficult environment now for investing.

"There's some conjecture that the equity markets are still overvalued, but there's also some speculation that bonds are overvalued. So you're kind of in a situation right now that there's not a lot of places to go with your money," she said. "There's a lot of liquidity available globally right now seeking return."

The ERS pension plan, bolstered in recent quarters by the strength of its international equities, voted to rebalance its portfolio by shifting $120 million from its overweighted international stock holdings to its underweighted domestic fixed-income allocation.

Board members also dropped the Delaware Large Cap Value fund for consistently underperforming its benchmarks and for ongoing organizational problems.

In addition, the board said it will be keeping a close eye on the Bishop Street Fixed Income and Bishop Street Equity funds after the announcement by First Hawaiian Bank Chief Investment Officer Greg Ratte that he will be stepping down as president of Bishop Street Capital Management toward the end of the year.

Bishop Street is a subsidiary of First Hawaiian Bank, which said yesterday that Dale Kobayashi, head of institutional client services at the bank, will become interim chief investment officer.

Although four of ERS' seven asset classes beat their benchmarks last quarter, most performance numbers were in the red as rising oil prices and inflation fears sank both stocks and fixed income investments. In the first quarter, the Nasdaq plunged 8 percent, the Russell 2000 index of small-cap stocks fell 5.3 percent, and the Dow Jones industrial average and Standard & Poor's 500 index each declined 2.1 percent.

It wasn't any better for U.S. fixed income as the Lehman Aggregate bond index fell 0.48 percent. Of that index, U.S. Treasurys dropped 0.42 percent and corporate bonds fell 1.05 percent.

For the ERS fund, bright spots were international stocks, up 0.19 percent; emerging markets, up 2.02 percent; real estate, up 2.52 percent; and alternative investments, such as timber, up 3.75 percent.

Becker-Wold said there appears to be a shift going on in the equity market after small-cap stocks -- represented by the Russell 2000 -- tumbled 5.3 percent during the quarter and took ERS' small-cap managers with it. Small-cap stocks had outperformed large caps over the previous six years, Becker-Wold said.

"This was kind of a new shift and many people think that with high-yield (bonds) underperforming and small cap underperforming that risk in the marketplace is no longer being rewarded like it was before," she said. "(The belief now is that) quality stocks with a low leverage, large caps and more growth-oriented stocks will do better in the coming months and years and that small caps and high-risk stocks have had their day. We'll see if that plays out."

[News] [Business] [Features] [Sports] [Editorial] [Do It Electric!]

[Classified Ads] [Search] [Subscribe] [Info] [Letter to Editor]

[Feedback]