Property tax

values soar

Rising home prices from

a hot real estate market drive

an average 26% increase

Property tax assessments for Oahu homes rose 26 percent on average this year, reflecting the island's sizzling real estate market.

Rising values

Property values in nearly every category went up this year:

Single family homes: +27.9 percent Condominiums: +21.1 percent Hotel/resort: +1.6 percent Commercial: +5.9 percent Industrial: +9.4 percent Unimproved residential: -0.2 percent

Source: City and County of Honolulu

|

The assessments being mailed to more than 268,000 property owners show that values for single-family houses increased nearly 28 percent, and condominiums went up 21 percent.

Kobayashi said she will be proposing some kind of tax relief next month, similar to Proposition 13, an initiative approved by California voters in 1978 to cap valuations at 2 percent annually.

"It's time for taking a serious look at relief for taxpayers," Kobayashi said.

Assessment notices are not tax bills.

Property taxes are determined by multiplying the assessed values by the tax rates given for different classifications of property. The Council sets the rates each spring.

This past year, the City Council approved a 7 percent tax rate increase for commercial, industrial and resort/hotel properties but vowed not to raise residential rates.

Real estate analyst Stephany Sofos said the city could lower tax rates to offset rising valuations and provide tax relief, but she does not see that happening.

|

"Now they're going to have a lot more money. Where can they spend it? They're going to use that extra cash to fund recycling efforts and their landfills and the police. (The rate) never goes down."

Stephany Sofos Real estate analyst, about city officials

|

She also said the big increase in assessments was expected. "We've all seen that values have gone up tremendously over the last year."

City officials echoed that sentiment, saying the increase in values parallels the rise in the median sales price of homes and condominiums. At the end of September, the median sales price for a single-family home was $469,000 compared with $380,000 in 2003, up 23 percent. Median condo prices rose to $215,000 compared with $175,000 in the same period, also a 23 percent increase.

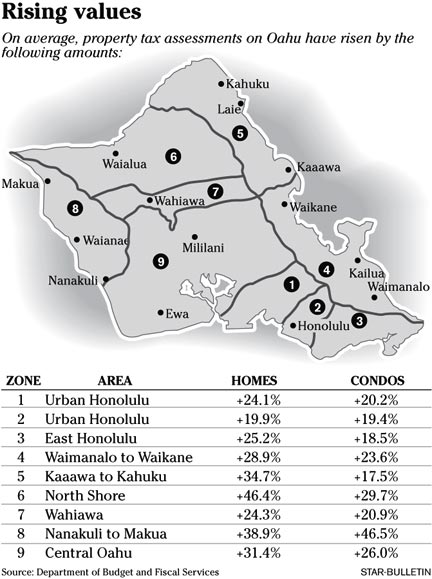

The area with the greatest increase in assessment value on average for single-family homes was the North Shore, where values rose more than 46 percent. In condominiums the greatest increase occurred along the Waianae Coast from Nanakuli to Makua, which saw average values up more than 46 percent.

Mayor-elect Mufi Hannemann said that a robust economy usually translates into higher tax revenues for the city, but it is too soon to tell what the rising assessments will mean for the city's fiscal picture. He noted that he plans to conduct a review of city operations and finances.

"We really need to open up the books and see for myself, and the public needs to know exactly where we are," Hannemann said.

He said he is "very cognizant of segments of the people on the fixed income who are going to be hurt by this."

Hannemann said he is open to Kobayashi's tax-relief idea, but he will reserve judgment on whether to roll back taxes or propose tax relief until after the review he is planning for the first 60 days of his administration, which begins Jan 2.

"I've got to be mindful of the serious problems that haven't gone away," Hannemann said.

Sofos said the real estate market that is driving the increasing values is not the "crazy and wild" market of the 1980s.

"This increase ... has been very methodical. It's been going up because of supply and demand and interest rates," Sofos said.

She said what is going to push the market further is demand.

"We might not see as high increases (in values) next year. There's still a tremendous demand for Hawaii real estate, but interest rates are going up so that should slow it down a tad," she said.

|

[News] [Business] [Features] [Sports] [Editorial] [Do It Electric!]

[Classified Ads] [Search] [Subscribe] [Info] [Letter to Editor]

[Feedback]