Rise in home

prices seen

Experts say the same supply

and demand factors as last year

will fuel the island market

Oahu's housing market ended 2004 the same way it began: with a roar.

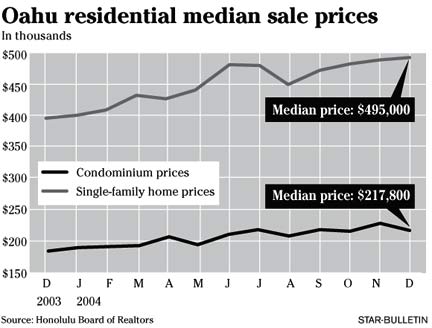

Buyers propelled the median single-family home price to $495,000 in December, the ninth record of the year, capping a year of remarkable growth for Hawaii property values. Though the pace is likely to cool this year, don't expect to find more affordable homes out there anytime soon.

The major components fueling the residential market last year -- tight supply, huge demand, attractive financing, growth in jobs and income -- remain in place. And economists, developers and real estate firms expect them to continue underpinning prices in the year ahead.

"It's basically the same picture, just a new year," said Paul Brewbaker, chief economist with Bank of Hawaii.

There were 4,702 single-family homes and 7,888 condominiums sold in 2004, both records.

December's median home price was 24 percent higher than a year earlier, and came amid robust sales of 417 homes. Condominium prices ended the year at a median $217,000 -- off November's record $229,300, but still 20 percent higher year-over-year. In December, 701 condos sold.

"We're going to see a little bit of slowing down on volume this year because so many people here have already bought a home. But there's no indication of any price weakness whatsoever," said Bill Chee, president and chief executive officer of Prudential Locations LLC.

So how much higher can prices go in 2005? That depends on interest rates.

Federal Reserve policymakers indicated during their last meeting in December that they would continue to raise rates to blunt inflation. But they've done so five times in 2004 with no apparent effect on Hawaii.

Chee said rates would have to leap 1.5 percentage points or more this year, which he doesn't expect, before having any impact. He expects home prices to grow another 10 percent this year.

"Interest rates are the obvious factor," he said. "But without a big jump, the demand side should stay strong, and we already know how tight supply is."

Brewbaker is even more bullish. Homes won't become "unaffordable," taking into account low interest rates and rising household income levels until well past the $600,000 mark, he said. And with key industries like tourism and construction running nearly at capacity, local buying power should remain substantial.

He also believes Hawaii's prices will align themselves with California markets like Orange County, San Diego and San Francisco, the sources of many mainland investors who have bought homes in Hawaii.

Those areas have comparable income levels to Hawaii, as well as median prices that appear to have topped out in a range from the mid-$500,000s to the mid-$600,000s.

The median is the point at which half the homes sold for more and half sold for less.

"As long as Oahu is cheaper than San Diego, capital will continue to flow here," Brewbaker said. "Those people can sell their house in San Diego, buy an Oahu property and have a somewhat similar lifestyle. There are a lot of similarities."

Developers have tried to sate demand by building new homes.

But the scarcity of buildable and properly zoned land, especially on Oahu, along with cumbersome zoning and permitting processes, limit how much of a dent they can make, said Mike Jones, president of homebuilder D.R. Horton, Schuler Division.

"If you look at the number of homes being built on Oahu compared to what's needed, they don't really compare. We need a lot more supply," Jones said.

He adds that a continued bottleneck in new-home deliveries is likely over "the next few years" before some equilibrium is reached.

Ultimately, the only threat to prices may be prices themselves, Brewbaker said.

"It's really the prices that will end up swamping the market, because there aren't any other (economic) indicators on the horizon to do that," he said.

[News] [Business] [Features] [Sports] [Editorial] [Do It Electric!]

[Classified Ads] [Search] [Subscribe] [Info] [Letter to Editor]

[Feedback]