|

It’s a small, small world

Andrew Poepoe leads the federal

government’s small business efforts

Andrew "Andy" Poepoe thought he'd be retired by now as district director for the U.S. Small Business Administration, but the job is still interesting and fascinating, he says, which pretty much also describes his entire career. The graduate of Kamehameha Schools has a bachelor's of science degree from Yale University, which he attended on scholarship, and a master's degree in business from the University of Hawaii. He worked five years for Castle & Cooke Terminals and about 30 years for Dole Co. Active in the Republican Party for many years, Poepoe also served 12 years in the state House and four years on the Honolulu City Council.

|

Who: Andrew "Andy" Poepoe Title: Hawaii district director, U.S. Small Business Administration Job: Oversees delivery of SBA programs throughout the Hawaii district.

|

Question: Who appointed you SBA director in Hawaii?

Answer: I am a civil servant, so I applied for my position through the normal civil service operation. But Pat Saiki was the (national) administrator at the time I came in, so I was fortunate in that -- I knew who the administrator was. She was an appointee of President Bush (the first one). But I am of the civil service rank.

Q: So it's not an appointed position?

A: No. I had to apply for the job and go through a battery of tests.

Q: Why do you think you were chosen for the job?

A: You have to score in the top three. They have a scoring system that they use with eight categories they inquire about -- administrative background, financial background, overseas marketing experience, managing people -- and that still is how we handle it now, so the ones that score high, the top few then go to the people who are hiring.

I believe I ranked first in the point system. I started in November 1991. I had retired from Dole at that time.

Q: With your background as a Republican, how did you fare under the Democratic Clinton administration?

A: I've been through two changes in the administration, and they all try to do a better job than their predecessors. I thought Saiki had done a great job, and the Clinton administration did very well, too. Now under the Bush administration, the younger Bush, we have Hector Barretto (as national director), and the last two years we broke all the previous records.

SBA has really grown as an agency since I've served with them, and the amount of money we've put into the community has grown substantially, which I like.

Q: Doesn't that kind of go against what Republicans supposedly stand for -- minimizing government in the economy?

A: What we do with our financial programs, our normal loan programs, is we guarantee the loans for the lenders, but the lenders can only make a loan using us that they would not make on their own. So we're pushing them to a little riskier position than they normally would make. And that pumps money into the economy.

Q: Doesn't that encourage malinvestment?

A: No. There's a role that banks and the SBA play to examine the credentials of the person borrowing the money, to make sure they have the ability to repay the loan. But you want to draw that line so you are taking risks and boosting the economy.

Q: Do you have a high default rate?

A: Our default rate is very modest. It's about 1.24 percent.

Q: What would it be for a normal bank?

A: A bank would be under 1 percent. The difference is slight in my opinion, but I don't define that. Congress and the administration wrestle with that and give us the guidelines.

Q: How many people work in the SBA's Hawaii district office?

A: I have 19 people and three on Guam. We are a small office.

Q: Do you travel to all of the areas covered by your office?

A: I have been to Guam and Saipan and Yap. I have a staff that is located in Guam, and they cover Micronesia.

They travel to Palau, the Federated States of Micronesia and the Republic of the Marshall Islands, and I have another staffer that travels to America Samoa, out of Hawaii.

Q: How do you define small business?

A: With very lengthy documents that the government has developed. It's defined by area -- manufacturing area, agricultural area, retail, wholesaling.

Q: It's not just a simple "50 employees or less"?

A: No, it isn't. I think they tried to develop a definition that would be fair. What is small in one type of business might not be small in another.

Andy Poepoe works with a staff of 19 people in Honolulu and three people on Guam. Among those in the Honolulu office is Candace Hahn, left, the agency's informational resources manager.

A: In this agency, we have done extremely well. We've increased lending in the community (since 1991) from a hundred loans to about 500 loans, totaling now about $63 million. Our counseling has gone up substantially. We counseled about 21,000 folks last year vs. about 2,000 in the beginning.

Government contract is the third area we work on getting work to small businesses. That grew from about $11 million to a high of about $259 million, but we'll exceed that this year -- over $300 million.

Q: How do you do that?

A: We work with different government agencies to provide these opportunities. Congress sets goals and we try to meet them. We're the second-best performing state in the country. I'm pretty proud of that.

I have a great staff, but the only way we can accomplish these goals is through our partners in the community, such as the banks for the lending and groups like the Small Business Development Center at UH-Hilo for the counseling.

Q: How long do you expect to remain in this job?

A: (Laughter) I put in my retirement papers in 1999 and I'm still here. We're developing some new programs in federal contracting work, and with all these new programs that are coming into Hawaii, with just a host of work that's being done, it's still pretty interesting work for me. I'm fascinated by what I do. I like all the people I work with.

Q: Do you have any goals for the Hawaii office to fulfill before you quit or are replaced?

A: I think there's more lending that can be done in the community, the risk lending that we've been talking about.

We also have a great long-term asset program -- it's a loan program.

We're in a low-interest rate period right now, so it's an opportune time to buy a long-term asset with a loan that the SBA manages through a partner.

And there's a little more work that needs to be done in the contracting program. It's important for the community. And as we work with government agencies, especially the military folks, we can get even better and better.

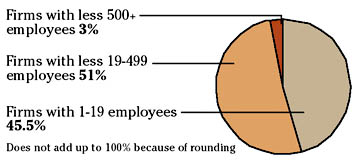

SMALL IS GROWING

Businesses with 19 or fewer employees added nearly half of the jobs created in Hawaii from 2000 to 2001.

[News] [Business] [Features] [Sports] [Editorial] [Do It Electric!]

[Classified Ads] [Search] [Subscribe] [Info] [Letter to Editor]

[Feedback]