BancWest earnings

rise 12% in quarter

Assets at the parent of First

Hawaiian Bank beat $50 billion

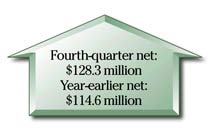

First Hawaiian Bank's parent, which bulked up in the fourth quarter by completing two acquisitions, posted a 12 percent increase in net income as its assets topped $50 billion for the first time.

![]()

For the year, BancWest's earnings rose 8.4 percent to $473.4 million from $436.6 million.

"These acquisitions have significantly enlarged BancWest's branch network, expanding our company into the Intermountain and Midwestern regions of the nation," said Don McGrath, president and chief executive of Honolulu-based BancWest. "At the same time, we continue to see internal growth from our existing Bank of the West and First Hawaiian Bank operations."

McGrath, the longtime president of First Hawaiian's sister bank, Bank of the West, took over as CEO of BancWest on Jan. 1 following the retirement of Walter Dods Jr., who has remained with BancWest as nonexecutive chairman.

BancWest's net income was weighed down in the fourth quarter by after-tax restructuring expenses of $4.5 million related to the two acquisitions. Without those expenses, the company's earnings would have risen 15.9 percent from the same period a year ago.

Net income for the year included $9.5 million in restructuring expenses and would have increased 10.6 percent without them.

BancWest, a subsidiary of French banking giant BNP Paribas SA, saw big year-over year jumps in assets, loans and deposits because of internal growth and the acquisitions.

Total assets soared 30.5 percent to $50.1 billion from $38.4 billion a year ago. Loans and leases rose 27.1 percent to $32.7 billion from $25.7 billion. And deposits increased 27.3 percent to $33.6 billion from $26.4 billion.

BancWest, which now has 543 branches in 17 Western and Midwestern states, Guam and Saipan, rebranded Community First into Bank of the West on Dec. 3 and plans to merge the branches of Union Safe Deposit Bank, a USDB subsidiary, into Bank of the West today.

Community First, which operated 156 branches in 12 states, was purchased for $1.2 billion and USDB, which had 19 branches in San Joaquin and Stanislaus counties in the Central Valley of California, was bought for $245 million.

BancWest's credit quality improved in the quarter as nonperforming assets were 0.45 percent of loans and foreclosed properties, compared with 0.59 percent a year earlier. BancWest's allowance for credit losses dropped to 1.33 percent of total loans and leases from 1.52 percent in the fourth quarter of 2003.

BancWest's net interest margin, which reflects the difference of what the bank pays depositors and what it brings in from loans, slipped to 3.84 percent from 4.17 percent a year ago. But net interest income jumped 14.8 percent to $378.4 million from the fourth quarter of 2003 as the acquisitions of Community First and Union Safe Deposit contributed to 25.3 percent growth in average loans and leases.

Noninterest income, which includes revenue from service charges and fees, rose 24.6 percent to $116.1 million while noninterest expense, which included merger-related expenses of $7.6 million, jumped 26.6 percent to $277.9 million. Excluding the merger expenses, noninterest expense rose 23.2 percent.

First Hawaiian Bank also ended the quarter as the largest single creditor, at $42.8 million, in the Aloha Airlines bankruptcy reorganization. The bank processes credit card transactions for the airline and has agreed to extend that arrangement, which was due to expire on Dec. 31, 2004, until the end of this month while the two sides negotiate.

In a Bankruptcy Court filing, Aloha said First Hawaiian's exposure was $47.5 million at the time of the bankruptcy. That means First Hawaiian could be liable for that amount if Aloha were forced to issue refunds for all credit-card purchases due to the cancellation of flights, or because of the redemption by customers of all refundable tickets. That amount would be partially offset, though, by the $16.65 million that Aloha has in a reserve account at First Hawaiian, according to the filing.

www.bancwestcorp.com

[News] [Business] [Features] [Sports] [Editorial] [Do It Electric!]

[Classified Ads] [Search] [Subscribe] [Info] [Letter to Editor]

[Feedback]